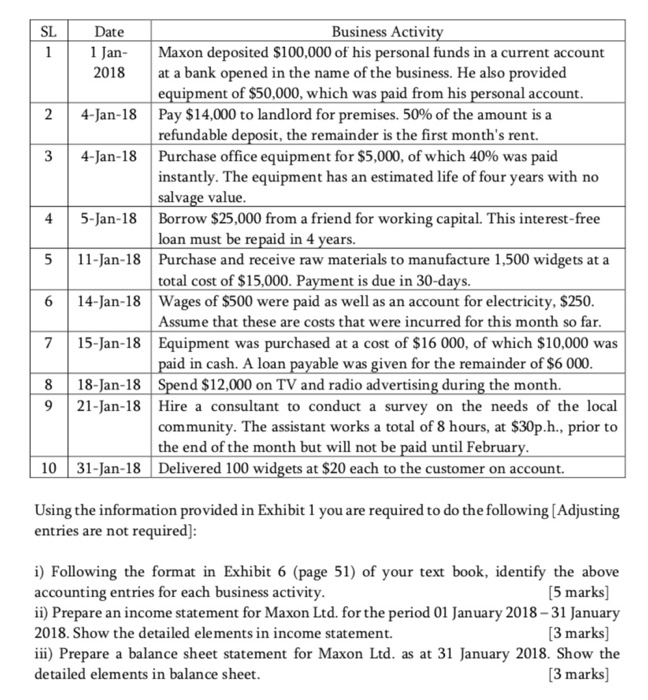

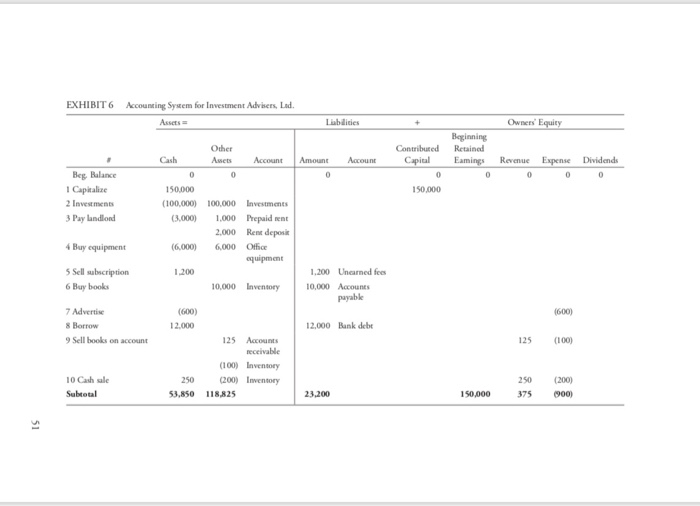

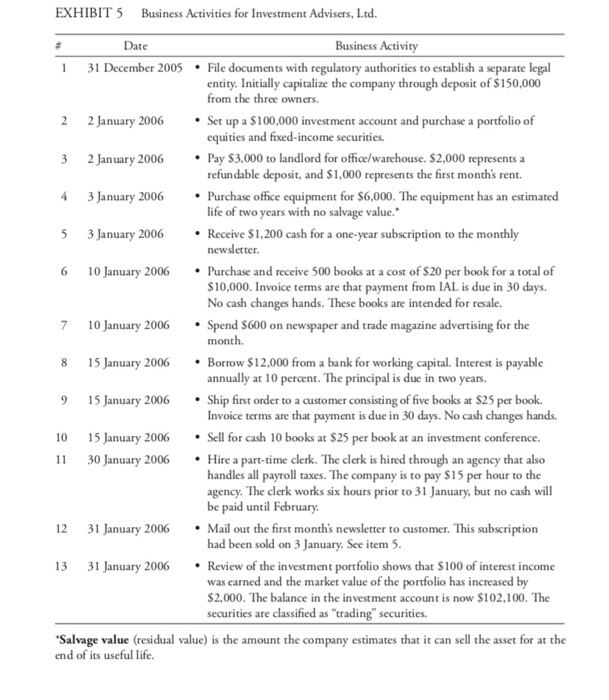

SL 1 Date Business Activit Jan- Maxon deposited $100,000 of his personal funds in a current account 2018 at a bank opened in the name of the business. He also provided | 4-Jan-18 | 4-Jan-18 ipment of $50,000, which was paid from his personal account 2 | Pay $14,000 to landlord for premises, 50% of the amount is a refundable deposit, the remainder is the first month's rent. | Purchase office equipment for $5,000, of which 40% was paid 3 instantly. The equipment has an estimated life of four years with no salvage value loan must be repaid in 4 vears. total cost of $15,000. Payment is due in 30-days. Assume that these are costs that were incurred for this month so far 45-Jan-18 Borrow $25,000 from a friend for working capital. This interest-free 5 | 1 1-Jan-18 Purchase and receive raw materials to manufacture 1,500 widgets at a 614-Jan-18 Wages of $500 were paid as well as an account for electricity, $250 715-Jan-18 Equipment was purchased at a cost of $16 000, of which $10,000 was d in cash. A loan payable was given for the remainder of $6 000 818-Jan-18 921-Jan-18 Hire a consultant to conduct a survey on the needs of the local nd $12,000 on TV and radio advertising during the month community. The assistant works a total of 8 hours, at $30p.h., prior to the end of the month but will not be paid until Februar 10 31-Jan-18 Delivered 100 widgets at $20 each to the customer on account. Using the information provided in Exhibit 1 you are required to do the following [Adjusting entries are not required] i) Following the format in Exhibit 6 (page 51) of your text book, identify the above accounting entries for each business activity ii) Prepare an income statement for Maxon Ltd. for the period 01 January 2018- 31 January 2018. Show the detailed elements in income statement. ii) Prepare a balance sheet statement for Maxon Ltd. as at 31 January 2018. Show the detailed elements in balance sheet [5 marks] 3 marks] 3 marks] EXHIBIT 6 Accouting System for Investment Advisers, Lad. Owners Other Assets Contributd Retained Cash Account AmountAccount Beg Balance 1 Capitalize 2 Investments Pay landlond 150,000 150,000 100,000) 100,000 Investments 3,000) 1.000 Prepaid nnt 2.000 Rene deposi Buy equipment (6,000) 6,000 Office Sell subscription 6 Buy books 200 Unearned fees 