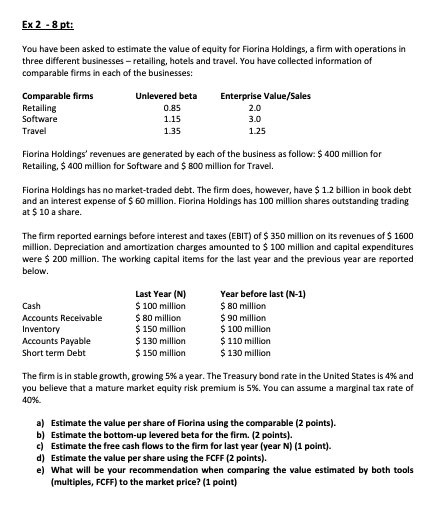

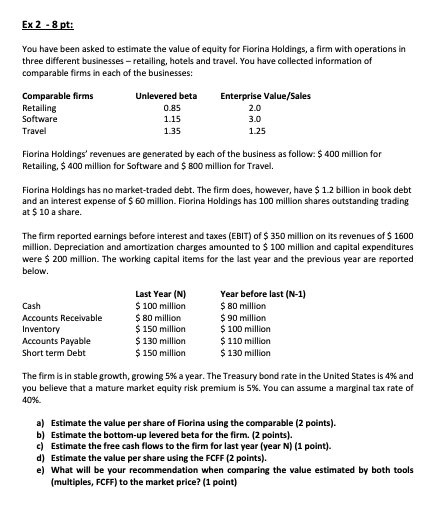

Ex 2 - 8 pt: You have been asked to estimate the value of equity for Fiorina Holdings, a firm with operations in three different businesses - retailing, hotels and travel. You have collected information of comparable firms in each of the businesses: Comparable firms Unlevered beta Enterprise Value/Sales Retailing 2.0 Software 1.15 3.0 Travel 1.35 1.25 0.85 Fiorina Holdings' revenues are generated by each of the business as follow: $ 400 million for Retailing, $ 400 million for Software and $ 800 million for Travel. Fiorina Holdings has no market-traded debt. The firm does, however, have $ 1.2 billion in book debt and an interest expense of $ 60 million. Fiorina Holdings has 100 million shares outstanding trading at $ 10 a share. The firm reported earnings before interest and taxes (EBIT) of $ 350 million on its revenues of $ 1600 million. Depreciation and amortization charges amounted to $ 100 million and capital expenditures were $ 200 million. The working capital items for the last year and the previous year are reported below. Last Year (N) Year before last (N-1) Cash $ 100 million $ 80 million Accounts Receivable $ 80 million $ 90 million Inventory $ 150 million $ 100 million Accounts Payable $ 130 million $ 110 million Short term Debt $ 150 million $ 130 million The firm is in stable growth, growing 5% a year. The Treasury bond rate in the United States is 4% and you believe that a mature market equity risk premium is 5%. You can assume a marginal tax rate of 40% a) Estimate the value per share of Fiorina using the comparable (2 points). b) Estimate the bottom-up levered beta for the firm. (2 points). c) Estimate the free cash flows to the firm for last year (year N) (1 point). d) Estimate the value per share using the FCFF (2 points). e) What will be your recommendation when comparing the value estimated by both tools (multiples, FCFF) to the market price? (1 point) Ex 2 - 8 pt: You have been asked to estimate the value of equity for Fiorina Holdings, a firm with operations in three different businesses - retailing, hotels and travel. You have collected information of comparable firms in each of the businesses: Comparable firms Unlevered beta Enterprise Value/Sales Retailing 2.0 Software 1.15 3.0 Travel 1.35 1.25 0.85 Fiorina Holdings' revenues are generated by each of the business as follow: $ 400 million for Retailing, $ 400 million for Software and $ 800 million for Travel. Fiorina Holdings has no market-traded debt. The firm does, however, have $ 1.2 billion in book debt and an interest expense of $ 60 million. Fiorina Holdings has 100 million shares outstanding trading at $ 10 a share. The firm reported earnings before interest and taxes (EBIT) of $ 350 million on its revenues of $ 1600 million. Depreciation and amortization charges amounted to $ 100 million and capital expenditures were $ 200 million. The working capital items for the last year and the previous year are reported below. Last Year (N) Year before last (N-1) Cash $ 100 million $ 80 million Accounts Receivable $ 80 million $ 90 million Inventory $ 150 million $ 100 million Accounts Payable $ 130 million $ 110 million Short term Debt $ 150 million $ 130 million The firm is in stable growth, growing 5% a year. The Treasury bond rate in the United States is 4% and you believe that a mature market equity risk premium is 5%. You can assume a marginal tax rate of 40% a) Estimate the value per share of Fiorina using the comparable (2 points). b) Estimate the bottom-up levered beta for the firm. (2 points). c) Estimate the free cash flows to the firm for last year (year N) (1 point). d) Estimate the value per share using the FCFF (2 points). e) What will be your recommendation when comparing the value estimated by both tools (multiples, FCFF) to the market price? (1 point)