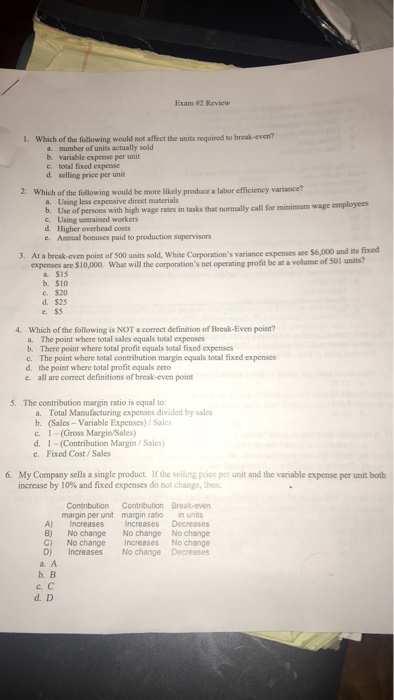

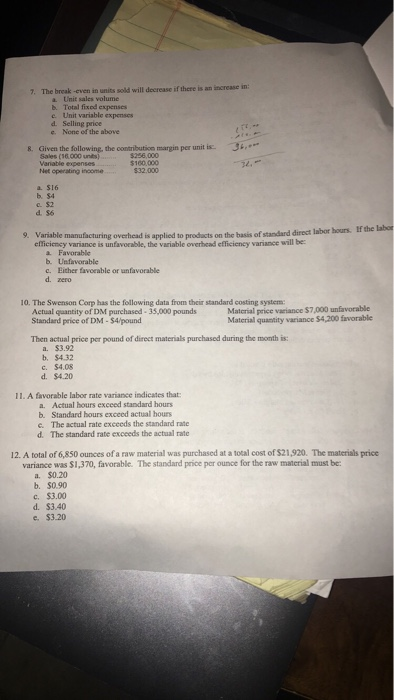

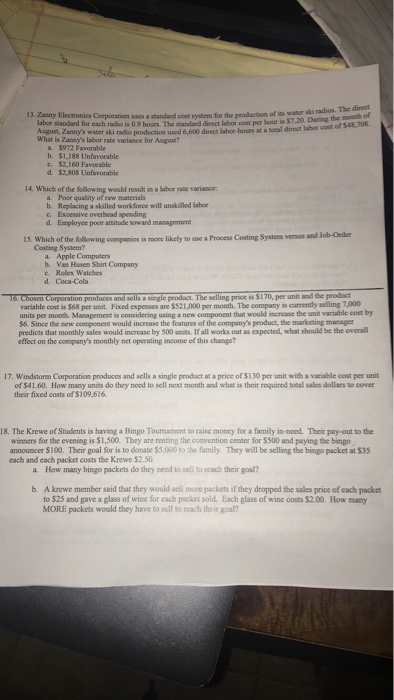

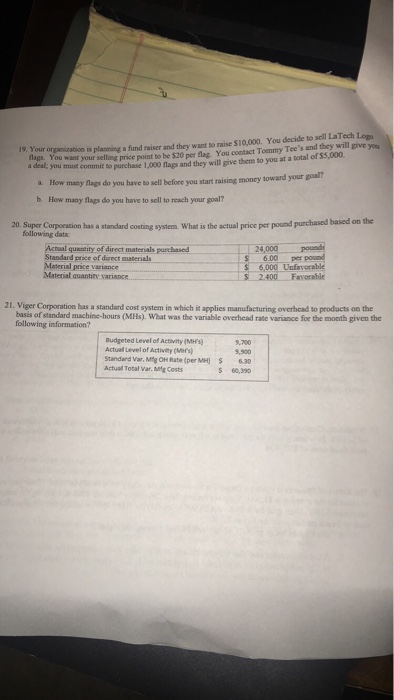

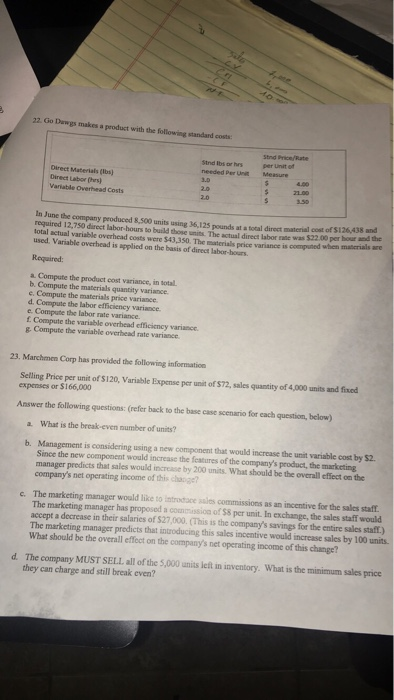

Exam #2 Review I. Which of the following would not affect the units required to break-even? a. number of units actually sold b. variable expense per unit e. total fixed expense d. selling price per unit 2. Which of the following would be more likely produce a labor efficiency variance? a. Using less expensive direet materials b. Use of persons with high wage rates in tasks that normally call for minimum wage employees c. Using untrained workers d. Higher overhead costs e. Annual bonuses paid to production supervisors At a brcak-even point of 500 units sold, White Corporation's variance expenses are $10,000. What will the corporation's net operating profit be at a volume ot 3. expenses are $6,000 and its fixed 501 units? a S1S b. $10 c. $20 d. $25 e. $5 Which of the following is NOT a conrect definition of Break-Even point? a. The point where total sales equals total expenses b There point where total profit equals total fixed expenses c. The point where total contribution margin equals total fixed expenses d. the point where total profit equals zero e. all are correct definitions of break-even point 4. 5. The contribution margin ratio is equal to: a. Total Manufacturing expenses divided by sales b. (Sales Variable Expenses)/Sales c. 1-(Gross Margin/Sales) d. 1-(Contribution Margin/Sales) e. Fixed Cost/ Sales My Company sells a single product If the seilling pice per unit and the variable expense per unit both increase by 10% and fixed expenses do not change, hea; 6. margin per unit margin ratio in unts A) Increases Increases Decreases B) No change No change No change C) No change Increases No change D) Increases No change Decreases a. A b. c. C d. D 7. The break -even in units sold will decrease if there is an increase in: b. Total fixed expenses e. Unit variable expenses d. Selling price e. None of the above Givens the following, the contributicn margin per unit is. , Sales (s6.000 unts) Variable Net operating income 8. the following, the contribution margin per unit is. $256,000 $160.000 a. $16 .$2 prodacts on the basis of standard direct labor hours. If the labor 9. Variable manufacturing overhead is applied to variance is unfavorable, the variable overhead efficieney variance will be a Favorable b. Unfavorable c. Either favoeable or unfavorable d. zero 10. The Swenson Corp has the following data from their standard costing system: Actual quantity of DM purchased-35,000 pounds Standard price of DM- $4/pound Matcrial price variance $7,000 unfavorable Material quantity variance $4,200 favorable Then actual price per pound of direct materials purchased during the month is: a. $3.92 b. $4.32 c. $4.08 d. $4.20 11. A favorable labor rate variance indicates that a. Actual hours exceed standard hours b. Standard hours exceed actual hours e. The actual rate exeeeds the standard rate d. The standard rate exceeds the actual rate 12. A total of 6,850 ounces of a raw material was purchased at a total cost of $21,920. The materials price variance was $1,370, favorable. The standard price per ounce for the raw material must be a. $0.20 b. $0.90 . $3.00 d. $3.40 e $3.20 adios. The direct During the mosth of 13. Zuany Electronies Coeporation uses a standard cost system for the peoduction of s ts water ski labor standard for each radio is 0.9 hours. The standand direct labor cost per hour is 57.0 Asgust, Zanny's water ski radio What is Zarny's labor rate variance for