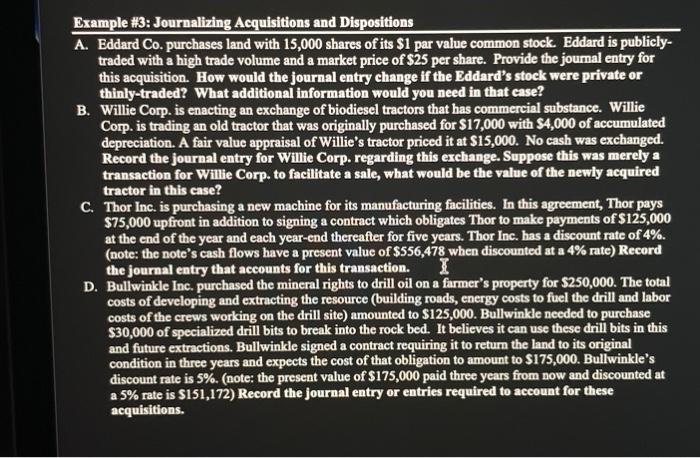

Example \#3: Journalizing Acquisitions and Dispositions A. Eddard Co. purchases land with 15,000 shares of its $1 par value common stock. Eddard is publiclytraded with a high trade volume and a market price of $25 per share. Provide the joumal entry for this acquisition. How would the journal entry change if the Eddard's stock were private or thinly-traded? What additional information would you need in that case? B. Willie Corp. is enacting an exchange of biodiesel tractors that has commercial substance. Willie Corp. is trading an old tractor that was originally purchased for $17,000 with $4,000 of accumulated depreciation. A fair value appraisal of Willie's tractor priced it at $15,000. No cash was exchanged. Record the journal entry for Willie Corp. regarding this exchange. Suppose this was merely a transaction for Willie Corp. to facilitate a sale, what would be the value of the newly acquired tractor in this case? C. Thor Inc. is purchasing a new machine for its manufacturing facilities. In this agreement, Thor pays $75,000 upfront in addition to signing a contract which obligates Thor to make payments of $125,000 at the end of the year and each year-end thereafter for five years. Thor Inc. has a discount rate of 4%. (note: the note's cash flows have a present value of $556,478 when discounted at a 4% rate) Record the journal entry that accounts for this transaction. D. Bullwinkle Inc. purchased the mineral rights to drill oil on a farmer's property for $250,000. The total costs of developing and extracting the resource (building roads, energy costs to fuel the drill and labor costs of the crews working on the drill site) amounted to $125,000. Bullwinkle needed to purchase $30,000 of specialized drill bits to break into the rock bed. It believes it can use these drill bits in this and future extractions. Bullwinkle signed a contract requiring it to return the land to its original condition in three years and expects the cost of that obligation to amount to $175,000. Bullwinkle's discount rate is 5%. (note: the present value of $175,000 paid three years from now and discounted at a 5% rate is $151,172 ) Record the journal entry or entries required to account for these acquisitions