Question

Examine the trends for the current year versus the previous year in profitability by doing a Dupont Analysis for the trends for ROE, ROA, EM,

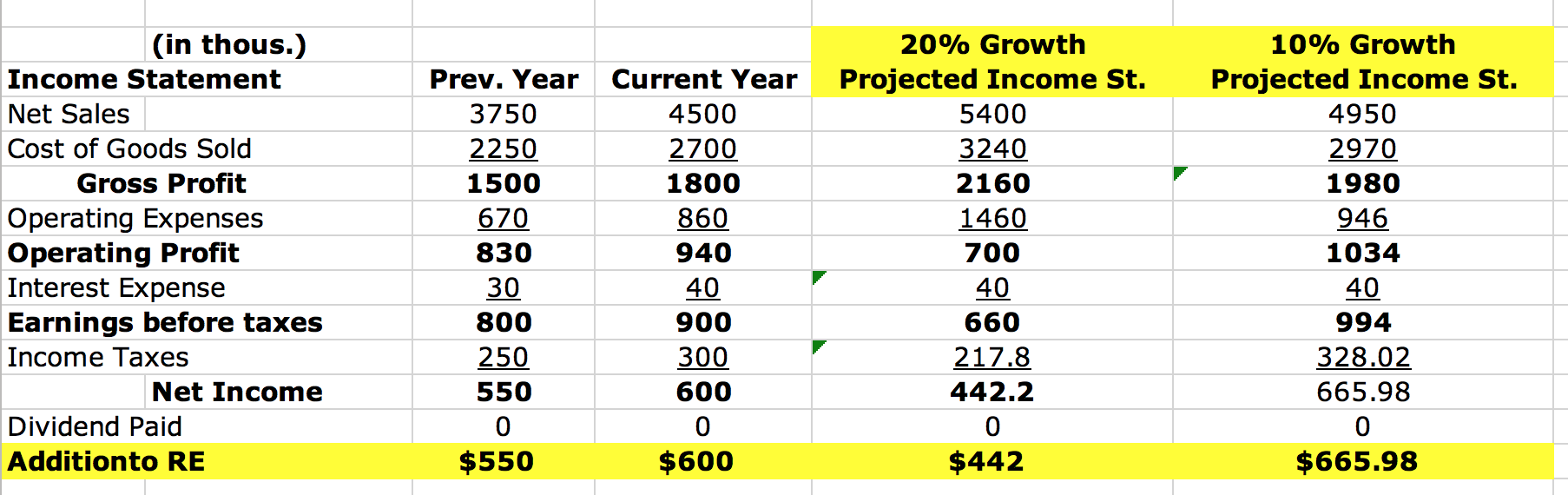

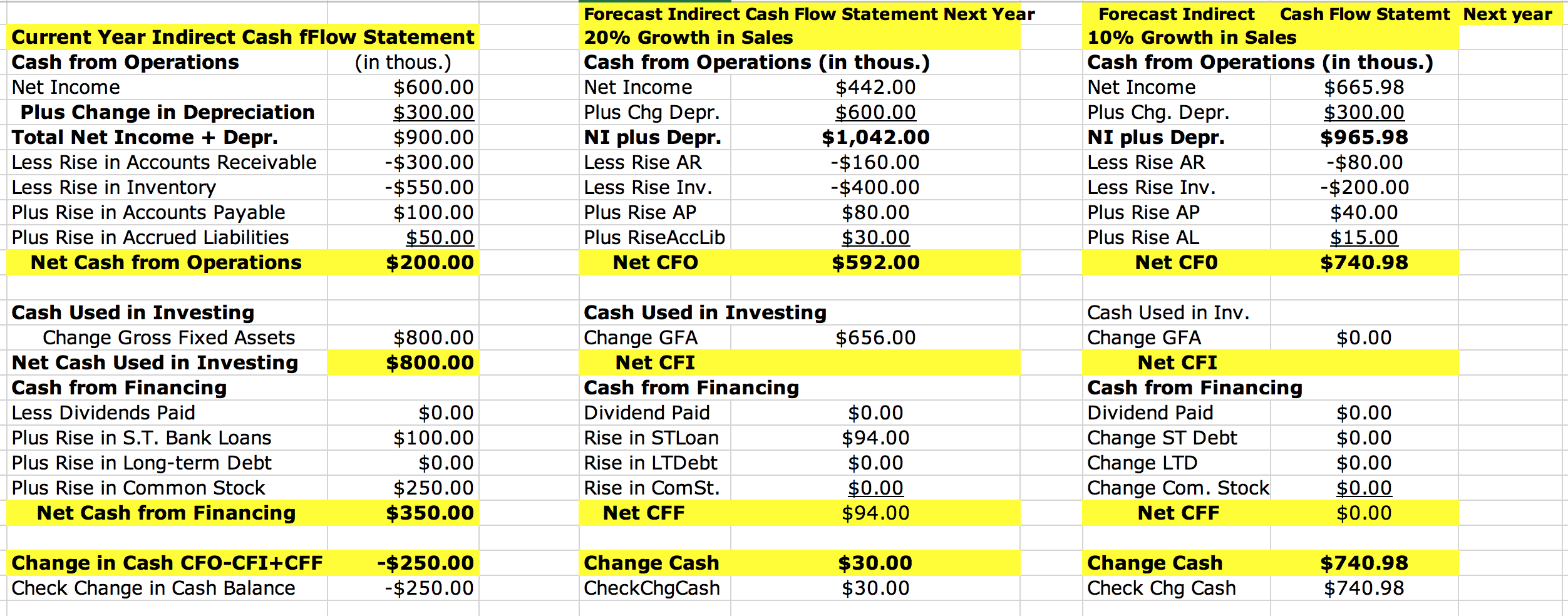

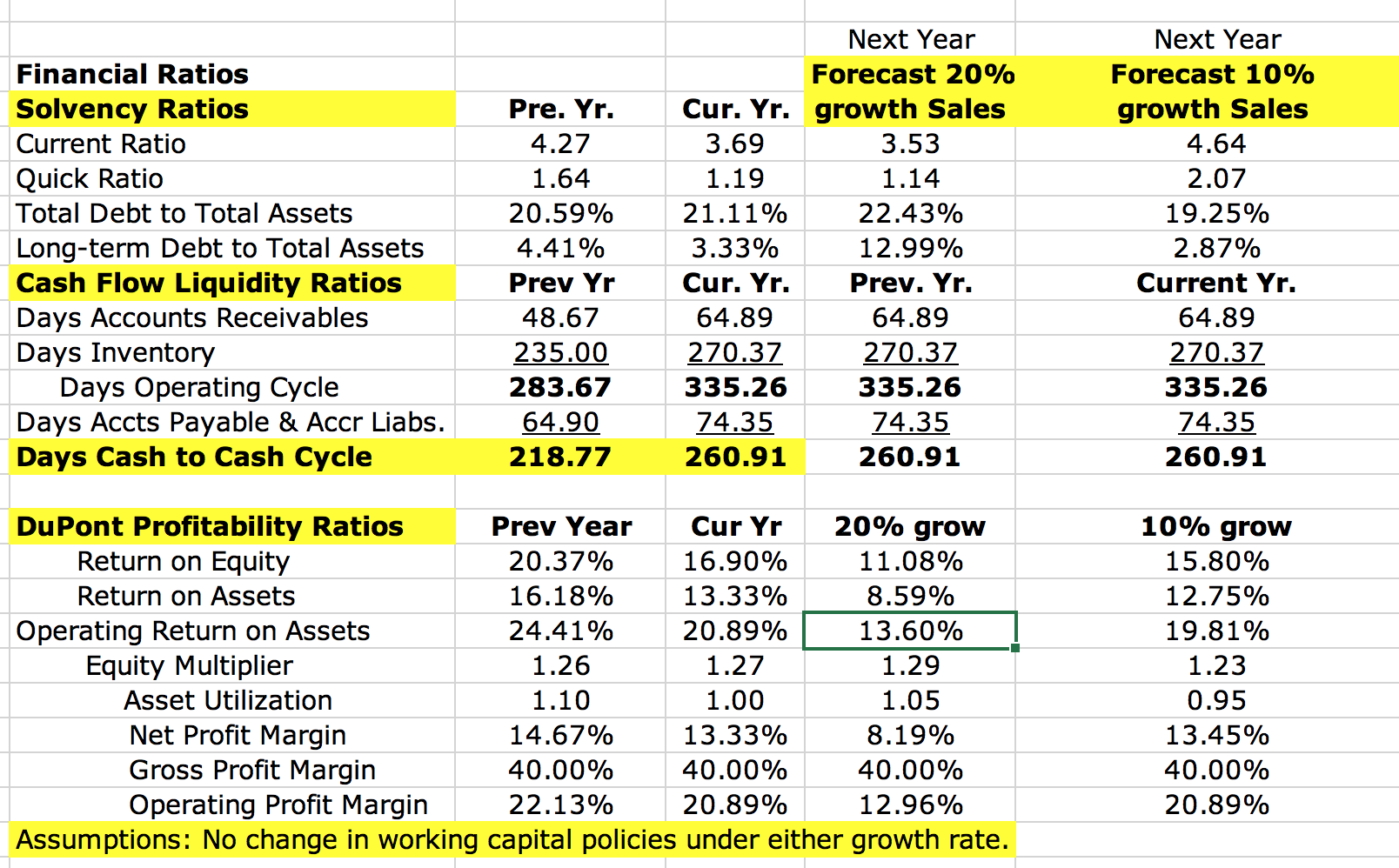

Examine the trends for the current year versus the previous year in profitability by doing a Dupont Analysis for the trends for ROE, ROA, EM, NPM, AU. Explain why the ROE changed in the current year compared to the past year based on trends in the NPM, AU, and EM.

2. Discuss why AU changed in the current year by looking at fixed asset utilization, days inventory, and days accounts receivables trends, and why the NPM changed by looking at GPM, OPM over time and comparisons to the industry averages.

Dupont Analysis: ROE = NPM x AU x EM Where ROE is a function of the firm's net profit margin (NPM), Asset utilization (AU), and its financial leverage measured by the Equity multiplier (EM) Where ROE = net income/total equity ROA = net income /total assets (or NPM x AU) NPM = net income / total revenues AU = total revenues / total assets