August? prodection used 6,600 direct labor-hours at a total direct labor cost of $48,708. a$972 Favorable b. $1,188 Unfavorable c. $2,160 Faverable d. $2,808 Unfavorable 14. Which of the following would resulk in a labor rate variance: Poor quality of raw materials b. Replacing a skilled work force will unskilled labor c. Excessive overhead spending d. Employee poor asitude toward management 15. Which of the fhollowing Cooting System? companies is more likely to use a Process Costing System versus and Job-Oeder a. Apple Computers b. Van Husen Shirt Company e Rolex Watches d. Coca-Cola Case Coporationproduces and sellsasingleprodat. The selling pree is S 170, per unit and the product variable cost is 568 per unit. units per month. Management is considering using a new component that would increase the unit variable cost by T Fixed expenses are $521,000 per month. The company is currently selling 7,000 $6. Since the new coemponent would increase the features of the company's product, the marketing manager predicts that monthly sales would incrcase by 500 units. Irall works out as expected, what should be the overall effect on the company's monthly net operating income of this change? 17. Windstorm Corporation produces and sells a single product at a price of S130 per unit with a variable cost per unit of $41.60. How many units do they need to sell next month and what is their roquired total sales dollars to cover their fixed costs of $109,616 18. The Krewe of Students is having a Bingo Toumament to raise moncy for a family in-need. Tbeir pay-out to the winners for the evening is $1,500. They are renting the convention center for $500 and paying the bimgo announcer S100. Their goal for is to donate $5,000 to the family. They will be selling the bingo packet at $35 each and each packet costs the Krewe $2.50 a. How many bingo packets do they need to sell to reach their goal? b. A krewe member said that they would sell more packets if they dropped the sales price of each packet to $25 and gave a glass of wine for each packet sold. Each glass of wine costs $2.00. How many MORE packets would they have to sell to reach their goal? ags You want your selling price point to be $20 per flag. You contact Tommy Tee's and they will give you a deai you mst commit to purchase 1,000 flags and they will give them to you at a total of $$,000. 19. Your organization is plarning a fund raiser and they want to raise $1Q,000. You decide to sell LaTech Logo a. How many flags do you have to sell before you start raising money toward your goal? b. How many flags do you have to sell to reach your goal? 20. Super Corporation has a standard costing system. What is the actual price per pound purchased based on following data: Actual quentity of direct materials tandard price of direct materials Material price variance Material quantity 24,000 pound 6.00 per pound 6,000 Unfavorable Favorable purchased variance 21. Viger Corporation has a standard cost system in which it applies manufacturing overhcad to products on the basis of standard machine-hours (MHs). What was the variable overhead rate variance for the month given the following information Budgeted Level of Activity (MH's Actual Level of Activity(Mers Standard Var, Mitg OH Rate (per MH) 6.30 Actual Total Var. itg Costs s 60,390 22. Go Dawgs makes a product with the following standard costs lbs or hrsStnd Price/Rate needed Per Unit per Unit of Measure Direct Materials (lbs) Direct Labor (hrs) Variable Overhead Costs 21.00 In June the company peoduced 8,500 units using 36,125 required 12,750 direct labor-hours to build those units. The actual direct labor