Answered step by step

Verified Expert Solution

Question

1 Approved Answer

example from the book: 12-10: Gallatin, Inc., has provided the estimates shown below relating to a proposed new project with a 4-year project life. At

example from the book: 12-10:

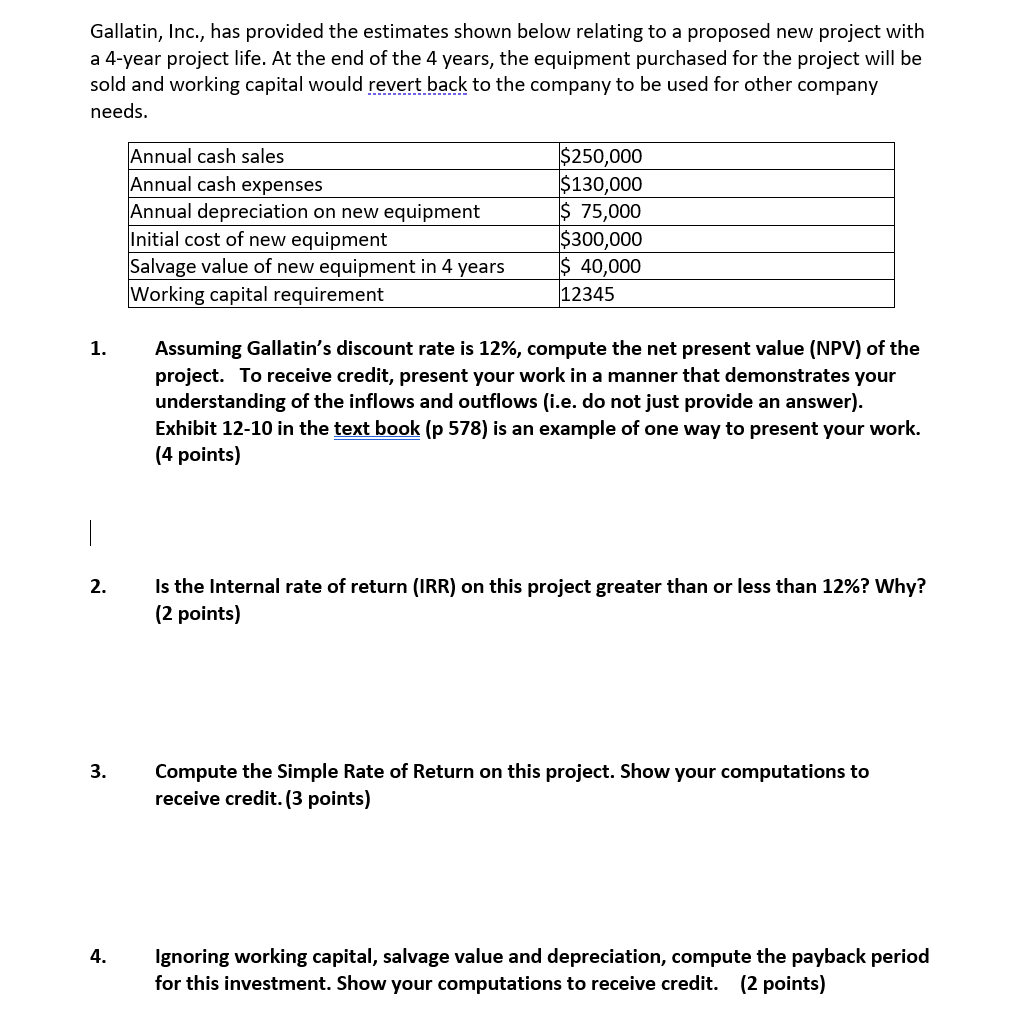

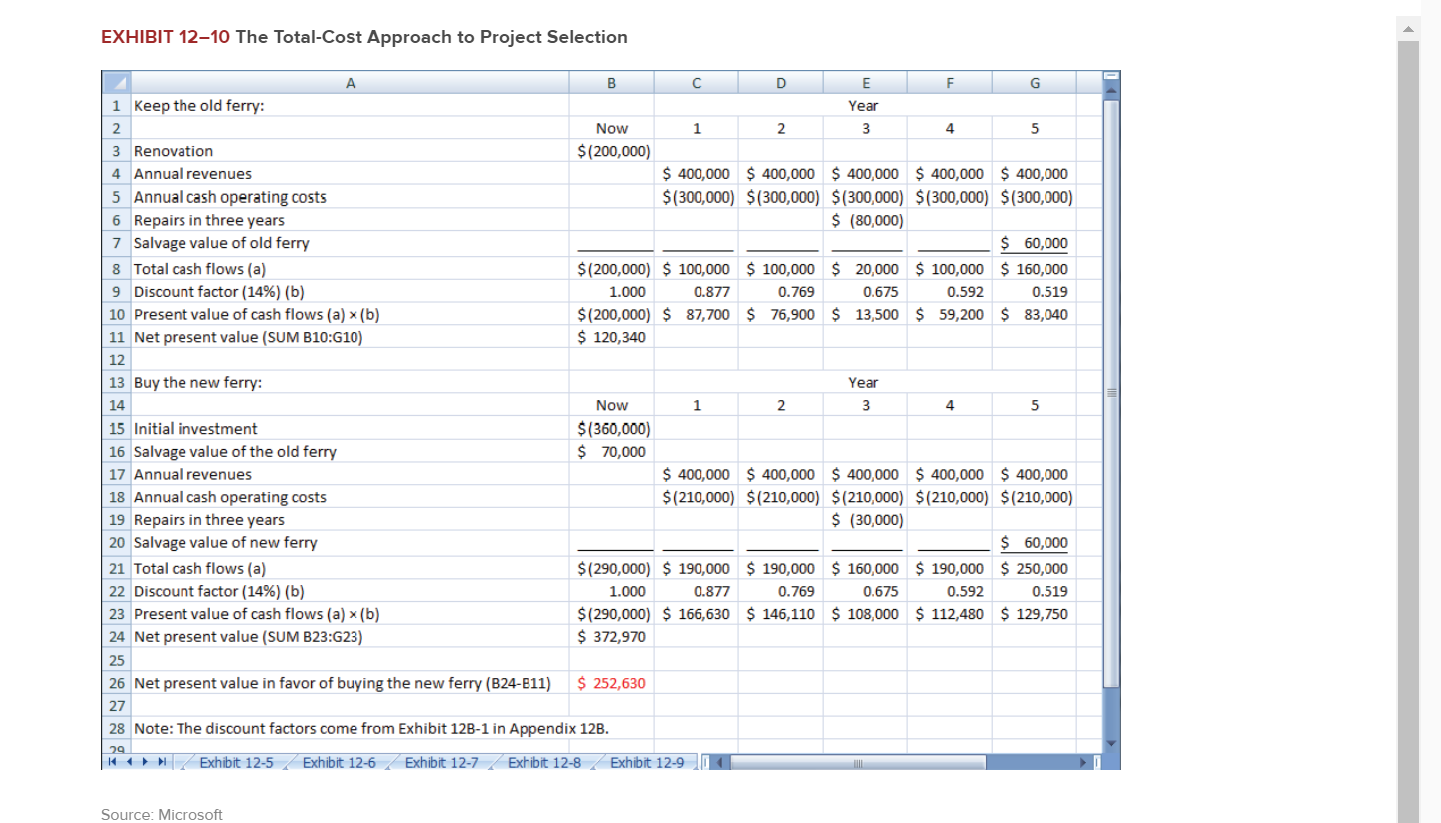

Gallatin, Inc., has provided the estimates shown below relating to a proposed new project with a 4-year project life. At the end of the 4 years, the equipment purchased for the project will be sold and working capital would revert back to the company to be used for other company needs. Annual cash sales Annual cash expenses Annual depreciation on new equipment Initial cost of new equipment Salvage value of new equipment in 4 years Working capital requirement $250,000 $130,000 $ 75,000 $300,000 $ 40,000 12345 1. Assuming Gallatin's discount rate is 12%, compute the net present value (NPV) of the project. To receive credit, present your work in a manner that demonstrates your understanding of the inflows and outflows (i.e. do not just provide an answer). Exhibit 12-10 in the text book (p 578) is an example of one way to present your work. (4 points) 2. Is the Internal rate of return (IRR) on this project greater than or less than 12%? Why? (2 points) 3. Compute the Simple Rate of Return on this project. Show your computations to receive credit. (3 points) 4. Ignoring working capital, salvage value and depreciation, compute the payback period for this investment. Show your computations to receive credit. (2 points) EXHIBIT 