Question

You are the manager in the audit of Vernal Manufacturing Company and are turning your attention to the income statement accounts. The in-charge auditor assessed

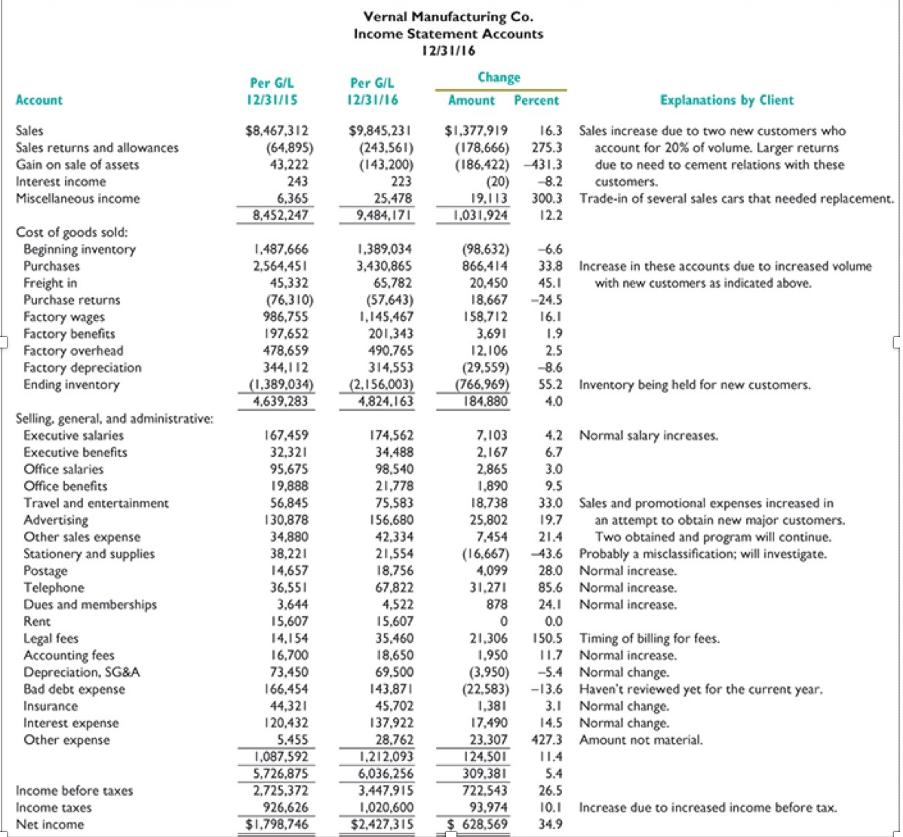

You are the manager in the audit of Vernal Manufacturing Company and are turning your attention to the income statement accounts. The in-charge auditor assessed control risk for all cycles as low, supported by tests of controls. There are no major inherent risks affecting income and expense accounts. Accordingly, you decide that the major emphasis in auditing the income statement accounts will be to use substantive analytical procedures. The client prepared a schedule of the key income statement accounts that compares the prior-year totals with the current year totals. The in-charge auditor completed the last column of the audit schedule, which includes explanations of variances obtained from discussions with client personnel. The audit schedule is included.

Required

a.Examine the schedule prepared by the client and your staff and write a memorandum to the in-charge that includes criticisms and concerns about the audit procedures performed and questions for the in-charge auditor to resolve.

b.Evaluate the explanations for variances provided by client personnel. List any alternative explanation to those given.

c.Indicate which variances are of special significance to the audit and how you believe they should be responded to in terms of additional audit procedures.

* There isn't any more info provided in the textbook this is the entire question.

Vernal Manufacturing Co. Income Statement Accounts 12/31/16 Per G/L Change Per G/L 12/31/16 Amount Percent Account 12/31/15 Explanations by Client 16.3 Sales increase due to two new customers who Sales Sales returns and allowances $8,467,312 (64,895) 43,222 $9,845,231 (243,561) (143.200) 223 $1,377,919 (178,666) 275.3 (186,422) -431.3 (20) 19,113 1.031.924 account for 20% of volume. Larger returns due to need to cement relations with these Gain on sale of assets Interest income 243 -8.2 customers. 25,478 9,484,171 Miscellaneous income 6.365 8,452,247 300.3 Trade-in of several sales cars that needed replacement. 12.2 Cost of goods sold: Beginning inventory Purchases 1,487,666 1,389,034 3,430,865 65,782 (57.643) 1,145,467 201,343 (98.632) -6.6 2,564,451 45,332 33.8 Increase in these accounts due to increased volume 45.1 866,414 Freight in Purchase returns Factory wages Factory benefits Factory overhead Factory depreciation Ending inventory 20,450 with new customers as indicated above. -24.5 (76.310) 986,755 197,652 18,667 158,712 16.1 1.9 2.5 3,691 478.659 490,765 12.106 344,112 314,553 (29,559) (766.969) 184.880 -8.6 (1.389,034) 4.639.283 (2.156.003) 4,824.163 55.2 Inventory being held for new customers. 4.0 Selling, general, and administrative: Executive salaries 174,562 34,488 4.2 Normal salary increases. 6.7 167,459 7,103 Executive benefits 32,321 2,167 2,865 1,890 18,738 25,802 7,454 Office salaries 95,675 19,888 56,845 130,878 98,540 21,778 75,583 156.680 3.0 Office benefits 9.5 Travel and entertainment 33.0 Sales and promotional expenses increased in 19.7 21.4 Advertising Other sales expense Stationery and supplies Postage Telephone Dues and memberships an attempt to obtain new major customers. Two obtained and program will continue. 34,880 38,221 42,334 21,554 (16,667) -43.6 Probably a misclassification; will investigate. 4,099 31,271 878 14,657 18,756 28.0 Normal increase. 36,551 67,822 85.6 Normal increase. 3,644 4,522 24.1 Normal increase. Rent 15,607 15,607 0.0 Legal fees Accounting fees Depreciation, SG&A Bad debt expense 21,306 1,950 (3.950) (22.583) -13.6 Haven't reviewed yet for the current year, 1,381 17,490 23.307 124,501 309.381 722,543 14,154 16,700 73,450 35,460 18,650 69,500 150.5 Timing of billing for fees. 11.7 Normal increase. -5.4 Normal change. 166,454 143,871 45,702 3.1 Normal change. 14.5 Normal change. 427.3 Amount not material. Insurance 44,321 1 20,432 5.455 1,087,592 5.726,875 2.725.372 926,626 $1,798,746 Interest expense Other expense 137,922 28.762 1,212.093 6,036.256 3,447,915 1,020.600 $2.427.315 11.4 5.4 Income before taxes 26.5 Income taxes 93.974 10.1 Increase due to increased income before tax. 34.9 Net income $ 628.569

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To InCharge Auditor From Audit Manager Subject Concerns about the schedule prepared by the client and the staff assistant in the audit of V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started