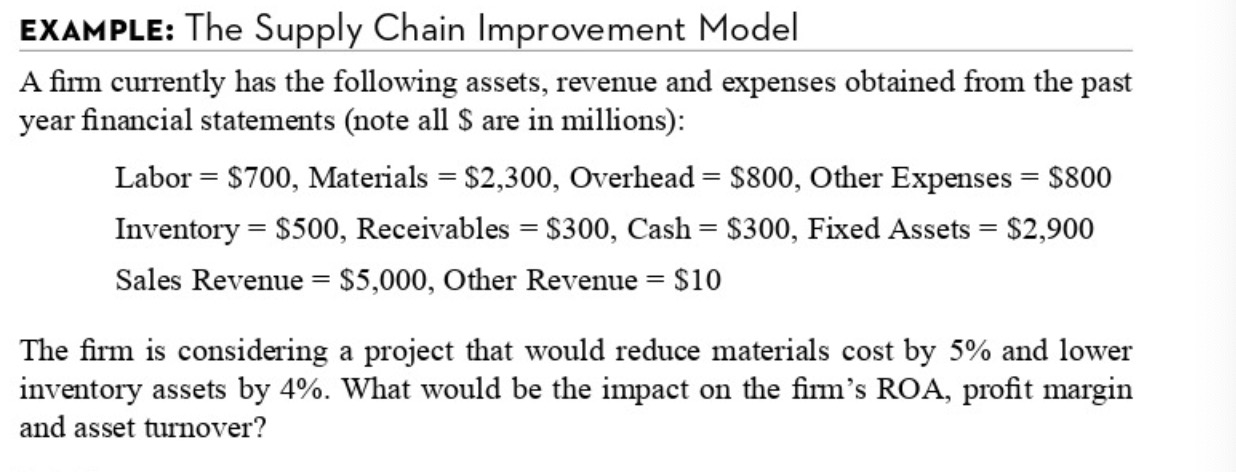

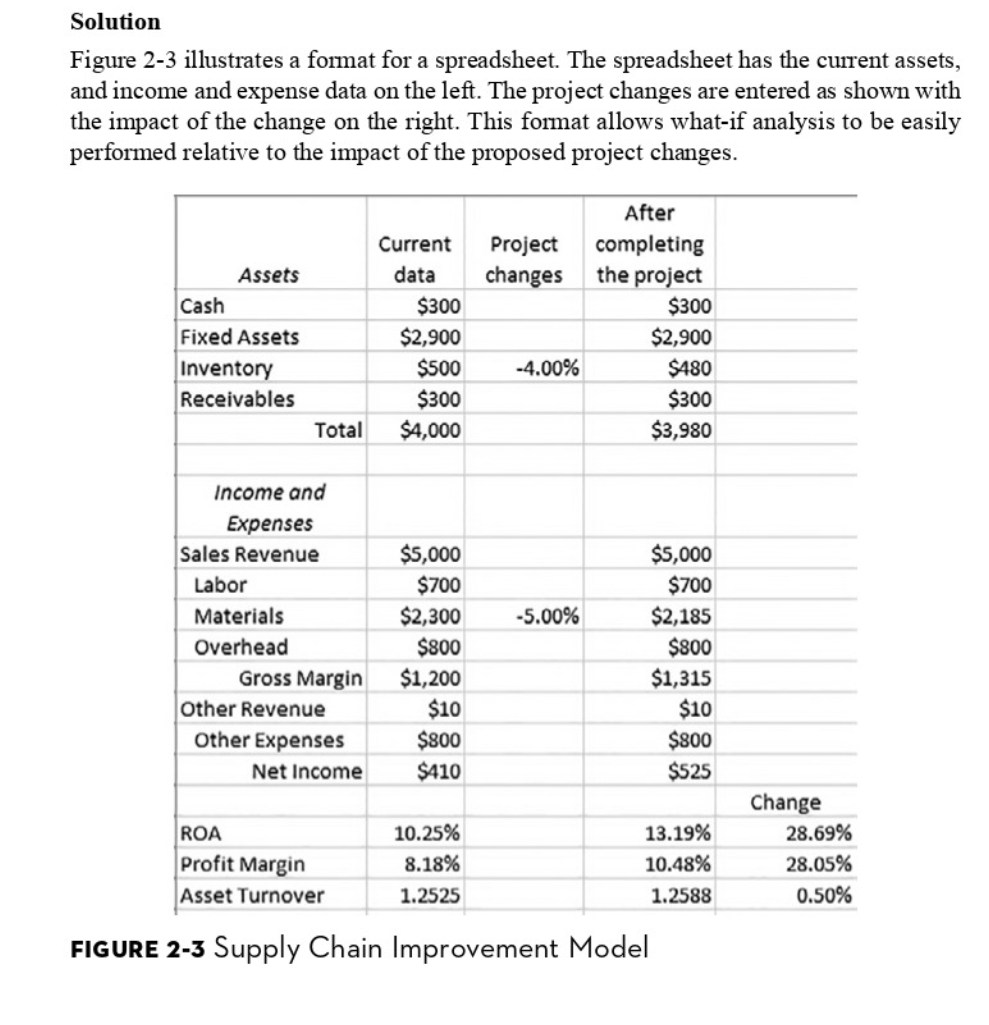

