Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Example 1: Because capital budgeting requires numerous repetitive cash flows, it is an ideal application for Excel. When doing a capital budgeting problem, as in

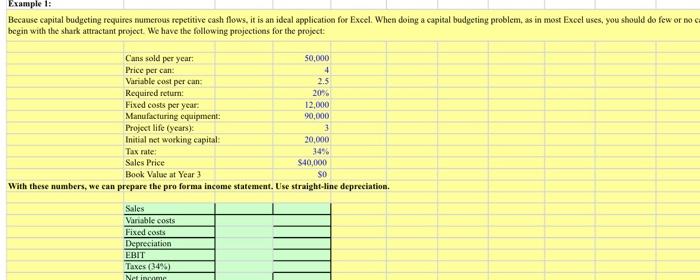

Example 1: Because capital budgeting requires numerous repetitive cash flows, it is an ideal application for Excel. When doing a capital budgeting problem, as in most Excel uses, you should do few or no ca begin with the shark attractant project. We have the following projections for the project: Cans sold per year: Price per can: 50,000 4 Variable cost per can: Required return: 2.5 20% Fixed costs per year: 12,000 Manufacturing equipment: 90,000 Project life (years): 3 Initial net working capital: 20,000 Tax rate: 34% Sales Price $40,000 SO Book Value at Year 3 With these numbers, we can prepare the pro forma income statement. Use straight-line depreciation. Sales Variable costs Fixed costs Depreciation EBIT Taxes (34%) Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started