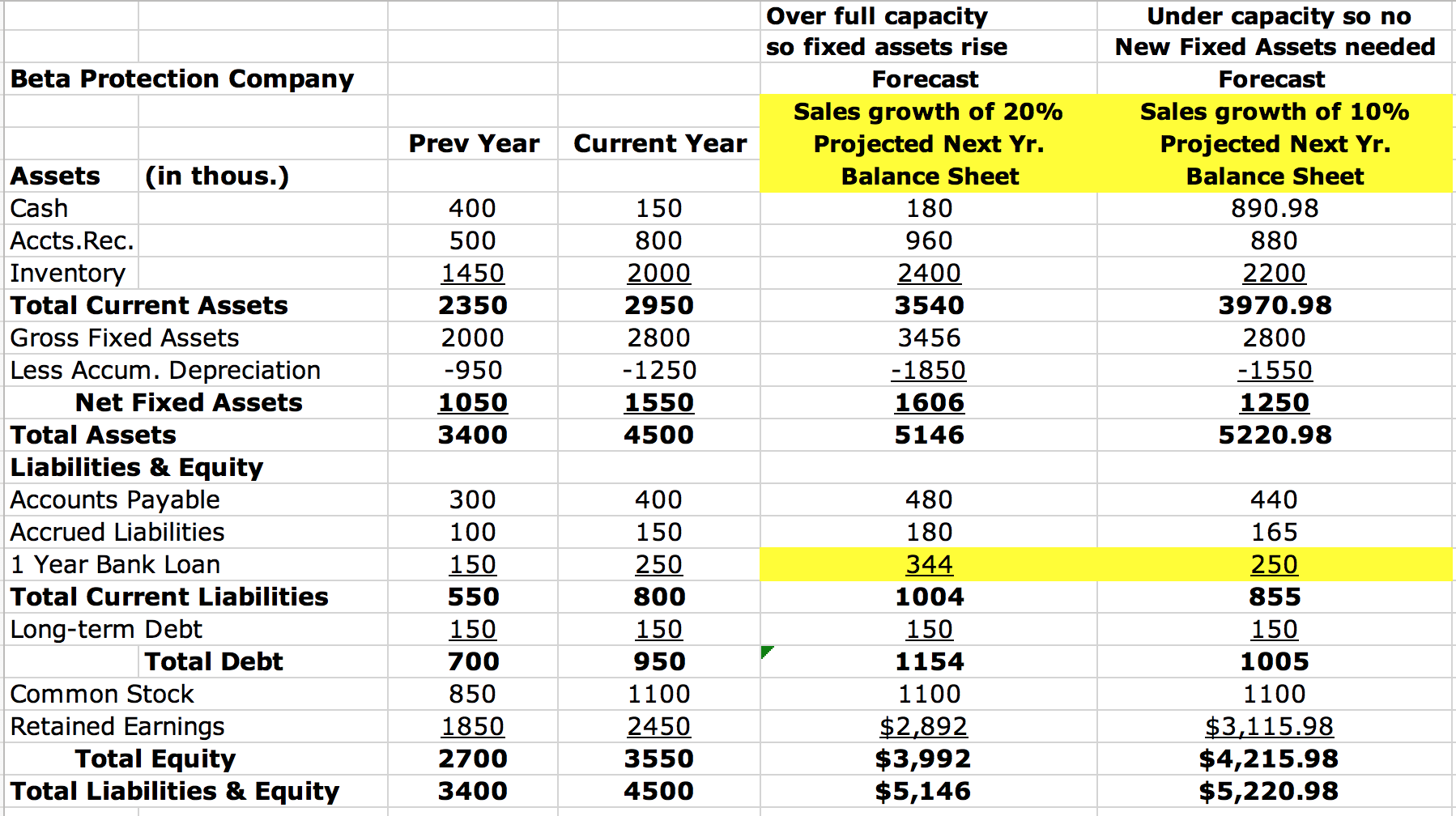

Beta Protection Company Assets (in thous.) Cash Accts.Rec. Prev Year Current Year Over full capacity so fixed assets rise Forecast Sales growth of 20% Projected Next Yr. Balance Sheet Under capacity so no New Fixed Assets needed Forecast Sales growth of 10% Projected Next Yr. Balance Sheet 890.98 880 400 150 180 500 800 960 Inventory 1450 2000 2400 2200 Total Current Assets 2350 2950 3540 3970.98 Gross Fixed Assets 2000 2800 3456 2800 Less Accum. Depreciation -950 -1250 -1850 -1550 Net Fixed Assets 1050 1550 1606 Total Assets 3400 4500 5146 1250 5220.98 Liabilities & Equity Accounts Payable 300 400 480 440 Accrued Liabilities 100 150 180 165 1 Year Bank Loan 150 250 344 250 Total Current Liabilities 550 800 1004 855 Long-term Debt 150 150 150 150 Total Debt 700 950 1154 1005 Common Stock 850 1100 1100 Retained Earnings 1850 2450 $2,892 1100 $3,115.98 Total Equity 2700 3550 $3,992 $4,215.98 Total Liabilities & Equity 3400 4500 $5,146 $5,220.98

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started