Question

Examine changes and percent changes in the line items on the income statement. Comment on significant changes. Calculate the gross profit margin, profit margin, return

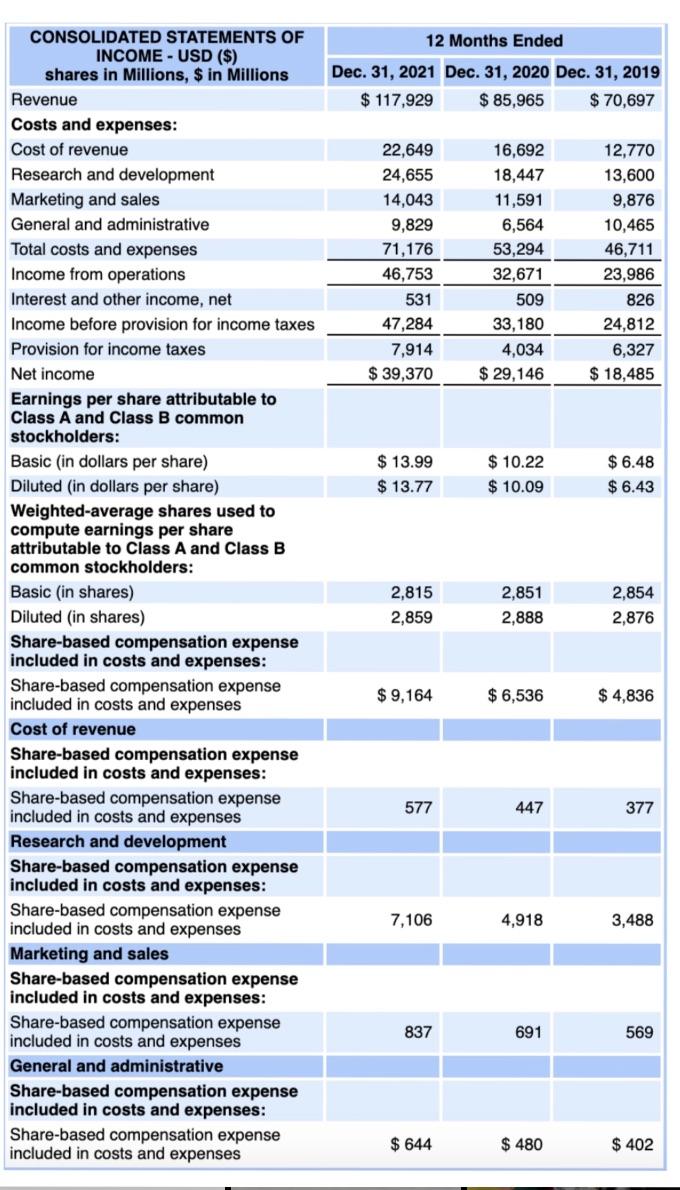

Examine changes and percent changes in the line items on the income statement. Comment on significant changes. Calculate the gross profit margin, profit margin, return on assets, and return on equity for all years. Comment on the company's profitability and changes

CONSOLIDATED STATEMENTS OF INCOME - USD ($) shares in Millions, $ in Millions Revenue Costs and expenses: Cost of revenue Research and development Marketing and sales General and administrative Total costs and expenses Income from operations Interest and other income, net Income before provision for income taxes Provision for income taxes Net income Earnings per share attributable to Class A and Class B common stockholders: Basic dollars per share) Diluted (in dollars per share) Weighted-average shares used to compute earnings per share attributable to Class A and Class B common stockholders: Basic (in shares) Diluted (in shares) Share-based compensation expense included in costs and expenses: Share-based compensation expense included in costs and expenses Cost of revenue Share-based compensation expense included in costs and expenses: Share-based compensation expense included in costs and expenses Research and development Share-based compensation expense included in costs and expenses: Share-based compensation expense included in costs and expenses Marketing and sales Share-based compensation expense included in costs and expenses: Share-based compensation expense included in costs and expenses General and administrative Share-based compensation expense included in costs and expenses: Share-based compensation expense included in costs and expenses 12 Months Ended Dec. 31, 2021 Dec. 31, 2020 Dec. 31, 2019 $ 117,929 $ 85,965 $70,697 22,649 24,655 14,043 9,829 71,176 46,753 531 47,284 7,914 $ 39,370 $13.99 $13.77 2,815 2,859 $9,164 577 7,106 837 $ 644 16,692 18,447 11,591 6,564 53,294 32,671 509 33,180 4,034 $29,146 $10.22 $ 10.09 2,851 2,888 $6,536 447 4,918 691 $480 12,770 13,600 9,876 10,465 46,711 23,986 826 24,812 6,327 $ 18,485 $6.48 $6.43 2,854 2,876 $4,836 377 3,488 569 $ 402

Step by Step Solution

3.30 Ratings (106 Votes)

There are 3 Steps involved in it

Step: 1

To analyze the changes and calculate various financial ratios for the given income statement data well perform the following steps Examine Changes in ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started