EXAMPLE PROBLEM:

I NEED THIS ONE ANSWERED:

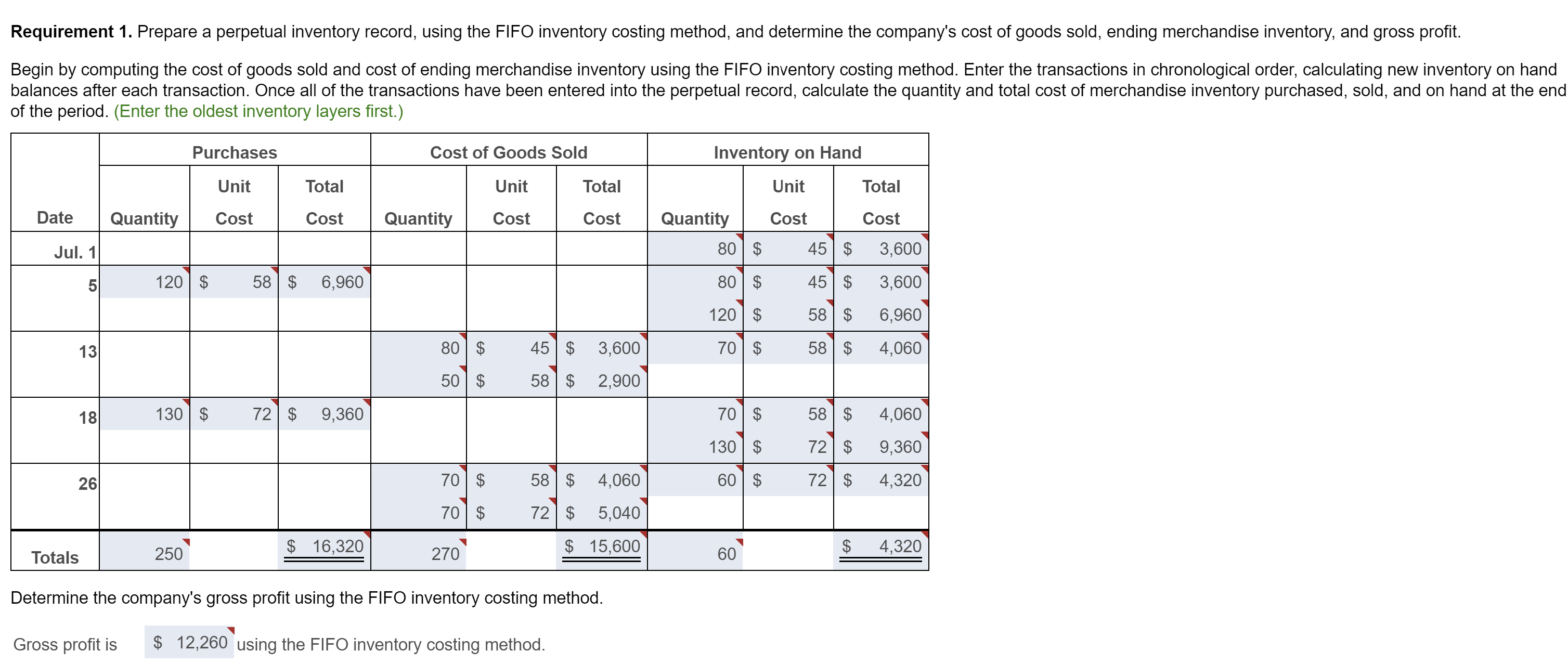

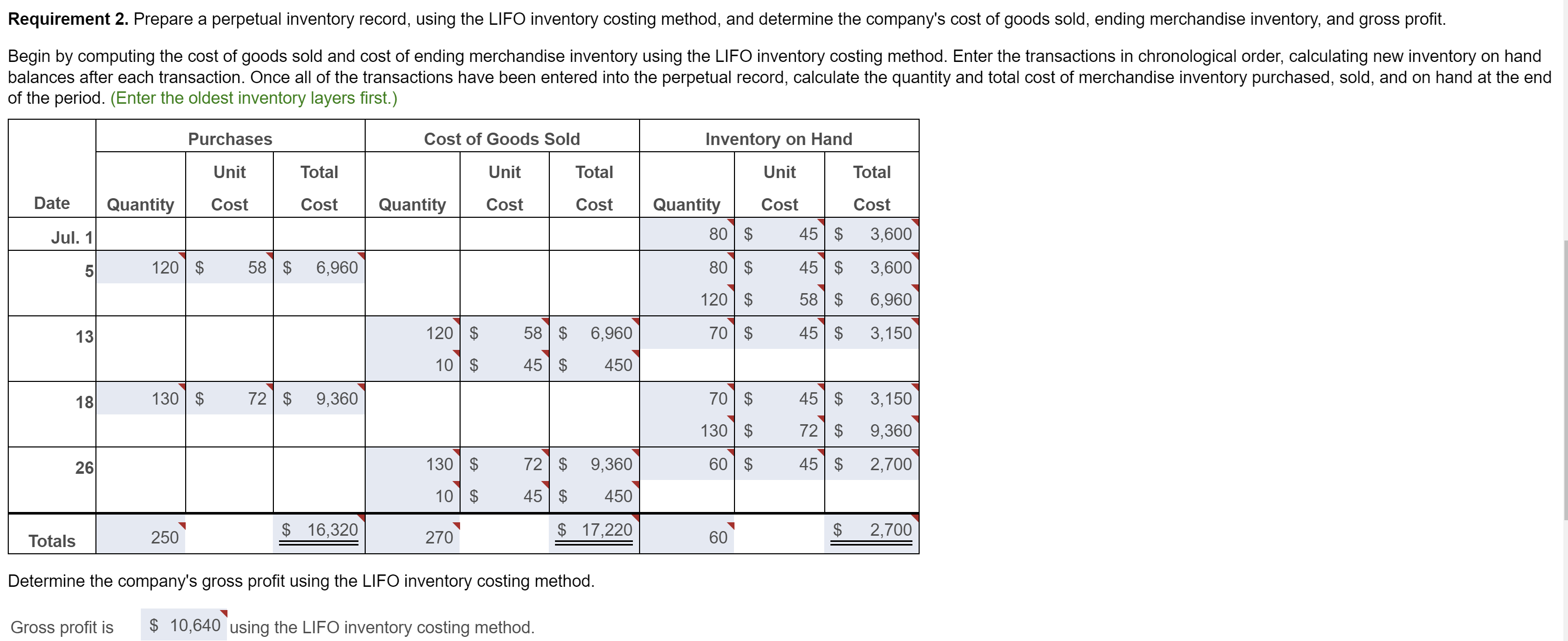

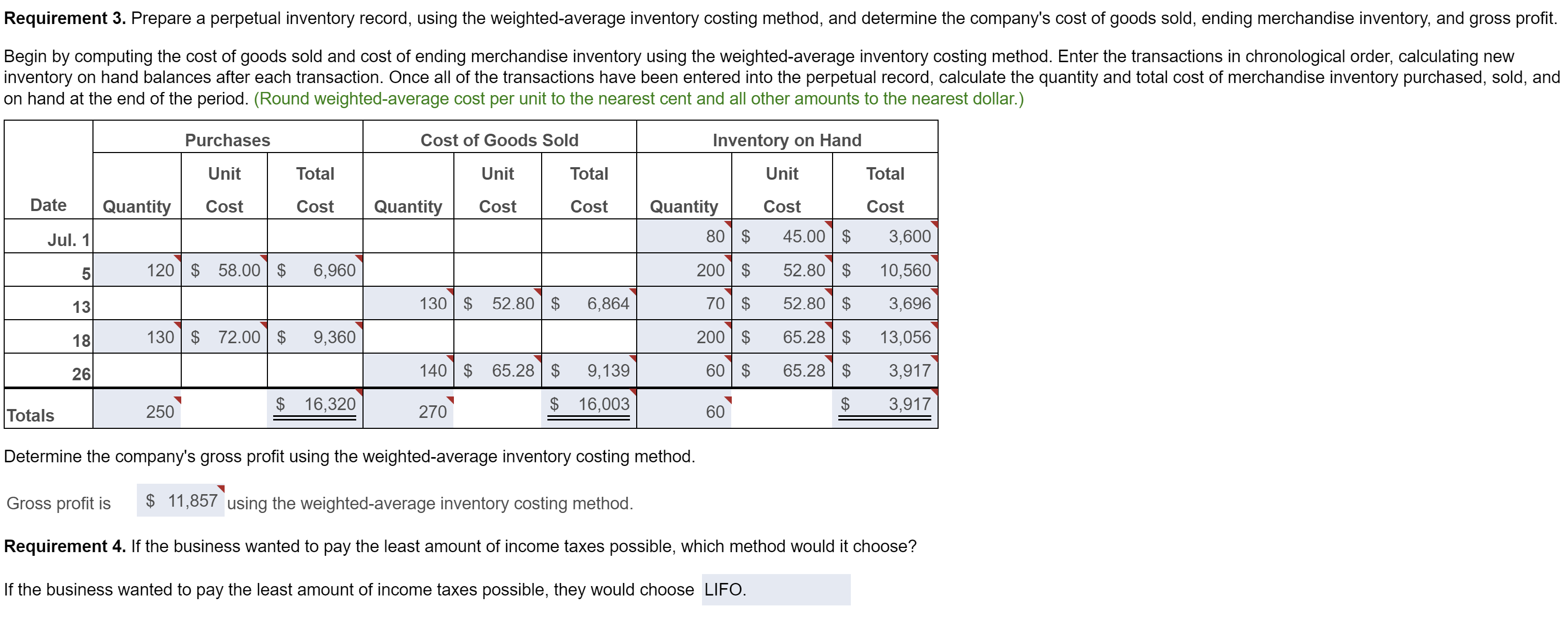

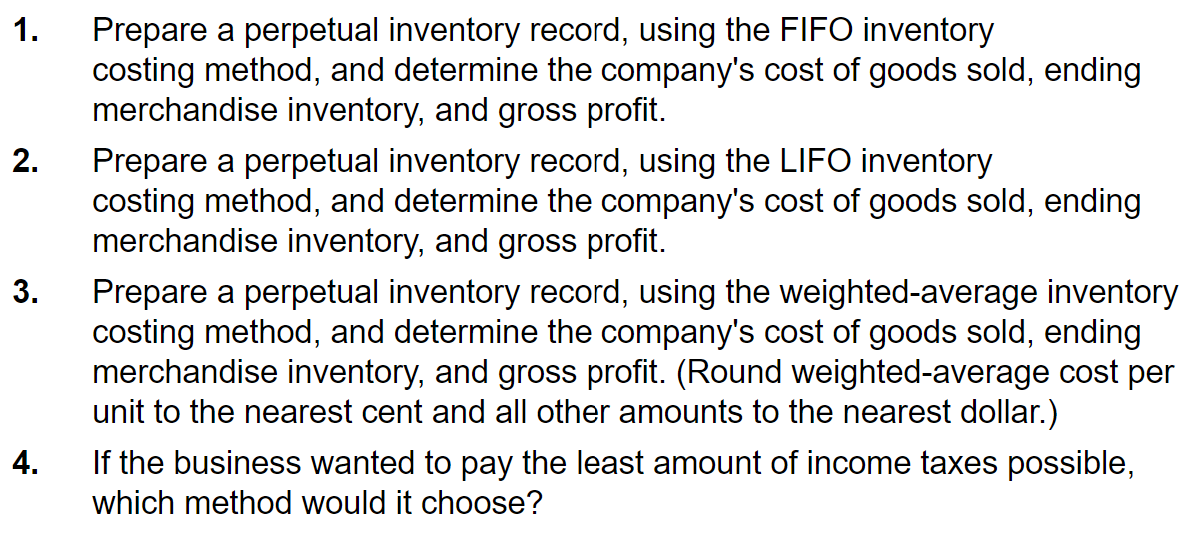

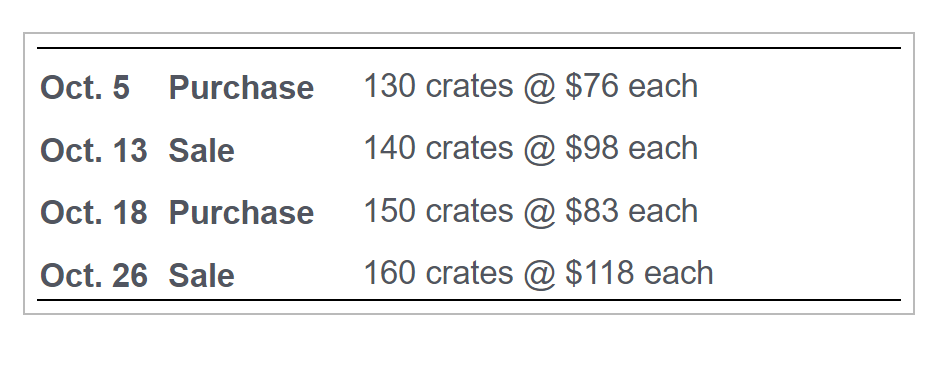

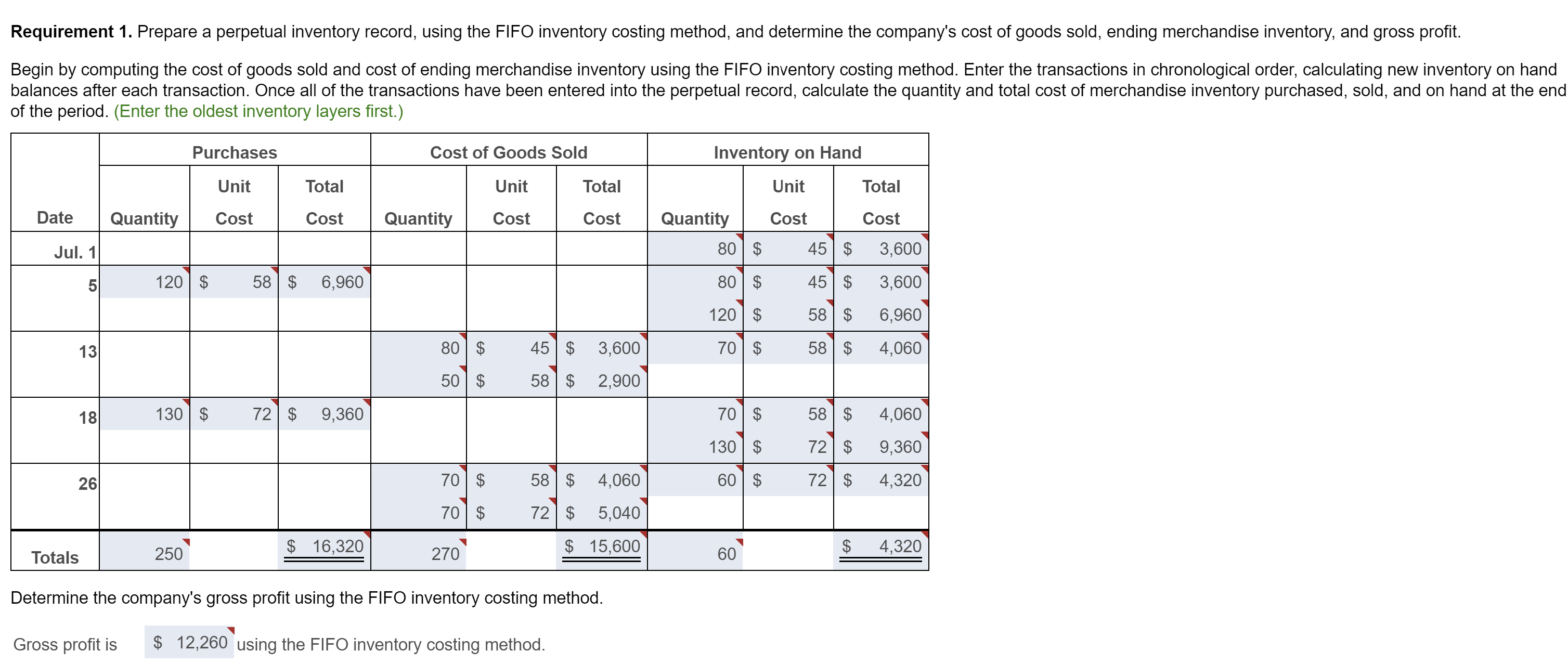

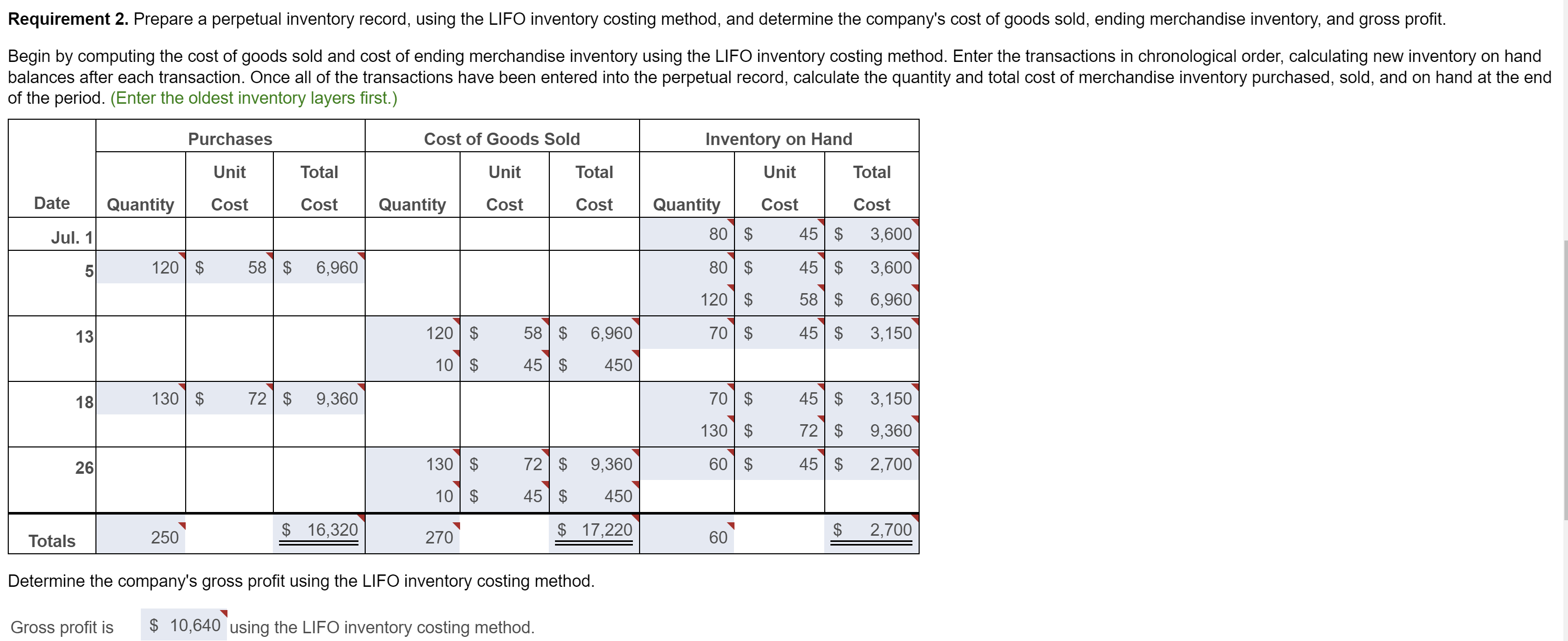

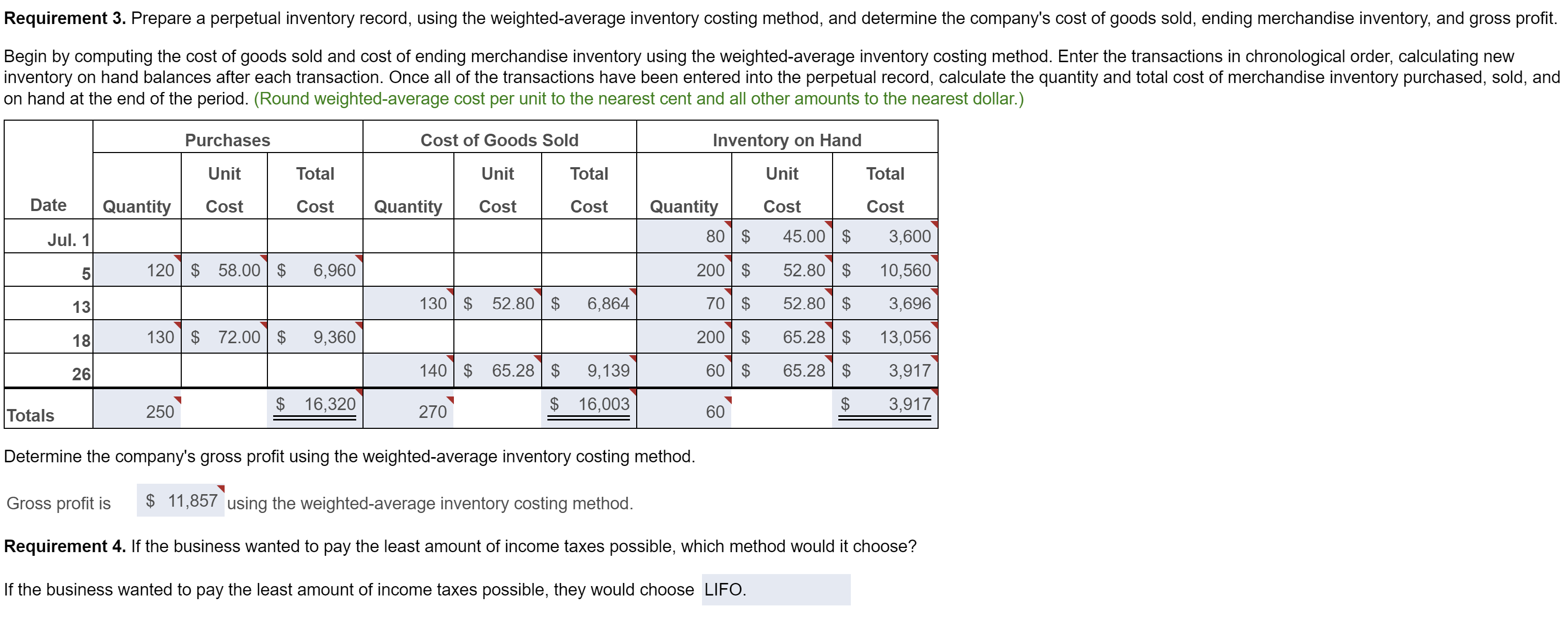

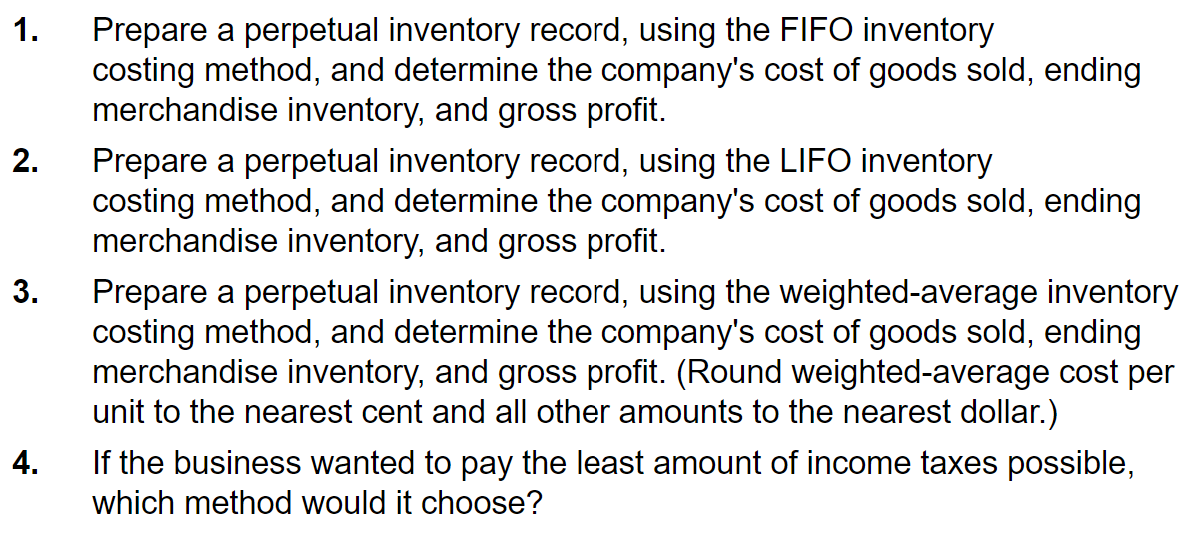

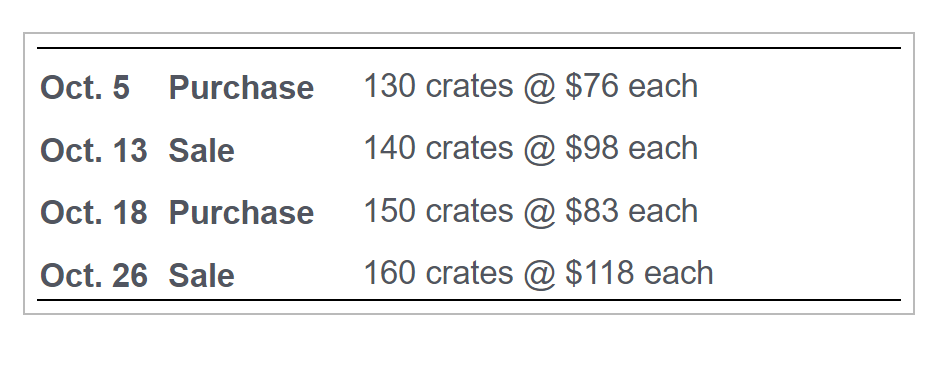

