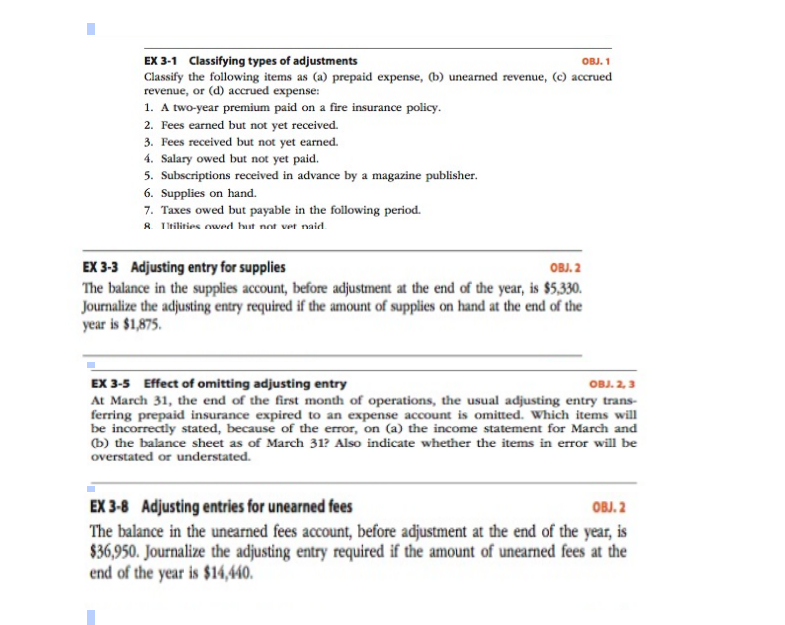

Question: EX 3-1 Classifying types of adjustments Classify the following items as (a) prepaid expense, (b) unearned revenue, (c) accrued revenue, or (d) accrued expense: 1.

EX 3-1 Classifying types of adjustments Classify the following items as (a) prepaid expense, (b) unearned revenue, (c) accrued revenue, or (d) accrued expense: 1. A two-year premium paid on a fire insurance policy 2. Fees earned but not yet received. 3. Fees received but not yet earned. 4. Salary owed but not yet paid. 5. Subscriptions received in advance by a magazine publisher 6. Supplies on hand. 7. Taxes owed but payable in the following period R Itilities awed ht not vet naid OBJ. 1 EX3-3 Adjusting entry for supplies The balance in the supplies account, before adjustment at the end of the year, is $5,330 Journalize the adjusting entry required if the amount of supplies on hand at the end of the year is $1,875 OBJ.2 EX 3-5 Effect of omitting adjusting entry At March 31, the end of the first month of operations, the usual adjusting entry trans- ferring prepaid insurance expired to an expense account is omitted. Which items will be incorrectly stated, because of the error, on (a) the income statement for March and (b) the balance sheet as of March 31? Also indicate whether the items in error will be OBJ. 2, 3 EX 3-8 Adjusting entries for unearned fees The balance in the unearned fees account, before adjustment at the end of the year, is $36,950. Journalize the adjusting entry required if the amount of unearned fees at the end of the year is $14,440 OBJ.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts