Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During 20X5, new water analysis in Alandia resort owned by Beautiful Spas showed that water was no longer contaminated. To improve its reputation, Beautiful

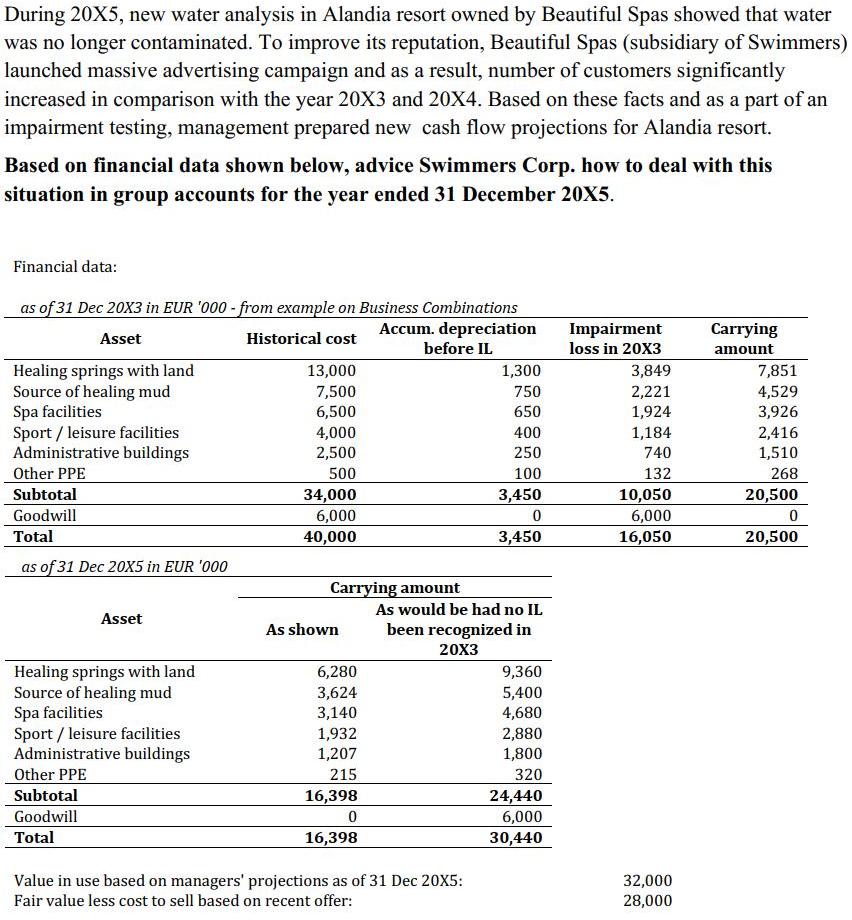

During 20X5, new water analysis in Alandia resort owned by Beautiful Spas showed that water was no longer contaminated. To improve its reputation, Beautiful Spas (subsidiary of Swimmers) launched massive advertising campaign and as a result, number of customers significantly increased in comparison with the year 20X3 and 20X4. Based on these facts and as a part of an impairment testing, management prepared new cash flow projections for Alandia resort. Based on financial data shown below, advice Swimmers Corp. how to deal with this situation in group accounts for the year ended 31 December 20X5. Financial data: as of 31 Dec 20X3 in EUR '000 - from example on Business Combinations Accum. depreciation before IL Impairment loss in 20X3 Carrying Asset Historical cost amount Healing springs with land Source of healing mud Spa facilities Sport / leisure facilities Administrative buildings 13,000 7,851 4,529 1,300 3,849 7,500 6,500 750 2,221 1,924 1,184 740 650 3,926 2,416 1,510 4,000 400 2,500 250 Other PPE 500 100 132 268 Subtotal 3,450 10,050 6,000 16,050 20,500 34,000 6,000 Goodwill Total 40,000 3,450 20,500 as of 31 Dec 20X5 in EUR '000 Carrying amount As would be had no IL Asset been recognized in 20X3 As shown Healing springs with land Source of healing mud Spa facilities Sport / leisure facilities Administrative buildings Other PPE 6,280 9,360 5,400 4,680 3,624 3,140 1,932 2,880 1,207 1,800 215 320 24,440 Subtotal 16,398 Goodwill 6,000 Total 16,398 30,440 Value in use based on managers' projections as of 31 Dec 20X5: Fair value less cost to sell based on recent offer: 32,000 28,000

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Impairment loss on fixed assets like PPE can be reversed as per IFRS if the prevailing circumstances ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started