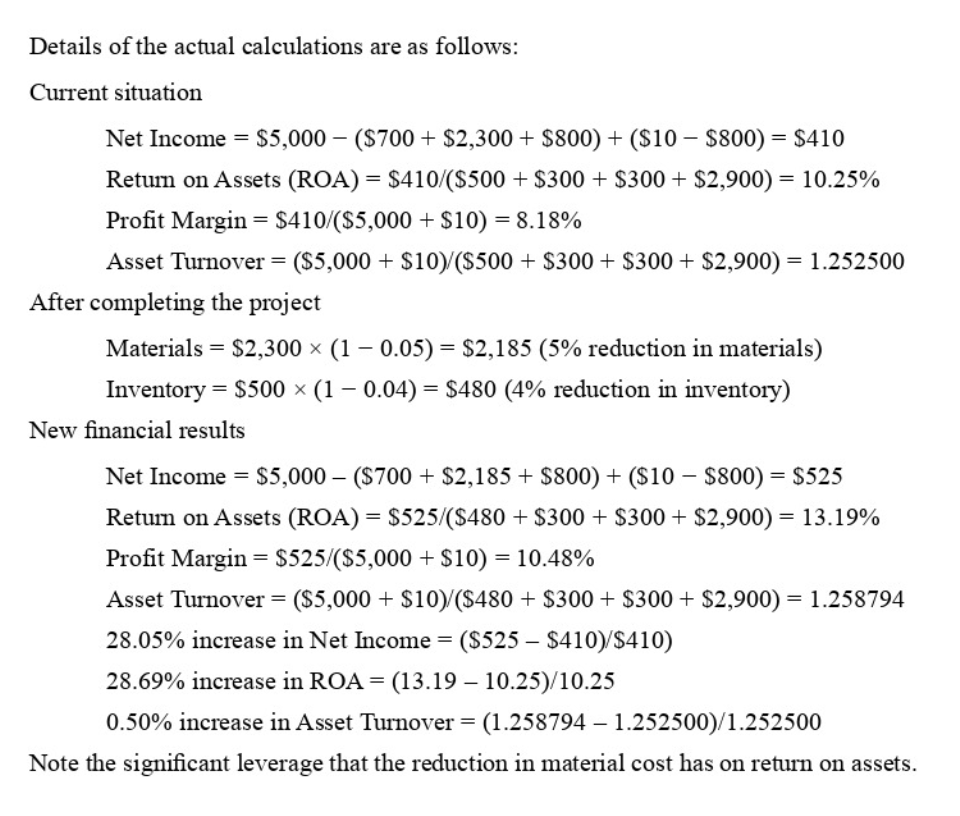

