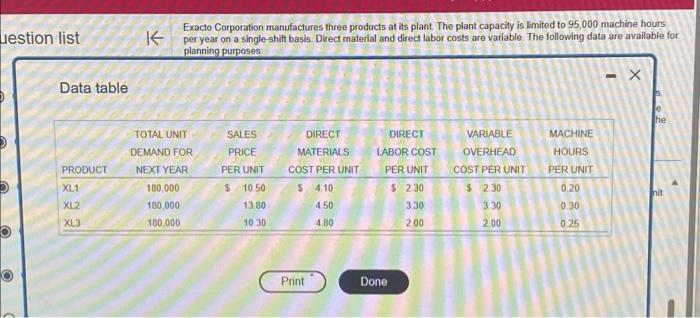

Exacto Corporation manufactures three products at its plant. The plant capacity is limited to 95,000 machine hours per year on a single-shift basis. Direct material and direct labor costs are variable. The following data are available for planning purposes: (Click the icon to view the data.) Requirements (a) Given the capacity constraint, determine the production levels for the three products that will maximize profits. (b) If the company authorizes overtime in order to produce more units of XL3, the direct labor cost per unit will be higher by 50% because of the overtime premium. Materials cost and variable overhead cost per unit will be the same for overtime production as regular production. Is it worthwhile operating overtime? Requirement (a) Given the capacity constraint, determine the production levels for the three products that will maximize profits. Begin by calculating the contribution margin per machine hour for each product. (Abbreviations used: MH = Machine hour) Exacto Corporation manufactures three products at its plant. The plant capacity is limited to 95,000 machine hours per year on a single-shift basis. Direct material and direct labor costs are variable. The following data are available for planning purposes: (Click the icon to view the data.) Requirements (a) Given the capacity constraint, determine the production levels for the three products that will maximize profits. (b) If the company authorizes overtime in order to produce more units of XL3. the direct labor cost per unit will be higher by 50% because of the overtime premium. Materials cost and variable overhead cost per unit will be the same for overtime production as regular production. Is it worthwhile operating overtime? Determine the production levels for the three products that will maximize profits Requirement (b) If the company authorizes overtime in order to produce more units of XL3, the direct labor cost per unit will be higher by 50% because of the overtime premium. Materials cost and variable overhead cost per unit will be the same for overtime production as regular production. Is it worthwhile operating overtime? Begin by Begin by calculating the contribution margin per unit of XL 3 under these circumstances. (Use a parentheses or a minus sign for a negative contribution margin per unit). Exacto Corporation manufactures three products at its plant. The plant capacity is limited to 95,000 machine hours per year on a single-shift basis. Direct material and direct labor costs are variable. The following data are available for planning purposes: (Click the icon to view the data.) Requirements (a) Given the capacity constraint, determine the production levels for the three products that will maximize profits. (b) If the company authorizes overtime in order to produce more units of XL3, the direct labor cost per unit will be higher by 50% because of the overtime premium. Materials cost and variable overhead cost per unit will be the same for overtime production as regular production. Is it worthwhile operating overtime? Requirement (b) If the company authorizes overtime in order to produce more units of XL3, the direct labor cost per unit will be higher by 50% because of the overtime premium. Materials cost and variable overhead cost per unit will be the same for overtime production as regular production. Is it worthwhile operating overtime? Begin by Begin by calculating the contribution margin per unit of XL3 under these circumstances. (Use a parentheses or a minus sign for a negative contribution margin per unit) Is it worthwhile operating overtime? It operating overtime because the unit contribution margin of XL3 using overtime is