Answered step by step

Verified Expert Solution

Question

1 Approved Answer

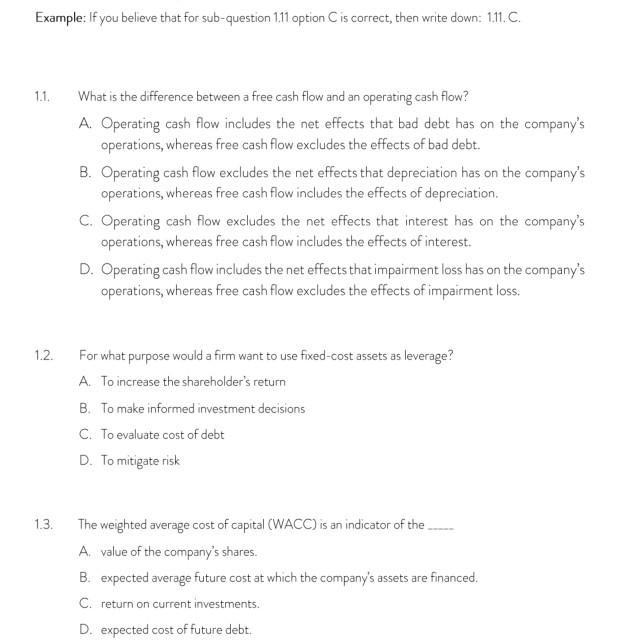

Example: If you believe that for sub-question 1.11 option is correct, then write down: 111. C. 1.1. What is the difference between a free cash

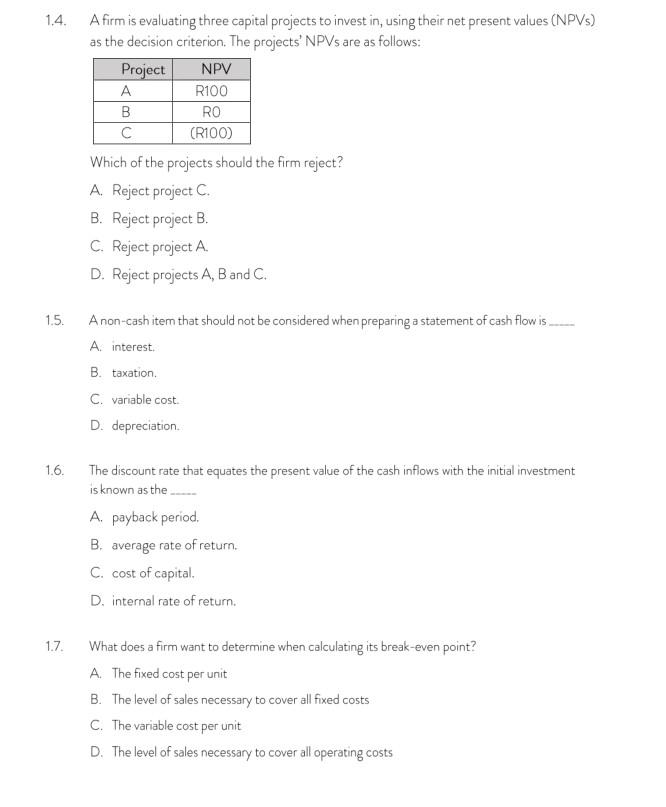

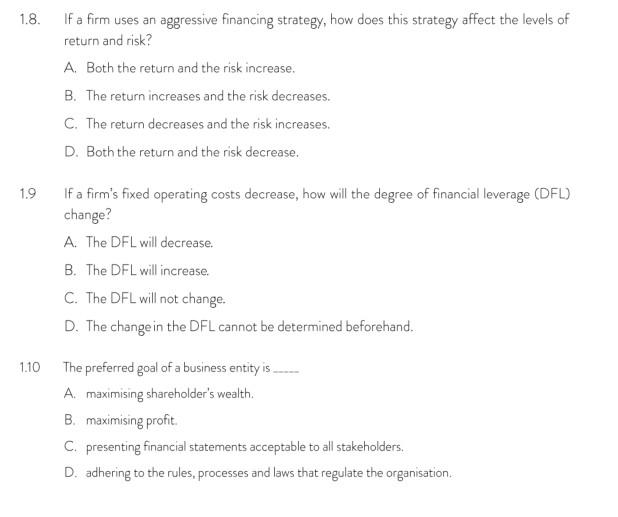

Example: If you believe that for sub-question 1.11 option is correct, then write down: 111. C. 1.1. What is the difference between a free cash flow and an operating cash flow? A. Operating cash flow includes the net effects that bad debt has on the company's operations, whereas free cash flow excludes the effects of bad debt. B. Operating cash flow excludes the net effects that depreciation has on the company's operations, whereas free cash flow includes the effects of depreciation. C. Operating cash flow excludes the net effects that interest has on the company's operations, whereas free cash flow includes the effects of interest. D. Operating cash flow includes the net effects that impairment loss has on the company's operations, whereas free cash flow excludes the effects of impairment loss. 1.2. For what purpose would a firm want to use fixed-cost assets as leverage? A. To increase the shareholder's return B. To make informed investment decisions C. To evaluate cost of debt D. To mitigate risk 1.3. The weighted average cost of capital (WACC) is an indicator of the A value of the company's shares. B. expected average future cost at which the company's assets are financed. C. return on current investments. D. expected cost of future debt. 1.4. A firm is evaluating three capital projects to invest in, using their net present values (NPVS) as the decision criterion. The projects' NPVs are as follows: Project NPV A R100 B RO c (R100) Which of the projects should the firm reject? A. Reject project C. B. Reject project B. C. Reject project A. D. Reject projects A, B and C. 1.5. Anon-cash item that should not be considered when preparing a statement of cash flow is A. interest B. taxation C. variable cost D. depreciation 1.6. The discount rate that equates the present value of the cash inflows with the initial investment is known as the A. payback period. B. average rate of return C. cost of capital D. internal rate of return. 1.7 What does a firm want to determine when calculating its break-even point? A. The fixed cost per unit B. The level of sales necessary to cover all fixed costs C. The variable cost per unit D. The level of sales necessary to cover all operating costs 1.8. If a firm uses an aggressive financing strategy, how does this strategy affect the levels of return and risk? A. Both the return and the risk increase. B. The return increases and the risk decreases. C. The return decreases and the risk increases. D. Both the return and the risk decrease. 1.9 If a firm's fixed operating costs decrease, how will the degree of financial leverage (DFL) change? A. The DFL will decrease. B. The DFL will increase C. The DFL will not change. D. The change in the DFL cannot be determined beforehand. 1.10 The preferred goal of a business entity is A maximising shareholder's wealth B. maximising profit C. presenting financial statements acceptable to all stakeholders. D. adhering to the rules, processes and laws that regulate the organisation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started