on hand at the end of the period. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Determine the company's gross profit using the weighted-average inventory costing method. Gross profit is using the weighted-average inventory costing method. Requirement 4. If the business wanted to pay the least amount of income taxes possible, which method would it choose? If the business wanted to pay the least amount of income taxes possible, they would choose 1. Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. 2. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Prepare a perpetual inventory record, using the weighted-average inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.) If the business wanted to pay the least amount of income taxes possible, which method would it choose? \begin{tabular}{lll} \hline Oct. 5 & Purchase & 130 crates @$76 each \\ Oct. 13 Sale & 140 crates @$98 each \\ Oct. 18 Purchase & 150 crates @$83 each \\ Oct. 26 Sale & 160 crates @$118 each \\ \hline \end{tabular} of the period. (Enter the oldest inventory layers first.) Determine the company's gross profit using the LIFO inventory costing method. Gross profit is using the LIFO inventory costing method. of the period. (Enter the oldest inventory layers first.) Determine the company's gross profit using the FIFO inventory costing method. Gross profit is using the FIFO inventory costing method. on hand at the end of the period. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Determine the company's gross profit using the weighted-average inventory costing method. Gross profit is using the weighted-average inventory costing method. Requirement 4. If the business wanted to pay the least amount of income taxes possible, which method would it choose? If the business wanted to pay the least amount of income taxes possible, they would choose 1. Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. 2. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Prepare a perpetual inventory record, using the weighted-average inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.) If the business wanted to pay the least amount of income taxes possible, which method would it choose? \begin{tabular}{lll} \hline Oct. 5 & Purchase & 130 crates @$76 each \\ Oct. 13 Sale & 140 crates @$98 each \\ Oct. 18 Purchase & 150 crates @$83 each \\ Oct. 26 Sale & 160 crates @$118 each \\ \hline \end{tabular} of the period. (Enter the oldest inventory layers first.) Determine the company's gross profit using the LIFO inventory costing method. Gross profit is using the LIFO inventory costing method. of the period. (Enter the oldest inventory layers first.) Determine the company's gross profit using the FIFO inventory costing method. Gross profit is using the FIFO inventory costing method