Answered step by step

Verified Expert Solution

Question

1 Approved Answer

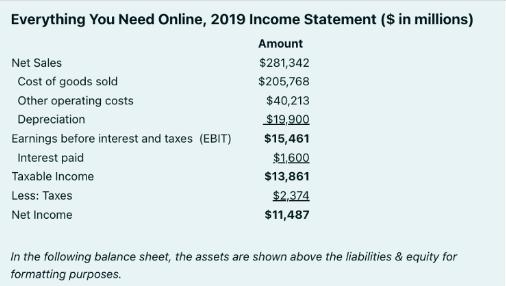

Everything You Need Online, 2019 Income Statement ($ in millions) Amount $281,342 $205,768 $40,213 $19,900 $15,461 Net Sales Cost of goods sold Other operating

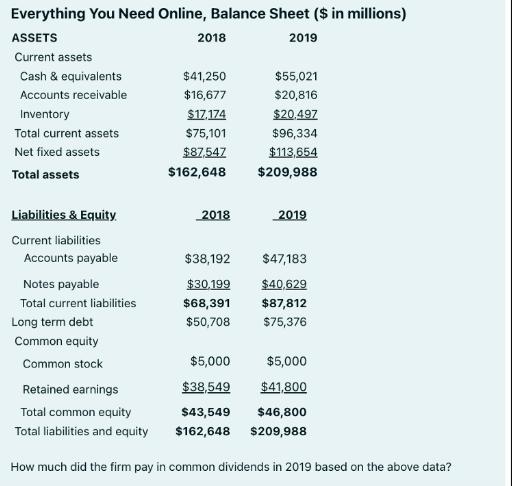

Everything You Need Online, 2019 Income Statement ($ in millions) Amount $281,342 $205,768 $40,213 $19,900 $15,461 Net Sales Cost of goods sold Other operating costs Depreciation Earnings before interest and taxes (EBIT) Interest paid Taxable income Less: Taxes Net Income $1,600 $13,861 $2,374 $11,487 In the following balance sheet, the assets are shown above the liabilities & equity for formatting purposes. Everything You Need Online, Balance Sheet ($ in millions) ASSETS 2019 Current assets Cash & equivalents Accounts receivable Inventory Total current assets Net fixed assets Total assets Liabilities & Equity. Current liabilities Accounts payable Notes payable Total current liabilities Long term debt Common equity Common stock Retained earnings Total common equity Total liabilities and equity 2018 $41,250 $16,677 $17,174 $75,101 $87,547 $162,648 2018 $38,192 $30,199 $68,391 $50,708 $5,000 $38,549 $43,549 $162,648 $55,021 $20,816 $20,497 $96,334 $113,654 $209,988 2019 $47,183 $40,629 $87,812 $75,376 $5,000 $41,800 $46,800 $209,988 How much did the firm pay in common dividends in 2019 based on the above data? How much did the firm pay in common dividends in 2019 based on the above data?

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the dividends paid to common equity holders shareholders in 2019 we need to determine ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started