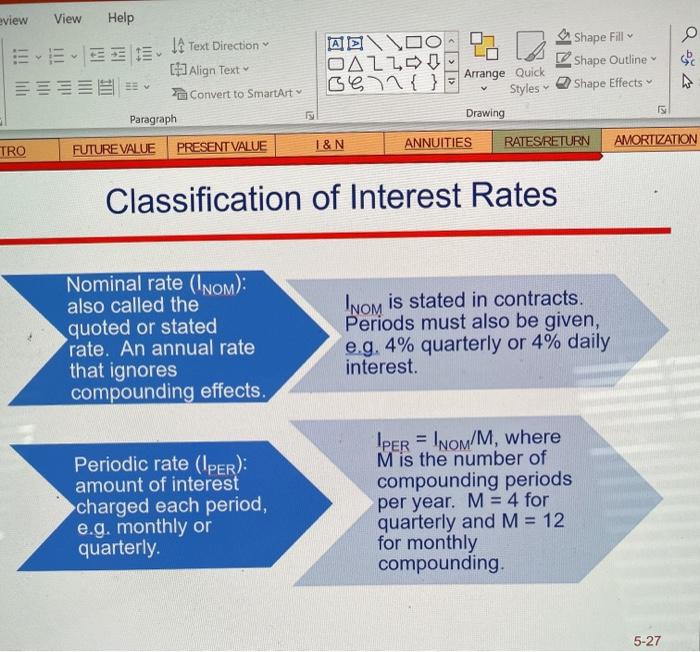

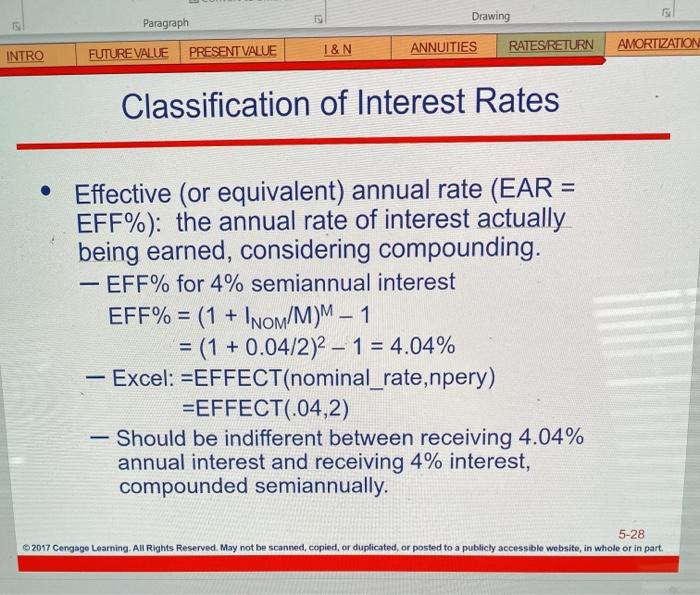

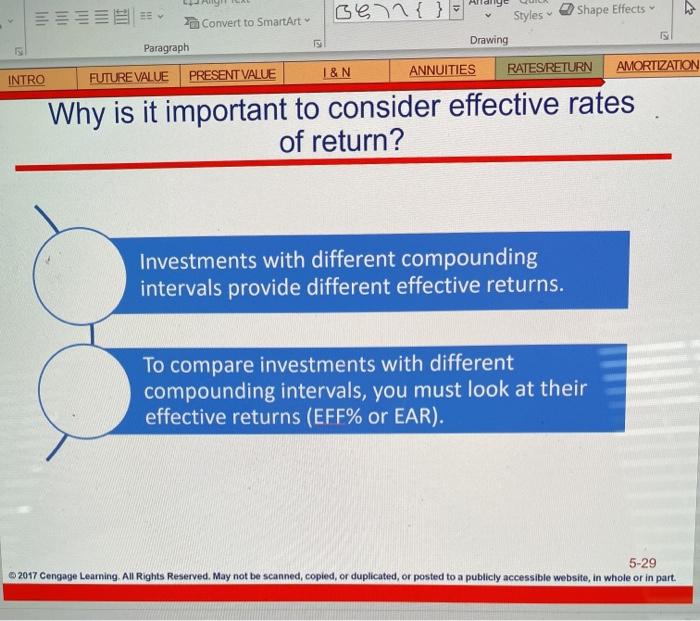

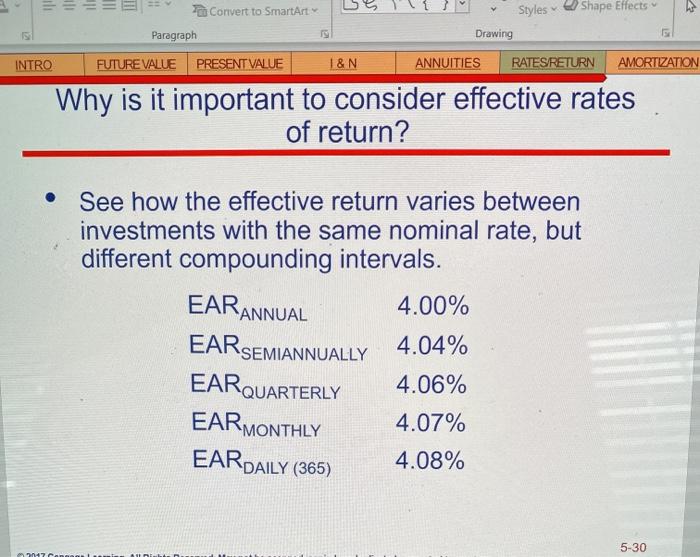

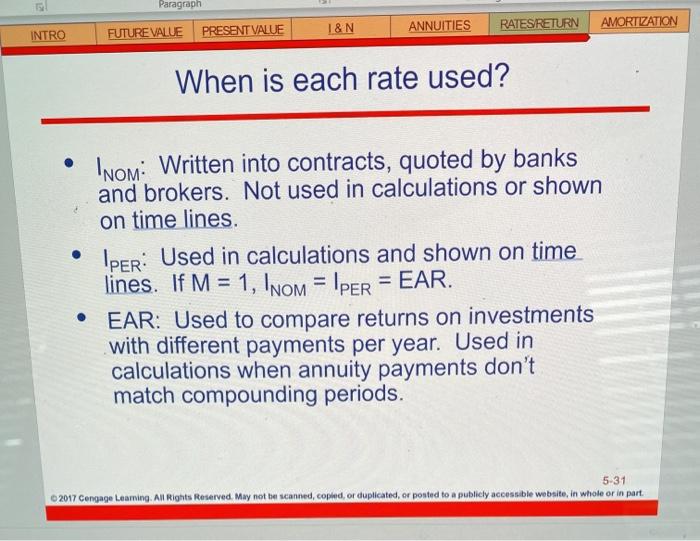

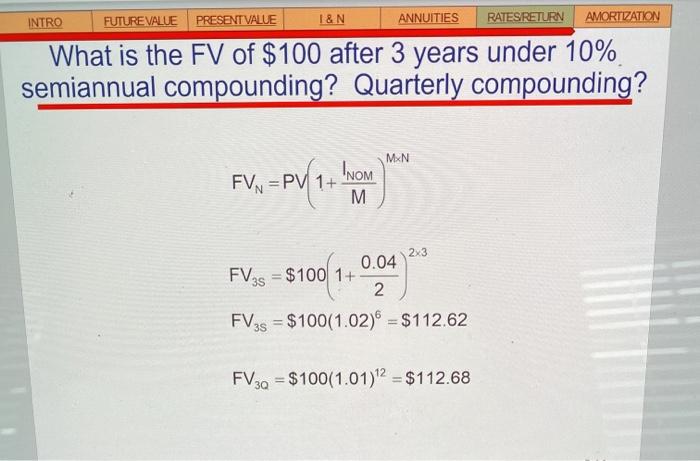

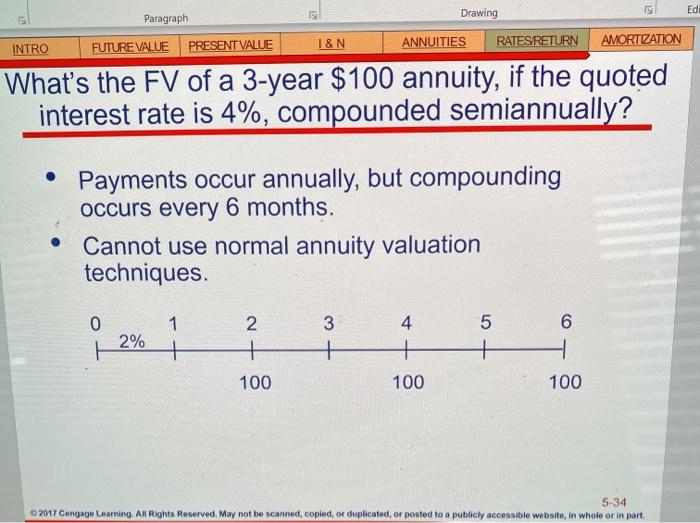

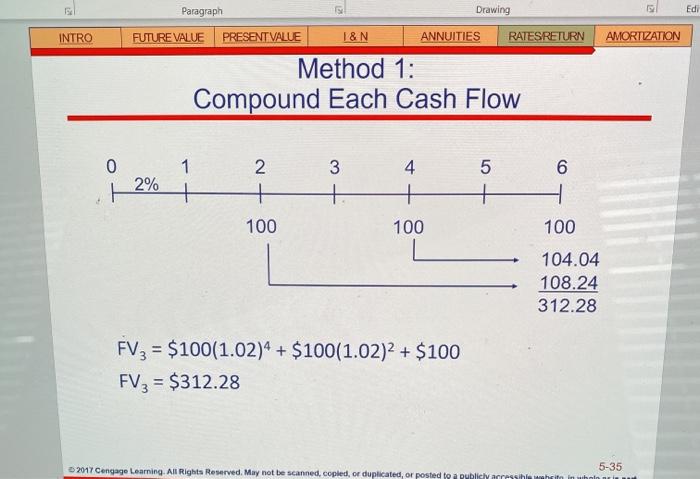

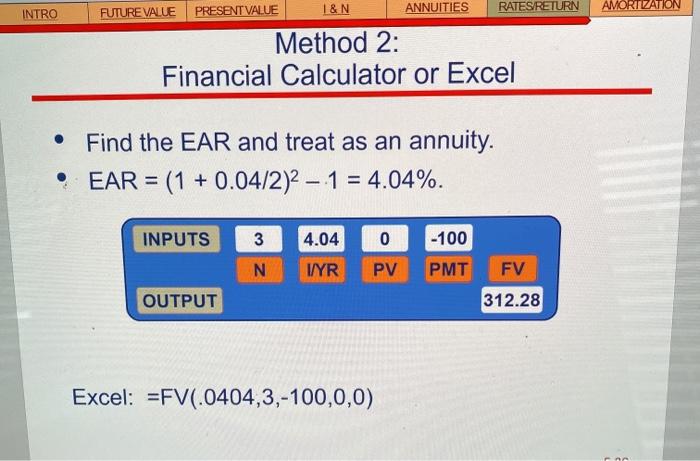

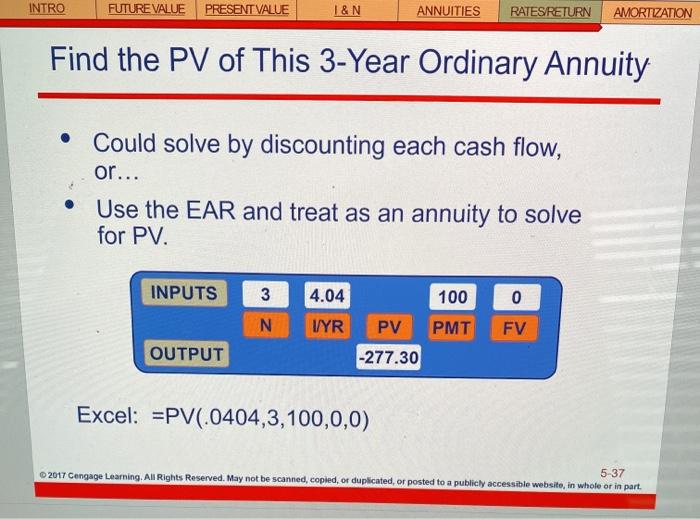

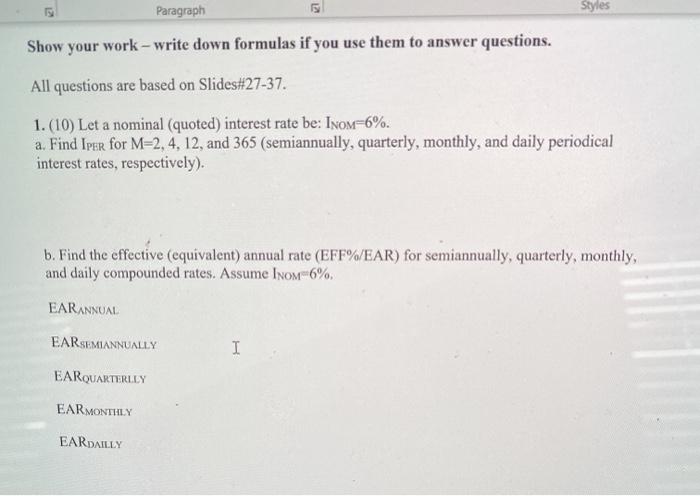

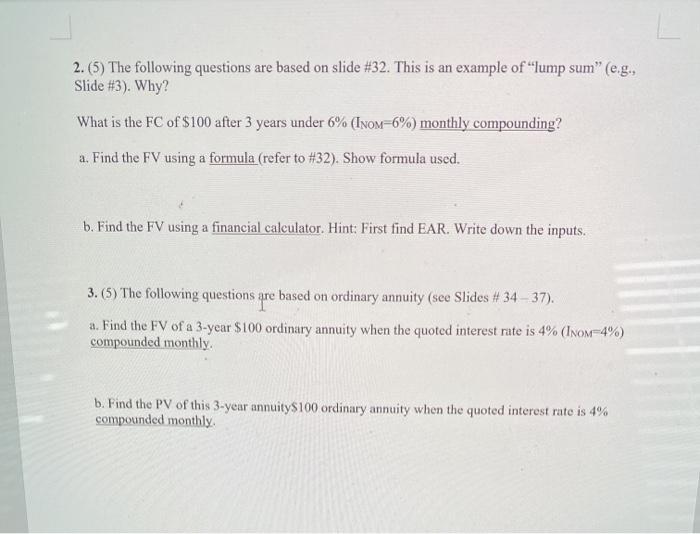

eview v View Help 1 Text Direction Align Text Convert to SmartArt Paragraph FUTURE VALUE PRESENTVALUE 0:00 OAZZO Ben{} Shape Fill shape Outline Shape Effects Arrange Quick Styles Drawing IS 1&N ANNUITIES RATESRETURN AMORTIZATION TRO Classification of Interest Rates Nominal rate (Inom): also called the quoted or stated rate. An annual rate that ignores compounding effects. Inom is stated in contracts. Periods must also be given, e.g. 4% quarterly or 4% daily interest. Periodic rate (IPER): amount of interest charged each period, e.g, monthly or quarterly IpeR = INOM/M, where M is the number of compounding periods per year. M = 4 for quarterly and M = 12 for monthly compounding 5-27 Paragraph Drawing ANNUITIES RATES RETURN INTRO PRESENTVALUE FUTURE VALUE AMORTIZATION I&N Classification