Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ex. 02: Workbook 10-8 Able Energy, Inc. is a company listed on NASDAQ (symbol: ABLE). A trader sold 100 shares of this company on

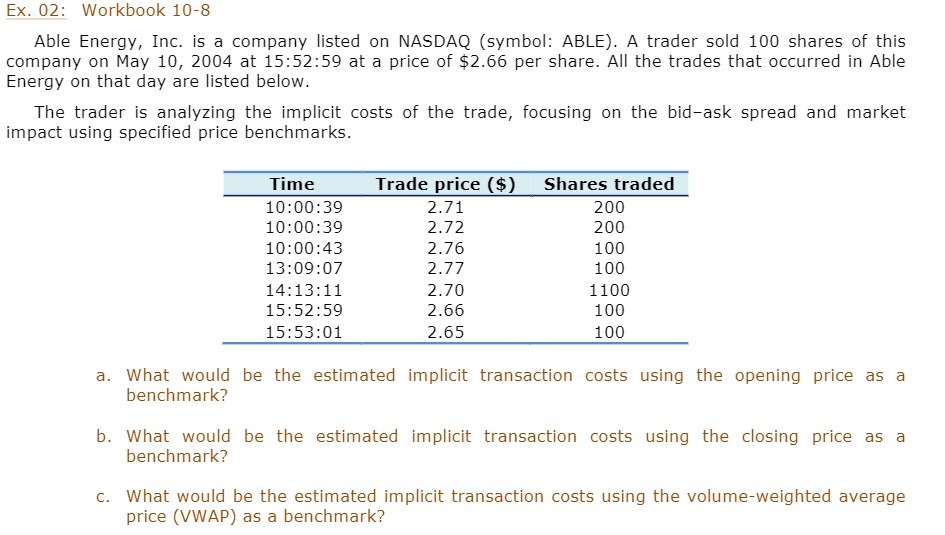

Ex. 02: Workbook 10-8 Able Energy, Inc. is a company listed on NASDAQ (symbol: ABLE). A trader sold 100 shares of this company on May 10, 2004 at 15:52:59 at a price of $2.66 per share. All the trades that occurred in Able Energy on that day are listed below. The trader is analyzing the implicit costs of the trade, focusing on the bid-ask spread and market impact using specified price benchmarks. Time 10:00:39 Trade price ($) Shares traded 2.71 200 10:00:39 2.72 200 10:00:43 2.76 100 13:09:07 2.77 100 14:13:11 2.70 1100 15:52:59 2.66 15:53:01 2.65 100 100 a. What would be the estimated implicit transaction costs using the opening price as a benchmark? b. What would be the estimated implicit transaction costs using the closing price as a benchmark? c. What would be the estimated implicit transaction costs using the volume-weighted average price (VWAP) as a benchmark?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Estimated implicit transaction costs using the opening price as a benchmark The opening price on t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started