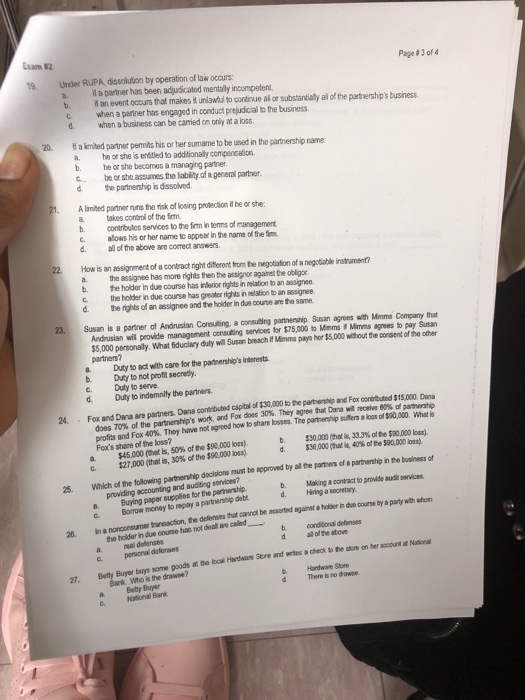

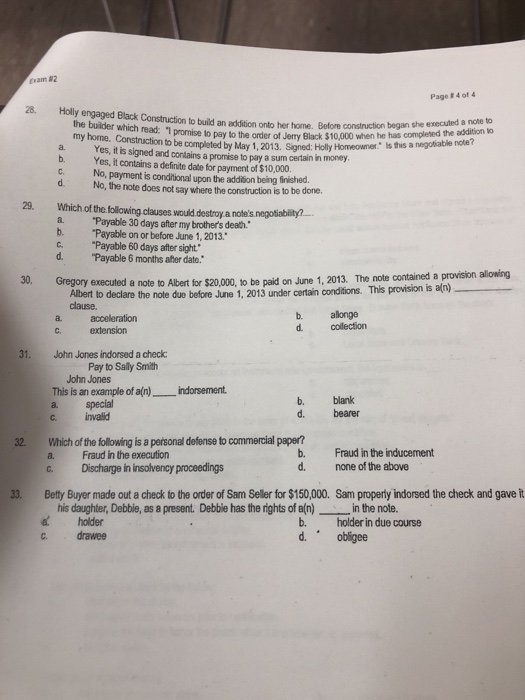

Exam 82 19. Under RUPA, dissolution by operation of law occurs Page # 3 of 4 a. a partner has been adjudicated mentally incompetent ? arevent occurs that makest unlawful to conne al or substantialy al oe the patershpS business c when a pantner has engaged in conduct prejudicial to the business. d. when a business can be carried on only at a loss 20. a limited partner permits his or her sumame to be used in the partnership name i or she is entitled to additionaly compensation. b. heor she becomes a managing partiner crshe assumes the labilily af ageceral parner d. tpartnership is dissolved A limited partner runs the risk of losing protection it he or she a taes control of the frm b. contrbutes services to the frm in temns of management clws his or her name to appear in the name of the em d. all of the above are correct answers 22 How ls an assignment of a contract right difterent from he negotiation of a negodiable instrument? the assignee has more rights then the assignor againet tve obligor b. the holder in due course has irderior rights in relation to an assignee. C. the holder in due course has greater rights in relstion to an assignee d. trights of an assignee and the hoider in due course are the same 23.Susan is a partner of Andrusian Consulting, a consuting partnership. Susan agrees wth Mimms Company that Andrusian will provide management consulting services for $75,000 to Mms Mimms agees to pay Susan $5,000 personaly. What fiduciary duty will Susan breach It Mimms pays her $5,000 wlthourt the consent of the other partners? ?. Duty to ed with care for the panerships ienests. b. Duty to not profit secretly. c. Duty to serve d. Duty to indemnity the partners. 24. For and Dana are partners. Dana contributed captal of $30,000 to the pertsership and Foxr condbud $15.000.ma deon does 70% of the partership's work, and For det 30%. They agree tat Dra mate 60% ofl partnership pr fits and Fox 40%. They have not agreed how to share losses. The pameship sutes a loas l soooo math Fox's share of the loss? a. ?5,000 (that is, 50% ofthe $90.00 Oss c. $27,000 (that is, 30% ofthe S9000 loss) b. d 530,000 (that is, 33.3% ofthe $90.000 loss). $36,00 hat is, 40% of te sea00 loss 25. Which of the folowing partnership dacions must be approved by all the parthers of e partnership in the business of providing accounting and auditing sorvices? ?. Buying paper supplies forthe parrerstip. c. Boow monay to repay a partnership delb b. Making a contract to provide audit services d. Hiring a secretary in a nonconsumer tranation, the defenses thu canct be asserted agairst a hober h due course by a party wth whom b conditional defenses d. all of the abowe eal defenses c penonal defonses the 2 Betty Buyer buys some Buger bus some goosthe boa Hardwacuk N b. Hardware Stone d There ia no drawse National Bank