12-10 The Total-Cost Approach to Project Selection A B D E F G 1 Keep the old ferry: Year 2 Now 1 2 3 4 5 3 Renovation $(200,000) 4 Annual revenues $ 400,000 $ 400,000 $ 400,000 $ 400,000 $ 400,000 5 Annual cash operating costs $(300,000) $(300,000) $(300,000) $(300,000) $(300,000) 6 Repairs in three years $ (80,000) 7 Salvage value of old ferry $ 60,000 8 Total cash flows (a) $(200,000) $ 100,000 $100,000 $ 20,000 $100,000 $ 160,000 9 Discount factor (14%) (b) 1.000 0.877 0.769 0.675 0.592 0.519 10 Present value of cash flows (a) (b) $(200,000) $ 87,700 $ 76,900 $ 13,500 $ 59,200 $ 83,040 11 Net present value (SUM B10:G10) $ 120,340 12 13 Buy the new ferry: Year 14 Now 1 2 3 4 5 15 Initial investment $(360,000) 16 Salvage value of the old ferry $ 70,000 17 Annual revenues $ 400,000 $ 400,000 $ 400,000 $ 400,000 $ 400,000 18 Annual cash operating costs $(210,000) $(210,000) $(210,000) $(210,000) $(210,000) 19 Repairs in three years $ (30,000) 20 Salvage value of new ferry $ 60,000 21 Total cash flows (a) $(290,000) $ 190,000 $ 190,000 $ 160,000 $ 190,000 $250,000 22 Discount factor (14%) (b) 1.000 0.877 0.769 0.675 0.592 0.519 23 Present value of cash flows (a) (b) $(290,000) $ 166,630 $ 146,110 $ 108,000 $ 112,480 $ 129,750 24 Net present value (SUM B23:23) $ 372,970 25 26 Net present value in favor of buying the new ferry (B24-811) $ 252,630 27 28 Note: The discount factors come from Exhibit 12B-1 in Appendix 12B. 29 + Exhibit 12-5 Exhibit 12-6 Exhibit 12-7 Exhibit 12-8 Exhibit 12-90 Source: Microsoft

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started