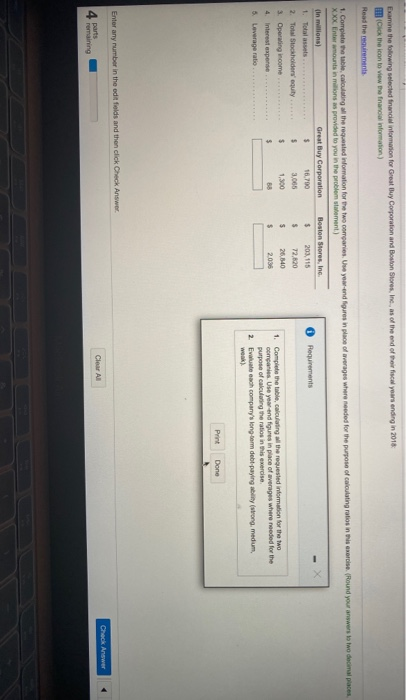

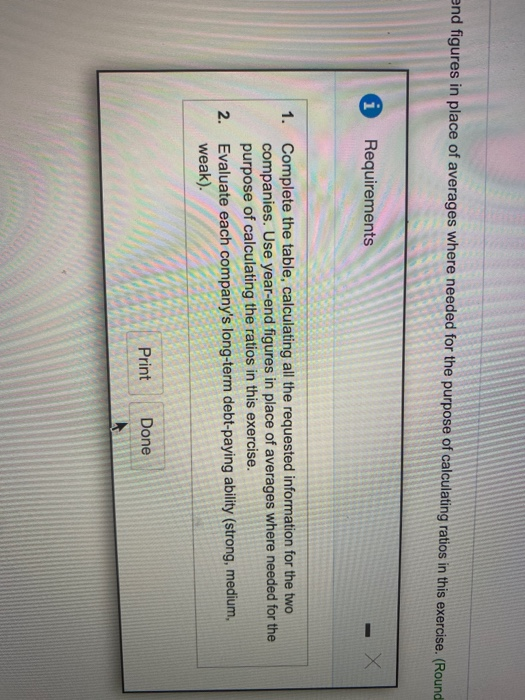

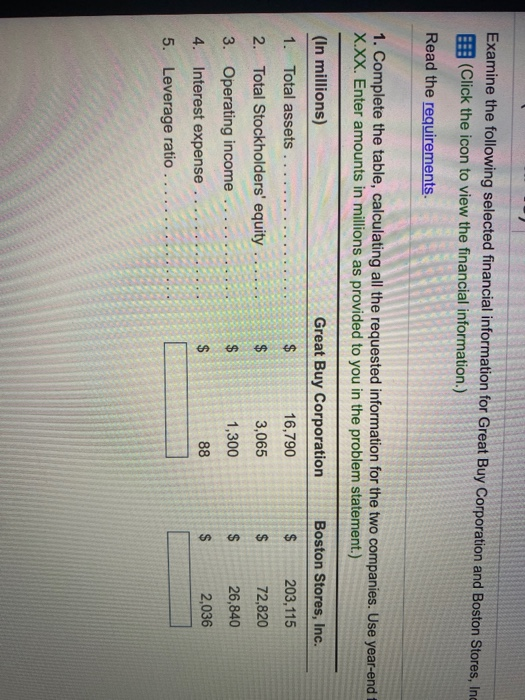

Examine the folowing selected financial information for Great Buy Corporation and Boston Stores, Inc., as of the end of their fiscal years ending in 2018 Click the icon to view the financial information) Read the requirements 1. Complete the table calculating all the requested Wormation for the two companies. Use your end figures in place of everages where needed for the purpose of calculating ratios in this exercise (Round your answers to two decimal places Xxx Entertain milions as provided to you in the problem sement) in millions) Great Buy Corporation Boston Stores, Inc. 1. Total assets $ 16700 $ 203, 115 Requirements 2. Total Stockholders' equity $ 3,065 s 72,620 3. Operating income s $ 26,840 1. Complete the table, calculating all the requested information for the two Interest expense 88 2.036 companies. Use year-end figures in place of averages where needed for the 5 Laverage ratio purpose of calculating the ratios in this exercise 2. Evaluate each company's long-term debt paying ability wrong, medium, we) 4 $ $ Print Done Enter any number in the edit fields and then click Check Answer Check Answer Clear Al parts remaining end figures in place of averages where needed for the purpose of calculating ratios in this exercise. (Round Requirements 1. Complete the table, calculating all the requested information for the two companies. Use year-end figures in place of averages where needed for the purpose of calculating the ratios in this exercise. Evaluate each company's long-term debt-paying ability (strong, medium, weak). 2. Print Done Examine the following selected financial information for Great Buy Corporation and Boston Stores, Inc (Click the icon to view the financial information.) Read the requirements. 1. Complete the table, calculating all the requested information for the two companies. Use year-end X.XX. Enter amounts in millions as provided to you in the problem statement.) (In millions) Boston Stores, Inc. 1. Total assets.. Great Buy Corporation $ 16,790 3,065 $ 203,115 72,820 $ $ 1,300 2. Total Stockholders' equity 3. Operating income 4. Interest expense 5. Leverage ratio. $ $ $ 26,840 2,036 $ 88 9 of 10 (7 complete) HW Score: 50.16%. Ques and Boston Stores, Inc., as of the end of their fiscal years ending in 2018: ompanies. Use year-end figures in place of averages where needed for the purpose of calculating ratios in this exercise. (Round your answers to two de 0 Requirements ston Stores, Inc. 203.115 72,820 26,840 5 1. $ 2,036 Complete the table, calculating all the requested information for the two companies. Use year-end figures in place of averages where needed for the purpose of calculating the ratios in this exercise. Evaluate each company's long-term debt-paying ability (strong, medium, weak). 2. Print Done Check