Answered step by step

Verified Expert Solution

Question

1 Approved Answer

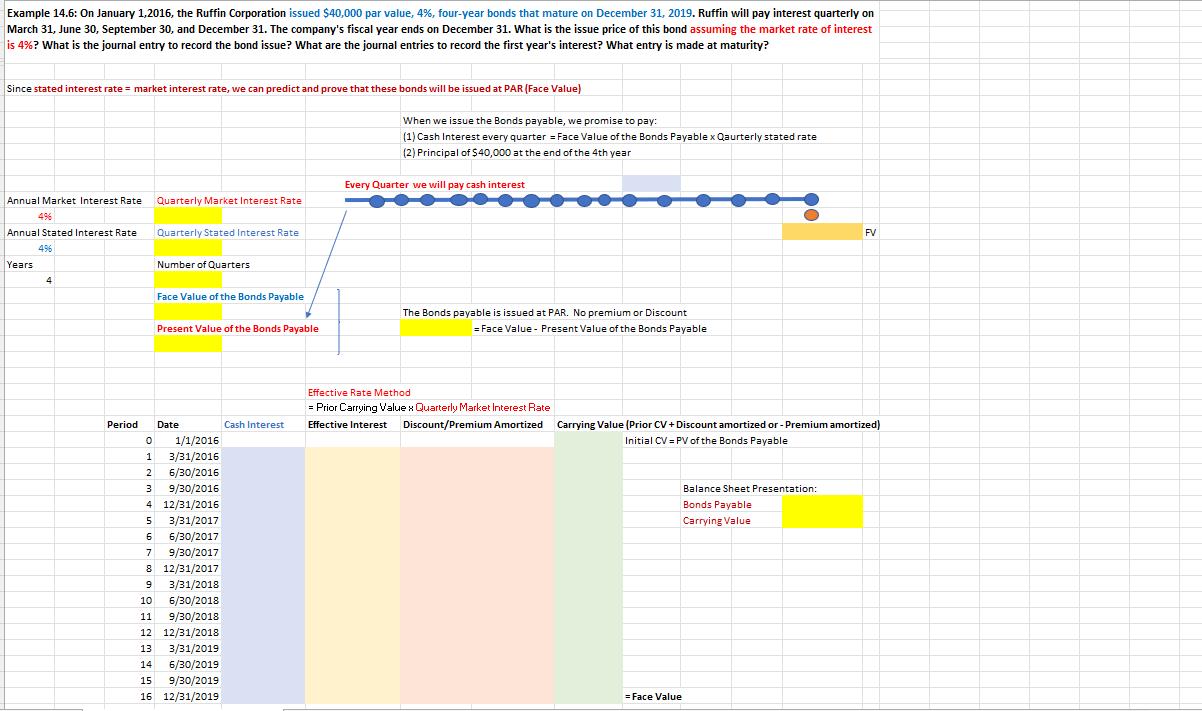

Example 14.6: On January 1,2016, the Ruffin Corporation issued $40,000 par value, 4%, four-year bonds that mature on December 31, 2019. Ruffin will pay

Example 14.6: On January 1,2016, the Ruffin Corporation issued $40,000 par value, 4%, four-year bonds that mature on December 31, 2019. Ruffin will pay interest quarterly on March 31, June 30, September 30, and December 31. The company's fiscal year ends on December 31. What is the issue price of this bond assuming the market rate of interest is 4%? What is the journal entry to record the bond issue? What are the journal entries to record the first year's interest? What entry is made at maturity? Since stated interest rate market interest rate, we can predict and prove that these bonds will be issued at PAR (Face Value) Annual Market Interest Rate 4% Annual Stated Interest Rate 496 Years 4 Period 3 3 4 p 5 0 1/1/2016 1 3/31/2016 2 6/30/2016 9/30/2016 12/31/2016 3/31/2017 6/30/2017 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 PANTHEON 12/31/2018 6 = 7 8 3 Quarterly Market Interest Rate 9 Quarterly Stated Interest Rate Number of Quarters Face Value of the Bonds Payable Present Value of the Bonds Payable Date 10 11 12 13 3/31/2019 14 6/30/2019 15 9/30/2019 16 12/31/2019 Cash Interest When we issue the Bonds payable, we promise to pay: (1) Cash Interest every quarter = Face Value of the Bonds Payable x Qaurterly stated rate (2) Principal of $40,000 at the end of the 4th year Every Quarter we will pay cash interest The Bonds payable is issued at PAR. No premium or Discount = Face Value - Present Value of the Bonds Payable Effective Rate Method = Prior Carrying Value x Quarterly Market Interest Rate Effective Interest Discount/Premium Amortized Discount/Premium Amortized Carrying Value (Prior CV + Discount amortized or - Premium amortized) Initial CV=PV of the Bonds Payable = Face Value FV Balance Sheet Presentation: Bonds Payable Carrying Value

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Sending the s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started