rate was $22.00 per hour and the lotal actual variable overhead costs were $43,350. The materials price variance is compuned when maserials are used. Variable overhead is applied on the basis of direct labor-hours the company peoduced 8,500 units using 36,125 pounds at a total direct material cost of $126438 and Required a. Compute the product cost variance, in total. b. Compute the materials quantity variance e. Compute the materials price variance d. Compute the labor efficiency variance e. Compute the labor rate variance. f Compute the variable overhead efficiency variance g Compute the variable overhead rate variance 23. Marchmen Corp has provided the following information Selling Price per unit of S120, Variable Expense per unit of $72, sales quantity of 4,000 units and fixed expenses or $166,000 Answer the following questions: (refer back to the base case scenario for each question, below) a. What is the break-even number of units? b. Management is considering using a new component that would increase the unit variable cost by $2 Since the new component would increase the features of the company's product, the marketing manager predicts that sales would increase by 200 units. What should be the overall effect on the company's net operating income of this chaoge? c. The marketing manager would like to introdace asies commissions as an incentive for the sales staff The marketing manager has proposed a cosion of $8 per unit. In exchange, the sales staff would accept a decrease in their salaries of $27,000. (This is the company's savings for the entire sales staff) The marketing manager predicts that introducing this sales incentive would increase sales by 100 units What should be the overall effect on the company's net operating income of this change? d. The company MUST SELL all of the 5,000 units left in inventory. What is the minimum sales price they can charge and still break even? Exam #2 Review I. Which of the following would not affect the units required to break-even? a. number of units actually sold b. variable expense per unit e. total fixed expense d. selling price per unit 2. Which of the following would be more likely produce a labor efficiency variance? a. Using less expensive direet materials b. Use of persons with high wage rates in tasks that normally call for minimum wage employees c. Using untrained workers d. Higher overhead costs e. Annual bonuses paid to production supervisors At a brcak-even point of 500 units sold, White Corporation's variance expenses are $10,000. What will the corporation's net operating profit be at a volume ot 3. expenses are $6,000 and its fixed 501 units? a S1S b. $10 c. $20 d. $25 e. $5 Which of the following is NOT a conrect definition of Break-Even point? a. The point where total sales equals total expenses b There point where total profit equals total fixed expenses c. The point where total contribution margin equals total fixed expenses d. the point where total profit equals zero e. all are correct definitions of break-even point 4. 5. The contribution margin ratio is equal to: a. Total Manufacturing expenses divided by sales b. (Sales Variable Expenses)/Sales c. 1-(Gross Margin/Sales) d. 1-(Contribution Margin/Sales) e. Fixed Cost/ Sales My Company sells a single product If the seilling pice per unit and the variable expense per unit both increase by 10% and fixed expenses do not change, hea; 6. margin per unit margin ratio in unts A) Increases Increases Decreases B) No change No change No change C) No change Increases No change D) Increases No change Decreases a. A b. c. C d. D 7. The break -even in units sold will decrease if there is an increase in: b. Total fixed expenses e. Unit variable expenses d. Selling price e. None of the above Givens the following, the contributicn margin per unit is. , Sales (s6.000 unts) Variable Net operating income 8. the following, the contribution margin per unit is. $256,000 $160.000 a. $16 .