of Interest Rates Effective (or equivalent) annual rate (EAR = EFF%): the annual rate of interest actually being earned, considering compounding. - EFF% for 4% semiannual interest EFF% = (1 + INOM/M)M 1 = (1 + 0.04/2)2 1 = 4.04% - Excel: =EFFECT(nominal_rate, npery) =EFFECT(.04,2) Should be indifferent between receiving 4.04% annual interest and receiving 4% interest, compounded semiannually. 5-28 2017 Cengage Learning. All Rights Reserved. May not be scanned, copied, or duplicated, or posted to a publicly accessible website, in whole or in part. Ge{} Shape Effects Convert to SmartArt Styles Drawing Paragraph I&N FUTURE VALUE PRESENT VALUE ANNUITIES RATESRETURN AMORTIZATION INTRO Why is it important to consider effective rates of return? Investments with different compounding intervals provide different effective returns. To compare investments with different compounding intervals, you must look at their effective returns (EFF% or EAR). 5-29 2017 Cengage Learning. All Rights Reserved. May not be scanned, copied, or duplicated, or posted to a publicly accessible website, in whole or in part ili Convert to SmartArt Styles Shape Effects Paragraph Drawing INTRO FUTURE VALUE PRESENT VALUE 1 &N ANNUITIES RATESRETURN AMORTIZATION Why is it important to consider effective