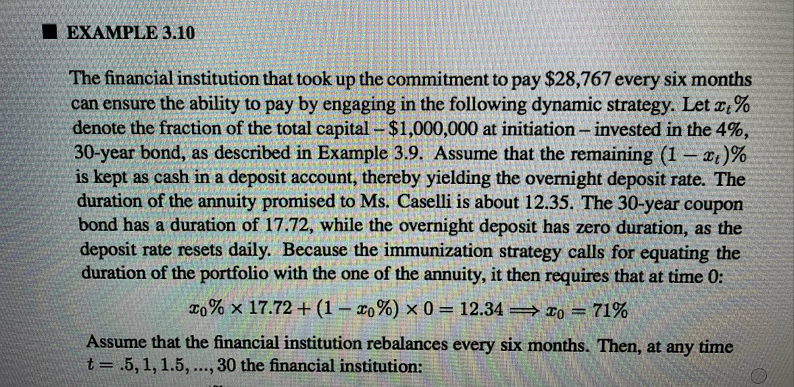

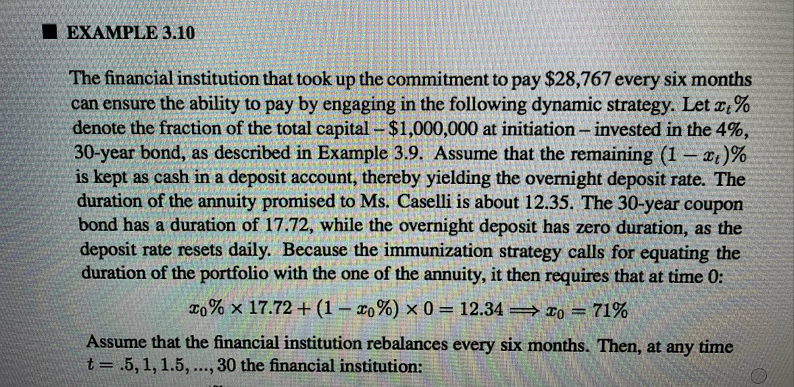

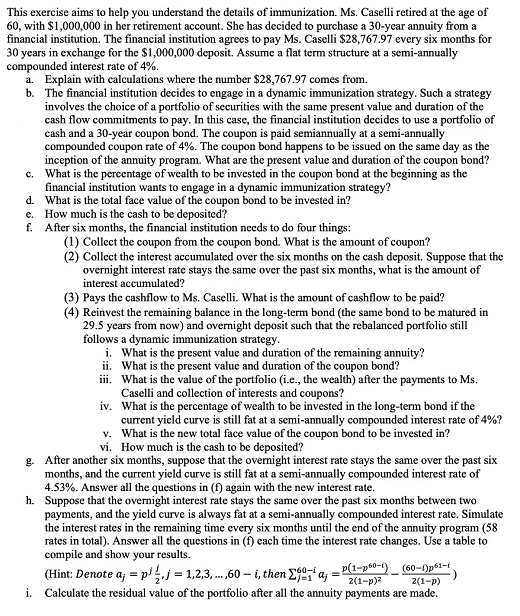

EXAMPLE 3.10 The financial institution that took up the commitment to pay $28,767 every six months can ensure the ability to pay by engaging in the following dynamic strategy. Let x% denote the fraction of the total capital $1,000,000 at initiation - invested in the 4%, 30-year bond, as described in Example 3.9. Assume that the remaining (1 - x)% is kept as cash in a deposit account, thereby yielding the overnight deposit rate. The duration of the annuity promised to Ms. Caselli is about 12.35. The 30-year coupon bond has a duration of 17.72, while the overnight deposit has zero duration, as the deposit rate resets daily. Because the immunization strategy calls for equating the duration of the portfolio with the one of the annuity, it then requires that at time 0: 20 % x 17.72 + (1 - 30%) x 0 = 12.34 = 20 = 71% Assume that the financial institution rebalances every six months. Then, at any time t=.5, 1, 1.5, ..., 30 the financial institution: a . This exercise aims to help you understand the details of immunization. Ms. Caselli retired at the age of 60, with $1,000,000 in her retirement account. She has decided to purchase a 30-year annuity from a financial institution. The financial institution agrees to pay Ms. Caselli $28,767.97 every six months for 30 years in exchange for the $1,000,000 deposit. Assume a flat term structure at a semi-annually compounded interest rate of 4%. a. Explain with calculations where the number $28,767.97 comes from. b. The financial institution decides to engage in a dynamic immunization strategy. Such a strategy involves the choice of a portfolio of securities with the same present value and duration of the cash flow commitments to pay. In this case, the financial institution decides to use a portfolio of cash and a 30-year coupon bond. The coupon is paid semiannually at a semi-annually compounded coupon rate of 4%. The coupon bond happens to be issued on the same day as the inception of the annuity program. What are the present value and duration of the coupon bond? c. What is the percentage of wealth to be invested in the coupon bond at the beginning as the financial institution wants to engage in a dynamic immunization strategy? d. What is the total face value of the coupon bond to be invested in? e. How much is the cash to be deposited? f. After six months, the financial institution needs to do four things: (1) Collect the coupon from the coupon bond. What is the amount of coupon? (2) Collect the interest accumulated over the six months on the cash deposit. Suppose that the overnight interest rate stays the same over the past six months, what is the amount of interest accumulated? (3) Pays the cashflow to Ms. Caselli. What is the amount of cashflow to be paid? (4) Reinvest the remaining balance in the long-term bond (the same bond to be matured in 29.5 years from now) and overnight deposit such that the rebalanced portfolio still follows a dynamic immunization strategy. i. What is the present value and duration of the remaining annuity? i. What is the present value and duration of the coupon bond? iii. What is the value of the portfolio (i.e., the wealth) after the payments to Ms. Caselli and collection of interests and coupons? iv. What is the percentage of wealth to be invested in the long-term bond if the current yield curve is still fat at a semi-annually compounded interest rate of 4%? v. What is the new total face value of the coupon bond to be invested in? vi. How much is the cash to be deposited? g. After another six months, suppose that the overnight interest rate stays the same over the past six months, and the current yield curve is still fat at a semi-annually compounded interest rate of 4.53%. Answer all the questions in (f) again with the new interest rate. h. Suppose that the overnight interest rate stays the same over the past six months between two payments, and the yield curve is always fat at a semi-annually compounded interest rate. Simulate the interest rates in the remaining time every six months until the end of the annuity program (58 rates in total). Answer all the questions in (f) cach time the interest rate changes. Use a table to compile and show your results. (Hint: Denote a; = p'4. j = 1,2,3,...,60 i, then 2997' a; = P(1~p80)_(60-0)61-1 1-) 2(1-P) i. Calculate the residual