$2 prodacts on the basis of standard direct labor hours. If the labor 9. Variable manufacturing overhead is applied to variance is unfavorable, the variable overhead efficieney variance will be a Favorable b. Unfavorable c. Either favoeable or unfavorable d. zero 10. The Swenson Corp has the following data from their standard costing system: Actual quantity of DM purchased-35,000 pounds Standard price of DM- $4/pound Matcrial price variance $7,000 unfavorable Material quantity variance $4,200 favorable Then actual price per pound of direct materials purchased during the month is: a. $3.92 b. $4.32 c. $4.08 d. $4.20 11. A favorable labor rate variance indicates that a. Actual hours exceed standard hours b. Standard hours exceed actual hours e. The actual rate exeeeds the standard rate d. The standard rate exceeds the actual rate 12. A total of 6,850 ounces of a raw material was purchased at a total cost of $21,920. The materials price variance was $1,370, favorable. The standard price per ounce for the raw material must be a. $0.20 b. $0.90 . $3.00 d. $3.40 e $3.20 adios. The direct During the mosth of 13. Zuany Electronies Coeporation uses a standard cost system for the peoduction of s ts water ski labor standard for each radio is 0.9 hours. The standand direct labor cost per hour is 57.0 Asgust, Zanny's water ski radio What is Zarny's labor rate variance for August? prodection used 6,600 direct labor-hours at a total direct labor cost of $48,708. a$972 Favorable b. $1,188 Unfavorable c. $2,160 Faverable d. $2,808 Unfavorable 14. Which of the following would resulk in a labor rate variance: Poor quality of raw materials b. Replacing a skilled work force will unskilled labor c. Excessive overhead spending d. Employee poor asitude toward management 15. Which of the fhollowing Cooting System? companies is more likely to use a Process Costing System versus and Job-Oeder a. Apple Computers b. Van Husen Shirt Company e Rolex Watches d. Coca-Cola Case Coporationproduces and sellsasingleprodat. The selling pree is S 170, per unit and the product variable cost is 568 per unit. units per month. Management is considering using a new component that would increase the unit variable cost by T Fixed expenses are $521,000 per month. The company is currently selling 7,000 $6. Since the new coemponent would increase the features of the company's product, the marketing manager predicts that monthly sales would incrcase by 500 units. Irall works out as expected, what should be the overall effect on the company's monthly net operating income of this change? 17. Windstorm Corporation produces and sells a single product at a price of S130 per unit with a variable cost per unit of $41.60. How many units do they need to sell next month and what is their roquired total sales dollars to cover their fixed costs of $109,616 18. The Krewe of Students is having a Bingo Toumament to raise moncy for a family in-need. Tbeir pay-out to the winners for the evening is $1,500. They are renting the convention center for $500 and paying the bimgo announcer S100. Their goal for is to donate $5,000 to the family. They will be selling the bingo packet at $35 each and each packet costs the Krewe $2.50 a. How many bingo packets do they need to sell to reach their goal? b. A krewe member said that they would sell more packets if they dropped the sales price of each packet to $25 and gave a glass of wine for each packet sold. Each glass of wine costs $2.00. How many MORE packets would they have to sell to reach their goal? ags You want your selling price point to be $20 per flag. You contact Tommy Tee's and they will give you a deai you mst commit to purchase 1,000 flags and they will give them to you at a total of $$,000. 