rates of return? See how the effective return varies between investments with the same nominal rate, but different compounding intervals. EAR ANNUAL 4.00% EARSEMIANNUALLY 4.04% 4.06% EAR QUARTERLY EARMONTHLY EAR DAILY (365) 4.07% 4.08% 5-30 17 am AE Paragraph I&N FUTURE VALUE PRESENT VALUE ANNUITIES RATESRETURN AMORTIZATION INTRO When is each rate used? . Inom: Written into contracts, quoted by banks and brokers. Not used in calculations or shown on time lines. Iper: Used in calculations and shown on time lines. If M = 1, INOm = IPER = EAR. EAR: Used to compare returns on investments with different payments per year. Used in calculations when annuity payments don't match compounding periods. 5-31 2017 Cengage Leaming. All Rights Reserved. May not be scanned, copied, or duplicated, or posted to a publicly accessible website, in whole or in part. INTRO FUTURE VALUE PRESENT VALUE 1&N ANNUITIES RATESRETURN AMORTWATION What is the FV of $100 after 3 years under 10% semiannual compounding? Quarterly compounding? MEN INOM FVN = PV 1+ M 2x3 0.04 FV3s = $100 1+ 2 FV3s = $100(1.02) = $112.62 FV30 = $100(1.01)2 = $112.68 Ed Paragraph Drawing ANNUITIES RATESRETURN INTRO PRESENT VALUE FUTURE VALUE AMORTIZATION I&N What's the FV of a 3-year $100 annuity, if the quoted interest rate is 4%, compounded semiannually? Payments occur annually, but compounding occurs every 6 months. Cannot use normal annuity valuation techniques. 