1,200 10,000 nventory10,000 Accoune 7 Advertise 8 Borrow 9Sell books on account (600) 12,000 600) 12,000 Bank debt 125 Accounts 125 100) (100) Invensory (200) Inventory 10 Cash ale 250 53,850 118825 250 (200) 23,200 150,000 375 900) EXHIBIT 5 Business Activities for Investment Advisers, Ltd. Date Business Activity File documents with regulatory authorities to establish a separate legal 1 31 December 2005 entity. Initially capitalize the company through deposit of $150,000 from the three owners Set up a $100,000 investment account and purchase a portfolio of 2 2 January 2006 32 January 2006. 43 January 2006' equities and fixed-income securities Pay $3,000 to landlord for office/warehouse. $2,000 represents a refundable deposit, and $1,000 represents the first months rent. office equipment for $6,000. The t has an estimated equipmen life of two years with no salvage Receive $1,200 cash for a one-year subscription to the monthly 3January 2006 newslctter. 6 10 January 2006Pchase and receive 500 books at a cost of $20 per book for a total of terms are that payment from IAL is due in 30 days. No cash changes hands. These books are intended for resale. 7 10 January 2006Spend $600 on newspaper and trade magazine advertising for the 8 5 January 2006 Borrow $12,000 from a bank for working capital. Interest is payable 915 January 2006 Ship first order to a customer consisting of five books at $25 per book 10 5 January 2006 Sell for cash 10 books at $25 per book at an investment conference. month. annually at 10 percent. The principal i s due in two years. Invoice terms are that payment is due in 30 days. No cash changes hands. 1 30 January 2 2006 Hire a part-time clerk. The cler handles all payroll taxes. The company is to pay $15 per hour to the agency. The clerk works six hours prior to 31 January, but no cash will be paid until February. k is hired through an agency that also 12 31 January 2006Mail out the first months newsletter to customer. This subscription had been sold on 3 January. See item 5 13 31 January 2006eview of the investment portfolio shows that $100 of interest income was earned and the market value of the portfolio has increased by $2,000. The balance in the investment account is now $102,100. The securities are classified as "trading securities. Salvage value (residual value) is the amount the company estimates that it can sell the asset for at the end of its useful life