Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ewan Company purchased a building with a market value of $275,000 and land with a market value of $65,000 on January 1, 2018. Ewan Company

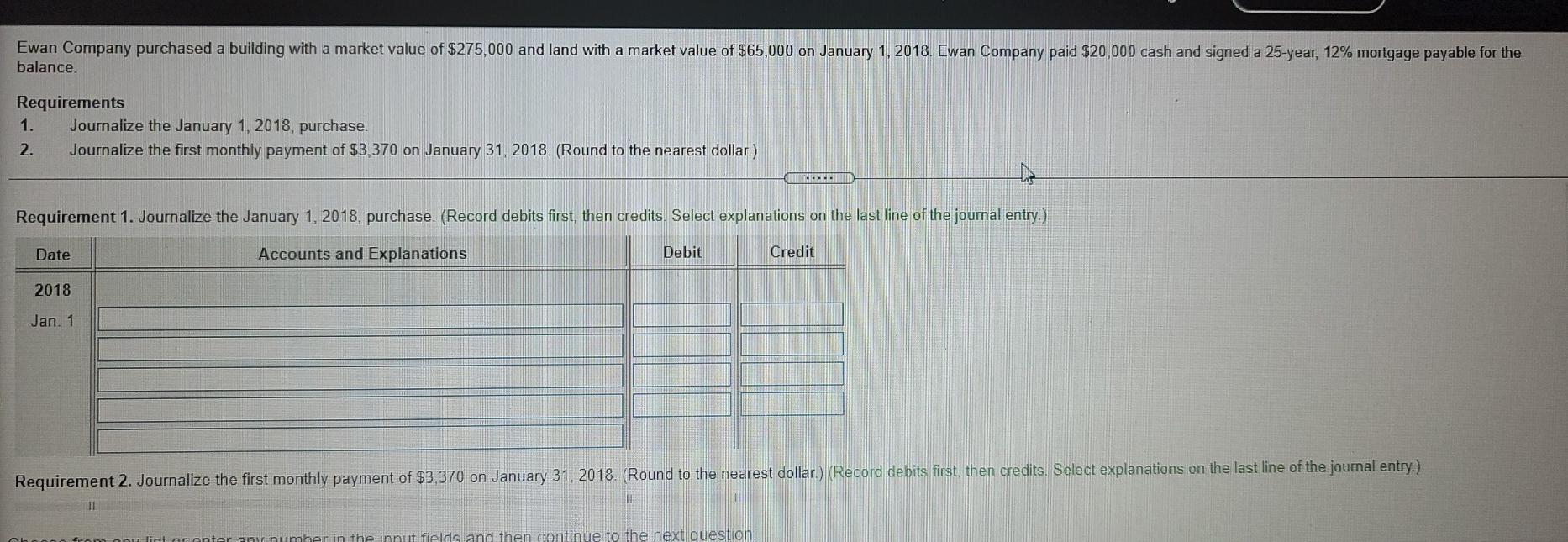

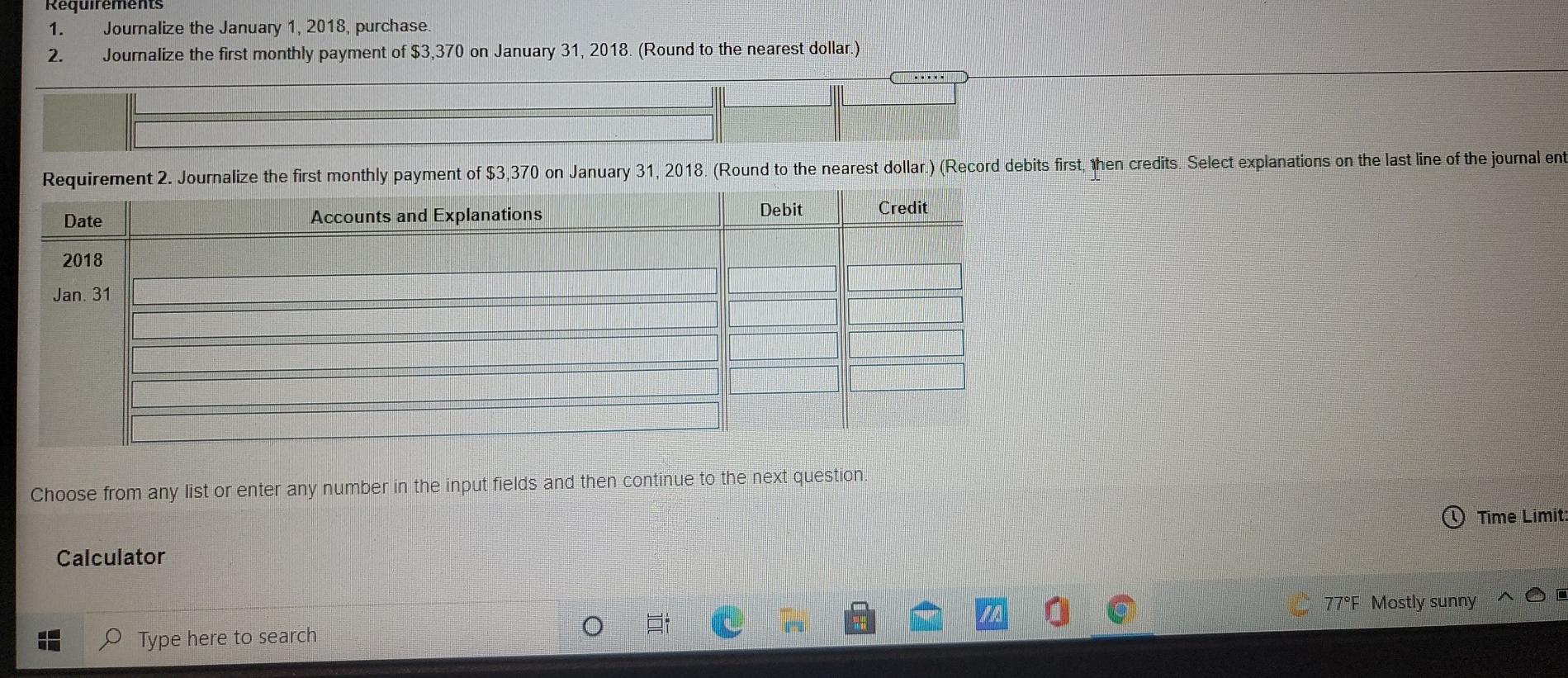

Ewan Company purchased a building with a market value of $275,000 and land with a market value of $65,000 on January 1, 2018. Ewan Company paid $20,000 cash and signed a 25-year, 12% mortgage payable for the balance. Requirements 1. Journalize the January 1, 2018, purchase. 2. Journalize the first monthly payment of $3,370 on January 31, 2018. (Round to the nearest dollar.) TELUT Requirement 1. Journalize the January 1, 2018, purchase. (Record debits first, then credits. Select explanations on the last line of the journal entry.) Date Accounts and Explanations Debit Credit 2018 Jan. 1 Requirement 2. Journalize the first monthly payment of $3,370 on January 31, 2018. (Round to the nearest dollar.) (Record debits first, then credits. Select explanations on the last line of the journal entry) II rany number in the innut fields and then continue to the next question Requir 1. Journalize the January 1, 2018, purchase. 2. Journalize the first monthly payment of $3,370 on January 31, 2018. (Round to the nearest dollar.) M Requirement 2. Journalize the first monthly payment of $3,370 on January 31, 2018. (Round to the nearest dollar) (Record debits first, then credits. Select explanations on the last line of the journal ent Debit Credit Date Accounts and Explanations 2018 Jan. 31 Choose from any list or enter any number in the input fields and then continue to the next question. Time Limit: Calculator 77F Mostly sunny JA O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started