0 1 N 3 2% 2 + 100 4 + 100 5 + 6 H 100 5-34 2017 Cangage Learning. All Rights Reserved. May not be scanned, copied, or duplicated, or posted to a publicly accessible websito, in whole or in part Edi Drawing ANNUITIES RATESRETURN INTRO Paragraph FUTURE VALUE PRESENTVALUE I&N Method 1: AMORTIZATION Compound Each Cash Flow 0 3 5 2% 1 + 2 + 100 4 + 100 5 + 6 H + 100 104.04 108.24 312.28 FV3 = $100(1.02)4 + $100(1.02)2 + $100 FV2 = $312.28 2017 Cengage Learning. All Rights Reserved. May not be scanned, copied, or duplicated, or posted to public acha wahit 5-35 PRESENTVALUE FUTURE VALUE INTRO I&N ANNUITIES RATES/RETURN AMORTIZATION Method 2: Financial Calculator or Excel Find the EAR and treat as an annuity. EAR = (1 + 0.04/2)2 1 = 4.04%. INPUTS 3 4.04 0 -100 N I/YR PV PMT FV OUTPUT 312.28 Excel: =FV(.0404,3,-100,0,0) INTRO FUTURE VALUE PRESENT VALUE I&N ANNUITIES RATES RETURN AMORTIZATION Find the PV of This 3-Year Ordinary Annuity Could solve by discounting each cash flow, or... Use the EAR and treat as an annuity to solve for PV. INPUTS 3 4.04 100 0 N I/YR PV PMT FV OUTPUT -277.30 Excel: =PV(.0404,3,100,0,0) 5-37 2017 Cengage Learning. All