Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exam #03 - Chapters 8, 9, 10 i 18 4 points eBook Ask Mc Graw LASER Problem 8-12 Stock Valuation and PE [LO2] The

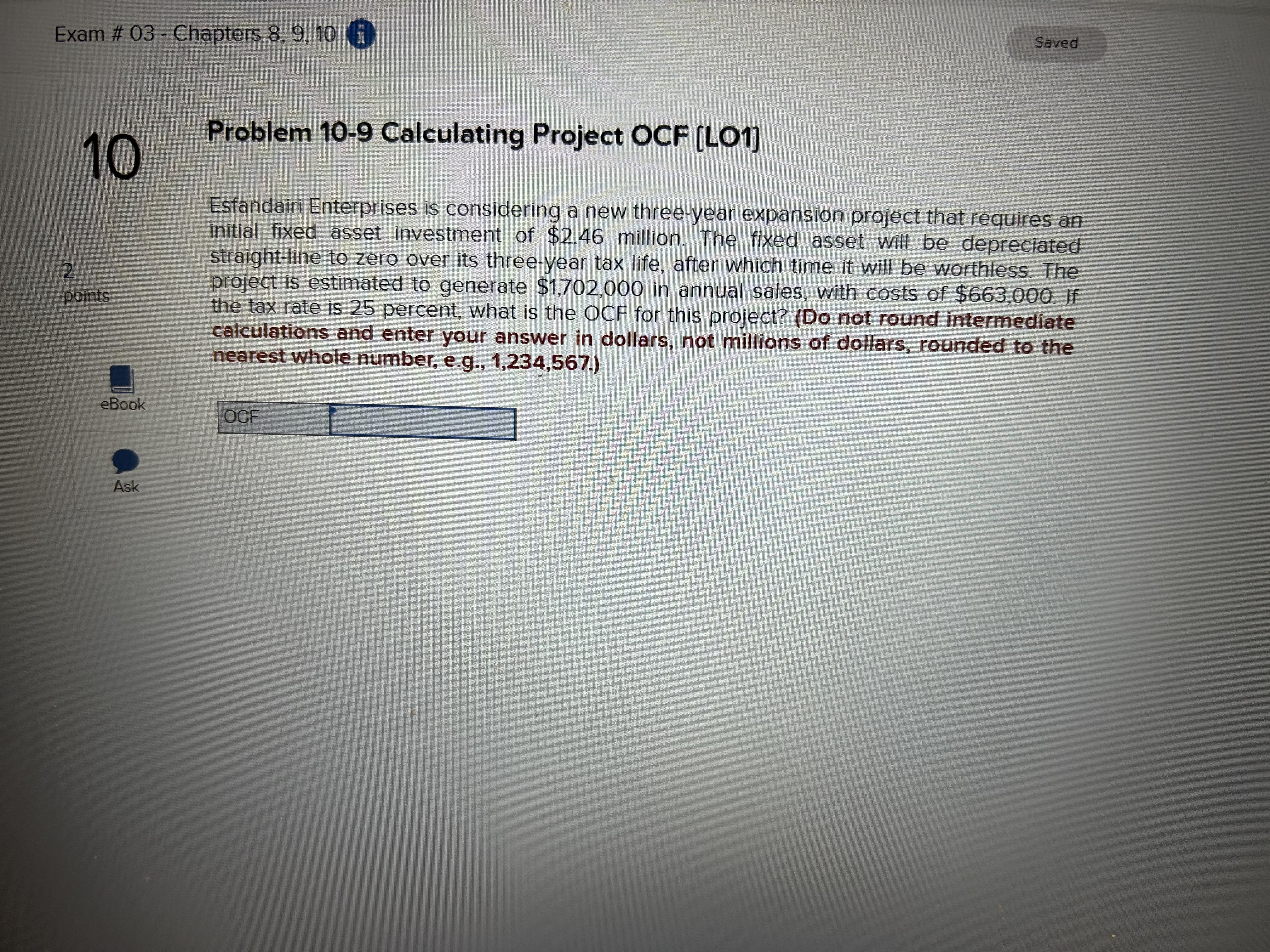

Exam #03 - Chapters 8, 9, 10 i 18 4 points eBook Ask Mc Graw LASER Problem 8-12 Stock Valuation and PE [LO2] The Dahlia Flower Company has earnings of $1.90 per share. The benchmark PE for the company is 14. Saved a. What stock price would you consider appropriate? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What if the benchmark PE were 17? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Stock price at a PE of 14 b. Stock price at a PE of 17 17 4 points eBook Ask Problem 8-3 Stock Values [LO1] The next dividend payment by Im, Incorporated, will be $1.40 per share. The dividends are anticipated to maintain a growth rate of 6 percent forever. The stock currently sells for $25 per share. a. What is the dividend yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the expected capital gains yield? (Enter your answer as a percent.) a. Dividend yield b. Capital gains yield % % 16 2 points 1 eBook Ask Mc Graw Hill TB MC Qu. 08-35 The secondary market is best defined... The secondary market is best defined as the market: Multiple Choice Type here to search O in which subordinated shares are issued and resold. conducted solely by brokers. dominated by dealers. where outstanding shares of stock are resold. where warrants are offered and sold. < Prem 16 of 26 Next > Exam #03 - Chapters 8, 9, 10 i 15 2 points eBook Ask Mc Graw TB MC Qu. 08-18 Which one of the following rights... Which one of the following rights is never directly granted to all shareholders of a publicly held corporation? Multiple Choice O O Electing the board of directors Receiving a distribution of company profits Voting either for or against a proposed merger or acquisition Determining the amount of the dividend to be paid per share Having first chance to purchase any new equity shares that may be offered Saved < Prev 15 of 26 T T cam #03 - Chapters 8, 9, 10 i 14 2 points eBook Ask MC TB MC Qu. 08-07 Read Corporation currently pays an annual... Multiple Choice Read Corporation currently pays an annual dividend of $1.46 per share and plans on increasing that amount by 2.75 percent annually. Cho, Incorporated, currently pays an annual dividend of $1.42 per share and plans on increasing its dividend by 3.1 percent annually. Given this information, you know for certain that the stock of Cho has a