value of the portfolio after all the annuity payments are made. EXAMPLE 3.10 The financial institution that took up the commitment to pay $28,767 every six months can ensure the ability to pay by engaging in the following dynamic strategy. Let x% denote the fraction of the total capital $1,000,000 at initiation - invested in the 4%, 30-year bond, as described in Example 3.9. Assume that the remaining (1 - x)% is kept as cash in a deposit account, thereby yielding the overnight deposit rate. The duration of the annuity promised to Ms. Caselli is about 12.35. The 30-year coupon bond has a duration of 17.72, while the overnight deposit has zero duration, as the deposit rate resets daily. Because the immunization strategy calls for equating the duration of the portfolio with the one of the annuity, it then requires that at time 0: 20 % x 17.72 + (1 - 30%) x 0 = 12.34 = 20 = 71% Assume that the financial institution rebalances every six months. Then, at any time t=.5, 1, 1.5, ..., 30 the financial institution: a . This exercise aims to help you understand the details of immunization. Ms. Caselli retired at the age of 60, with $1,000,000 in her retirement account. She has decided to purchase a 30-year annuity from a financial institution. The financial institution agrees to pay Ms. Caselli $28,767.97 every six months for 30 years in exchange for the $1,000,000 deposit. Assume a flat term structure at a semi-annually compounded interest rate of 4%. a. Explain with calculations where the number $28,767.97 comes from. b. The financial institution decides to engage in a dynamic immunization strategy. Such a strategy involves the choice of a portfolio of securities with the same present value and duration of the cash flow commitments to pay. In this case, the financial institution decides to use a portfolio of cash and a 30-year coupon bond. The coupon is paid semiannually at a semi-annually compounded coupon rate of 4%. The coupon bond happens to be issued on the same day as the inception of the annuity program. What are the present value and duration of the coupon bond? c. What is the percentage of wealth to be invested in the coupon bond at the beginning as the financial institution wants to engage in a dynamic immunization strategy? d. What is the total face value of the coupon bond to be invested in? e. How much is the cash to be deposited? f. After six months, the financial institution needs to do four things: (1) Collect the coupon from the coupon bond. What is the amount of coupon? (2) Collect the interest accumulated over the six months on the cash deposit. Suppose that the overnight interest rate stays the same over the past six months, what is the amount of interest accumulated? (3) Pays the cashflow to Ms. Caselli. What is the amount of cashflow to be paid? (4) Reinvest the remaining balance in the long-term bond (the same bond to be matured in 29.5 years from now) and overnight deposit such that the rebalanced portfolio still follows a dynamic immunization strategy. i. What is the present value and duration of the remaining annuity? i. What is the present value and duration of the coupon bond? iii. What is the value of the portfolio (i.e., the wealth) after the payments to Ms. Caselli and collection of interests and coupons? iv. What is the percentage of wealth to be invested in the long-term bond if the current yield curve is still fat at a semi-annually compounded interest rate of 4%? v. What is the new total face value of the coupon bond to be invested in? vi. How much is the cash to be deposited? g. After another six months, suppose that the overnight interest rate stays the same over the past six months, and the current yield curve is still fat at a semi-annually compounded interest rate of 4.53%. Answer all the questions in (f) again with the new interest rate. h. Suppose that the overnight interest rate stays the same over the past six months between two payments, and the yield curve is always fat at a semi-annually compounded interest rate. Simulate the interest rates in the remaining time every six months until the end of the annuity program (58 rates in total). Answer all the questions in (f) cach time the interest rate changes. Use a table to compile and show your results. (Hint: Denote a; = p'4. j = 1,2,3,...,60 i, then 2997' a; = P(1~p80)_(60-0)61-1 1-) 2(1-P) i. Calculate the residual value of the portfolio after all the annuity payments are made