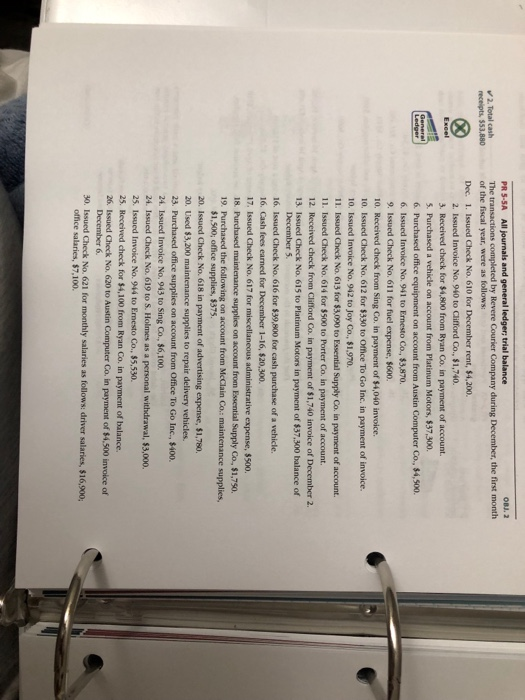

Ex 5-2

Ex 5-3

Ex 5-4

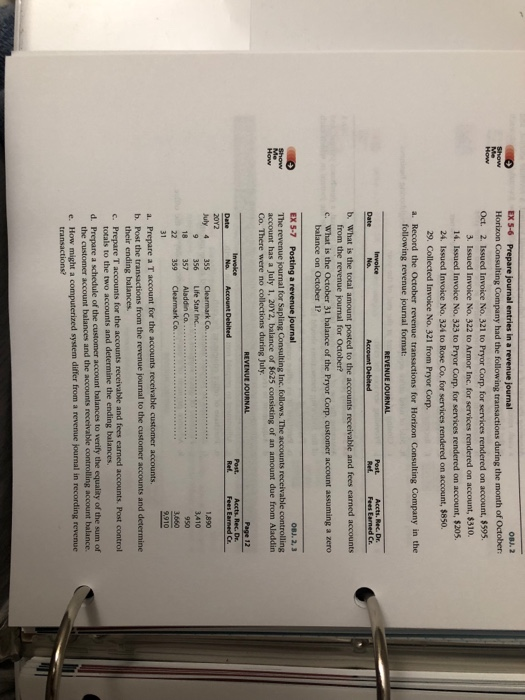

Ex 5-6

Ex 5-7

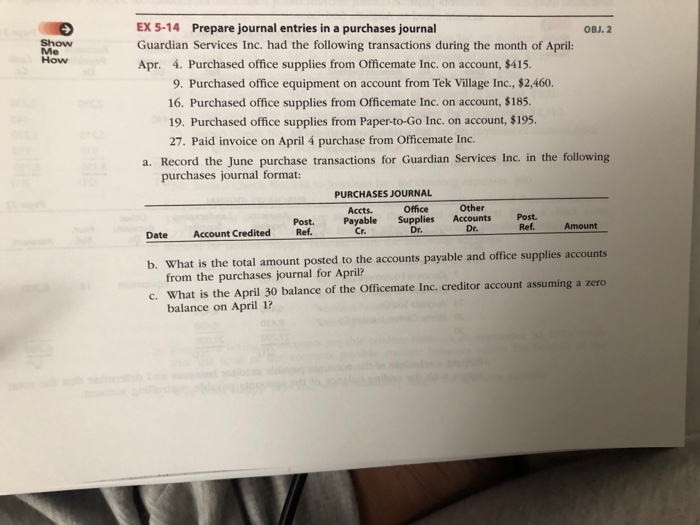

Ex 5-14

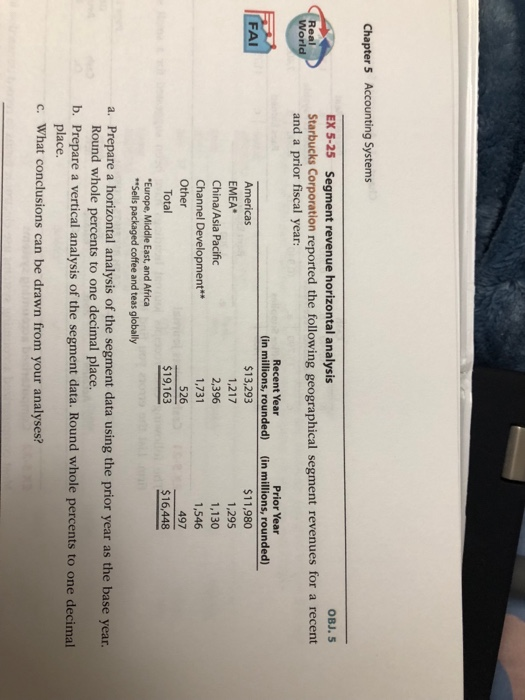

Ex 5-25

Ex Pr 5-5a

All of these are different problems that need to be solve

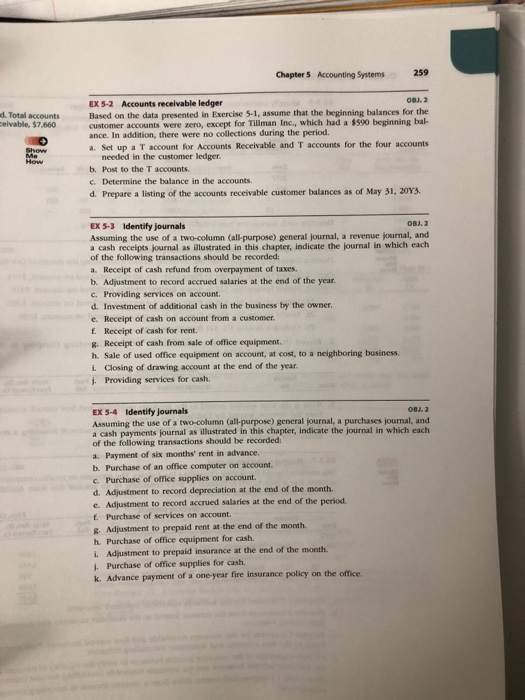

Chapter S Accounting Systems 259 OBJ. 2 EX5-2 Accounts receivable ledger Based on the data presented in Exercise 5-1, assume that the beginning balances for the customer accounts were zero, except for Tillman Inc, which had a $590 beginning bal- ance. In addition, there were no collections during the period a. Set up a T account for Accounts Receivable and T accounts for the four accounts d. Total accounts eivable, $7,660 needed in the customer ledger b. Post to the T accounts. c. Determine the balance in the accounts d. Prepare a listing of the accounts receivable customer balances as of May 31, 20Y3 ), 2 EX 5-3 Identify journals Assuming the use of a two-column (all-purpose) general journal, a revenue journal, and a cash receipts journal as illustrated in this chapter, indicate the journal in which each of the following transactions should be recorded a. Receipt of cash refund from overpayment of taxes. b. Adjustment to record accrued salaries at the end of the year c. Providing services on account. d. Investment of additional cash in the business by the owner. e. Receipt of cash on account from a customer f. Receipt of cash for rent. &. Receipt of cash from sale of office equipment. h. Sale of used office equipment on account, at cost, to a neighboring business. i. Closing of drawing account at the end of the year. Providing services for cash. OBL 2 EX5-4 Identify journals Assuming the use of a two-column (all-purpose) general journal, a purchases journal, and a cash payments journal as illustrated in this chapter, indicate the journal in which each of the following transactions should be recorded a. Payment of six months' rent in advance. b. Purchase of an office computer on account. c. Purchase of office supplies on account. d. Adjustment to record depreciation at the end of the month. e. Ad justment to record accrued salaries at the end of the period. f Purchase of services on account. & Adjustment to prepaid rent at the end of the month. h. Purchase of office equipment for