Question

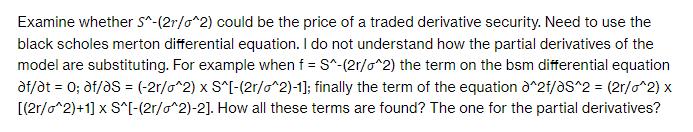

Examine whether S^-(2r/o^2) could be the price of a traded derivative security. Need to use the black scholes merton differential equation. I do not

Examine whether S^-(2r/o^2) could be the price of a traded derivative security. Need to use the black scholes merton differential equation. I do not understand how the partial derivatives of the model are substituting. For example when f = S^-(2r/o^2) the term on the bsm differential equation af/at = 0; af/as = (-2r/o^2) x S^[-(2r/o^2)-1]; finally the term of the equation a^2f/aS^2 = (2r/o^2) x [(2r/o^2)+1] x S^[-(2r/o^2)-2]. How all these terms are found? The one for the partial derivatives?

Step by Step Solution

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

To understand how the partial derivatives are found in the BlackScholesMerton BSM differential equation lets first review the BSM formula for a Europe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Derivatives Markets

Authors: Robert McDonald

3rd Edition

978-9332536746, 9789332536746

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App