Rights Reserved. May not be scanned, copied, or duplicated, or posted to a publicly accessible website, in whole or in part. Paragraph Styles Show your work - write down formulas if you use them to answer questions. All questions are based on Slides#27-37. 1. (10) Let a nominal (quoted) interest rate be: Inom=6%. a. Find Iper for M-2, 4, 12, and 365 (semiannually, quarterly, monthly, and daily periodical interest rates, respectively). b. Find the effective (equivalent) annual rate (EFF%/EAR) for semiannually, quarterly, monthly, and daily compounded rates. Assume Inom 6% EARANNUAL EARSEMIANNUALLY I EARQUARTERLLY EARMONTHLY EARDAILLY 2. (5) The following questions are based on slide #32. This is an example of "lump sum" (e.g., Slide #3). Why? What is the FC of $100 after 3 years under 6% (INOM=6%) monthly compounding? a. Find the FV using a formula (refer to #32). Show formula used. b. Find the FV using a financial calculator. Hint: First find EAR. Write down the inputs. 3. (5) The following questions are based on ordinary annuity (see Slides # 34 37). a. Find the FV of a 3-year $100 ordinary annuity when the quoted interest rate is 4% (INOM-4%) compounded monthly b. Find the PV of this 3-year annuity$100 ordinary annuity when the quoted interest rate is 4% compounded monthly