cash. i. Adjustment to prepaid insurance at the end of the month. . Purchase of office supplies for cash. k. Advance payment of a one-year fire insurance policy on the office. Chapter S Accounting Systems 259 OBJ. 2 EX5-2 Accounts receivable ledger Based on the data presented in Exercise 5-1, assume that the beginning balances for the customer accounts were zero, except for Tillman Inc, which had a $590 beginning bal- ance. In addition, there were no collections during the period a. Set up a T account for Accounts Receivable and T accounts for the four accounts d. Total accounts eivable, $7,660 needed in the customer ledger b. Post to the T accounts. c. Determine the balance in the accounts d. Prepare a listing of the accounts receivable customer balances as of May 31, 20Y3 ), 2 EX 5-3 Identify journals Assuming the use of a two-column (all-purpose) general journal, a revenue journal, and a cash receipts journal as illustrated in this chapter, indicate the journal in which each of the following transactions should be recorded a. Receipt of cash refund from overpayment of taxes. b. Adjustment to record accrued salaries at the end of the year c. Providing services on account. d. Investment of additional cash in the business by the owner. e. Receipt of cash on account from a customer f. Receipt of cash for rent. &. Receipt of cash from sale of office equipment. h. Sale of used office equipment on account, at cost, to a neighboring business. i. Closing of drawing account at the end of the year. Providing services for cash. OBL 2 EX5-4 Identify journals Assuming the use of a two-column (all-purpose) general journal, a purchases journal, and a cash payments journal as illustrated in this chapter, indicate the journal in which each of the following transactions should be recorded a. Payment of six months' rent in advance. b. Purchase of an office computer on account. c. Purchase of office supplies on account. d. Adjustment to record depreciation at the end of the month. e. Ad justment to record accrued salaries at the end of the period. f Purchase of services on account. & Adjustment to prepaid rent at the end of the month. h. Purchase of office equipment for cash. i. Adjustment to prepaid insurance at the end of the month. . Purchase of office supplies for cash. k. Advance payment of a one-year fire insurance policy on the office