19. Your organization is plarning a fund raiser and they want to raise $1Q,000. You decide to sell LaTech Logo a. How many flags do you have to sell before you start raising money toward your goal? b. How many flags do you have to sell to reach your goal? 20. Super Corporation has a standard costing system. What is the actual price per pound purchased based on following data: Actual quentity of direct materials tandard price of direct materials Material price variance Material quantity 24,000 pound 6.00 per pound 6,000 Unfavorable Favorable purchased variance 21. Viger Corporation has a standard cost system in which it applies manufacturing overhcad to products on the basis of standard machine-hours (MHs). What was the variable overhead rate variance for the month given the following information Budgeted Level of Activity (MH's Actual Level of Activity(Mers Standard Var, Mitg OH Rate (per MH) 6.30 Actual Total Var. itg Costs s 60,390 22. Go Dawgs makes a product with the following standard costs lbs or hrsStnd Price/Rate needed Per Unit per Unit of Measure Direct Materials (lbs) Direct Labor (hrs) Variable Overhead Costs 21.00 In June the company peoduced 8,500 units using 36,125 required 12,750 direct labor-hours to build those units. The actual direct labor rate was $22.00 per hour and the lotal actual variable overhead costs were $43,350. The materials price variance is compuned when maserials are used. Variable overhead is applied on the basis of direct labor-hours the company peoduced 8,500 units using 36,125 pounds at a total direct material cost of $126438 and Required a. Compute the product cost variance, in total. b. Compute the materials quantity variance e. Compute the materials price variance d. Compute the labor efficiency variance e. Compute the labor rate variance. f Compute the variable overhead efficiency variance g Compute the variable overhead rate variance 23. Marchmen Corp has provided the following information Selling Price per unit of S120, Variable Expense per unit of $72, sales quantity of 4,000 units and fixed expenses or $166,000 Answer the following questions: (refer back to the base case scenario for each question, below) a. What is the break-even number of units? b. Management is considering using a new component that would increase the unit variable cost by $2 Since the new component would increase the features of the company's product, the marketing manager predicts that sales would increase by 200 units. What should be the overall effect on the company's net operating income of this chaoge? c. The marketing manager would like to introdace asies commissions as an incentive for the sales staff The marketing manager has proposed a cosion of $8 per unit. In exchange, the sales staff would accept a decrease in their salaries of $27,000. (This is the company's savings for the entire sales staff) The marketing manager predicts that introducing this sales incentive would increase sales by 100 units What should be the overall effect on the company's net operating income of this change? d. The company MUST SELL all of the 5,000 units left in inventory. What is the minimum sales price they can charge and still break even