Answered step by step

Verified Expert Solution

Question

1 Approved Answer

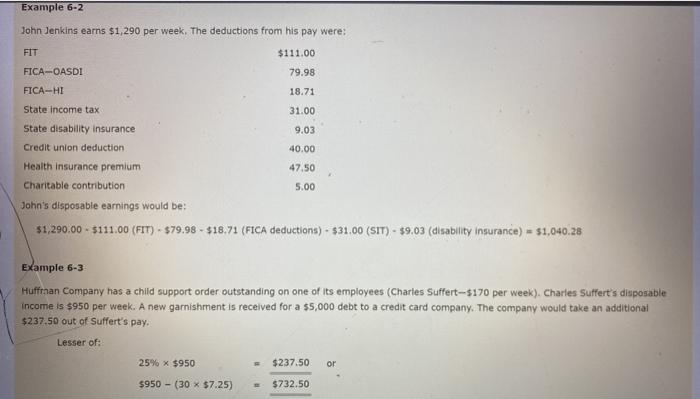

Example 6-2 John Jenkins earns $1,290 per week. The deductions from his pay were: FIT FICA-OASDI FICA-HI State income tax State disability insurance Credit

Example 6-2 John Jenkins earns $1,290 per week. The deductions from his pay were: FIT FICA-OASDI FICA-HI State income tax State disability insurance Credit union deduction Health insurance premium Charitable contribution John's disposable earnings would be: $111.00 79.98 18.71 31.00 9.03 40.00 47.50 5.00 $1,290.00 - $111.00 (FIT) $79.98 $18.71 (FICA deductions) $31.00 (SIT) $9.03 (disability insurance) $1,040.28 Example 6-3 Huffman Company has a child support order outstanding on one of its employees (Charles Suffert-$170 per week). Charles Suffert's disposable income is $950 per week. A new garnishment is received for a $5,000 debt to a credit card company. The company would take an additional $237.50 out of Suffert's pay. Lesser of: 25% x $950 $237.50 or $950 (30 x $7.25) $732.50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started