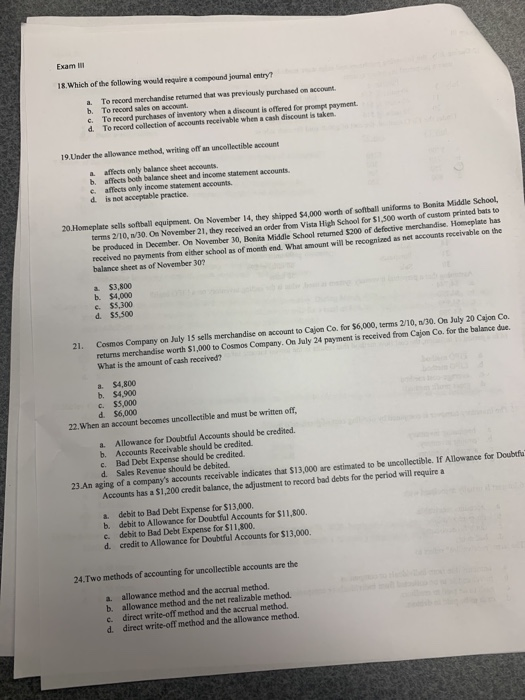

Exam 1 18. Which of the following would require a compound joumal entry? b. c. d To record merchandise returned that was previously purchased on account To record sales on accou. To record purchases of eventory when a discount is offered for prompt payment. To record collection of accounts receivable when a cash discount is taken 19. Under the allowance method, writing of an uncollectible account affects only balance sheet accounts b. affects both balance sheet and income statement accounts. affects only income statement accounts. d is not acceptable practice. 20 Homeplate sells softball equipment. On November 14, they shipped $4,000 worth of softball uniforms to Bonita Middle School terms 2/10, 1/30. On November 21, they received an order from Vista High School for $1,500 worth of custom printed bats to be produced in December. On November 30, Bonita Middle School returned $200 of defective merchandise Homeplate has received no payments from either school as of month end. What amount will be recognized as set counts receivable on the balance sheet as of November 30? b $3,800 $4.000 $5,300 $5,500 d 21. Cosmos Company on July 15 sells merchandise on account to Cajon Co. for 56,000, terms 2/10, 1/30. On July 20 Cajon Co. returns merchandise worth $1,000 to Cosmos Company. On July 24 payment is received from Cajon Co. for the balance du What is the amount of cash received? S4,800 b. $4.900 c. 55.000 d $6,000 22. When an account becomes uncollectible and must be written off, & Allowance for Doubtful Accounts should be credited. b Accounts Receivable should be credited. c. Bad Debt Expense should be credited. d Sales Revenue should be debited. 23.An aging of a company's accounts receivable indicates that $13,000 are estimated to be uncollectible. If Allowance for Doubtfu Accounts has a $1,200 credit balance, the adjustment to record bad debts for the period will require a debit to Bad Debt Expense for $13,000 b. debit to Allowance for Doubtful Accounts for $11,800. c. debit to Bad Debt Expense for $11.800. d credit to Allowance for Doubtful Accounts for $13,000. 24.Two methods of accounting for uncollectible accounts are the allowance method and the accrual method. ballowance method and the net realizable method. c. direct write-off method and the accrual method. d direct write-off method and the allowance method