higher than the stock of Read. O dividend yield O Type here to search market price O capital gains yield total return real return On C Saved < < PIEN 14 of 26 hp Next > Help Save & E 49F Mostly cloudy O 1 https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252tconnect.mheduc Exam # 03 - Chapters 8, 9, 10 i 13 2 points eBook Ask Mc Graw TB MC Qu. 08-09 Which one of the following applies... Which one of the following applies to the dividend growth model? Multiple Choice Type here to search O An individual stock has the same value to every investor. Even if the dividend amount and growth rate remain constant, the value of a stock can vary. Zero-growth stocks have no market value. Stocks that pay the same annual dividend will have equal market values. The dividend growth rate is inversely related to a stock's market price. O II 20 < Prem Saved W 13 of 26 Next > Exam # 03 - Chapters 8, 9, 10 i 12 2 points eBook Ask Problem 9-6 Calculating AAR [LO4] You're trying to determine whether to expand your business by building a new manufacturing plant. The plant has an installation cost of $12.5 million, which will be depreciated straight-line to zero over its four-year life. If the plant has projected net income of $1,904,300, $1,957,600, $1,926,000, and $1,379,500 over these four years, respectively, what is the project's average accounting return (AAR)? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Average accounting return Saved % 11 2 points eBook Ask Mc Graw UI:11 Problem 8-2 Stock Values [LO1] The next dividend payment by Im, Incorporated, will be $1.80 per share. The dividends are anticipated to maintain a growth rate of 5 percent forever. If the stock currently sells for $35 per share, what is the required return? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Required return Exam #03 - Chapters 8, 9, 10 i 10 2 points eBook Ask Saved Problem 10-9 Calculating Project OCF [LO1] Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.46 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1,702,000 in annual sales, with costs of $663,000. If the tax rate is 25 percent, what is the OCF for this project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) OCF

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer 18a To calculate the stock price at a PE of 14 we can use the formula Stock Price Earnings per Share xPE Ratio Given Earnings per Share 190 PE Ratio 14 Substitute the values into the formula St...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started