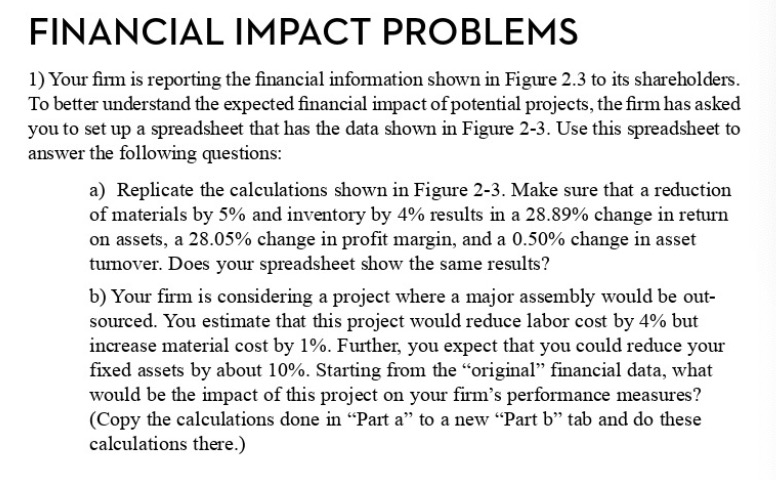

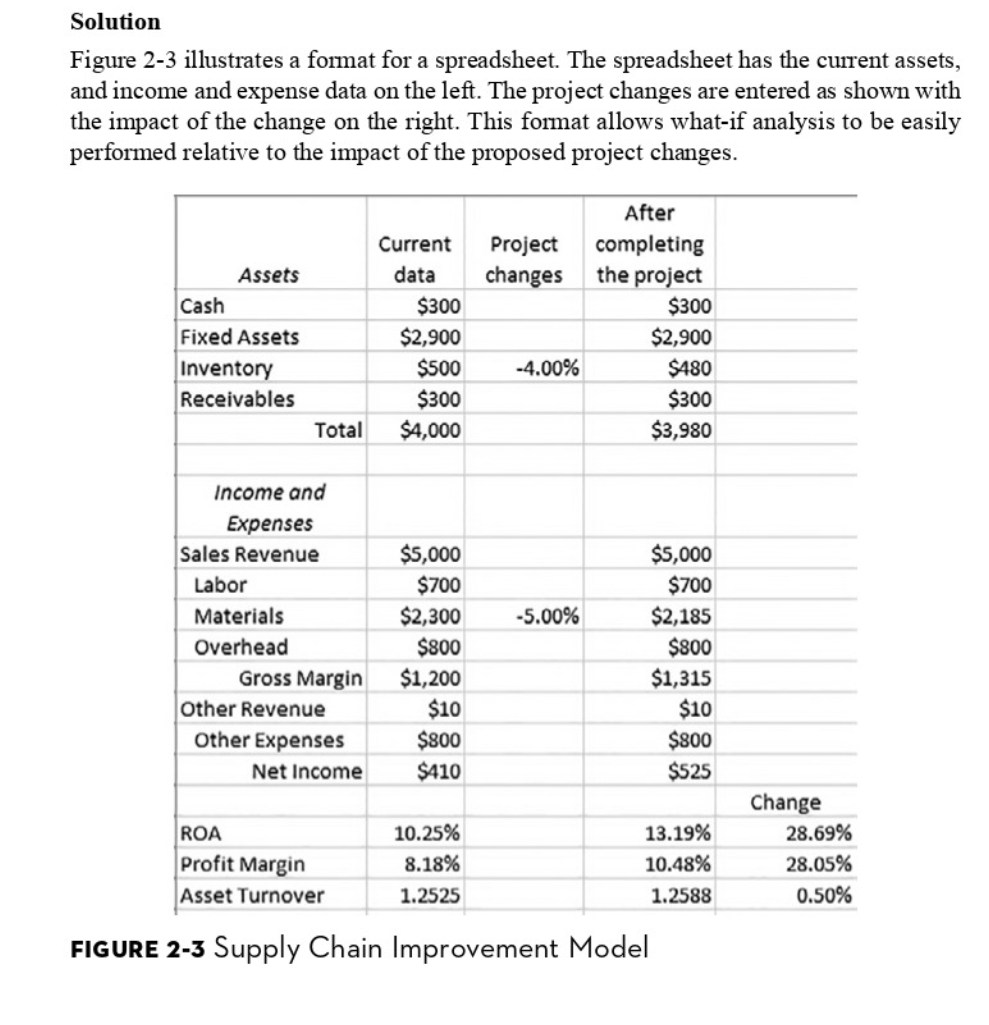

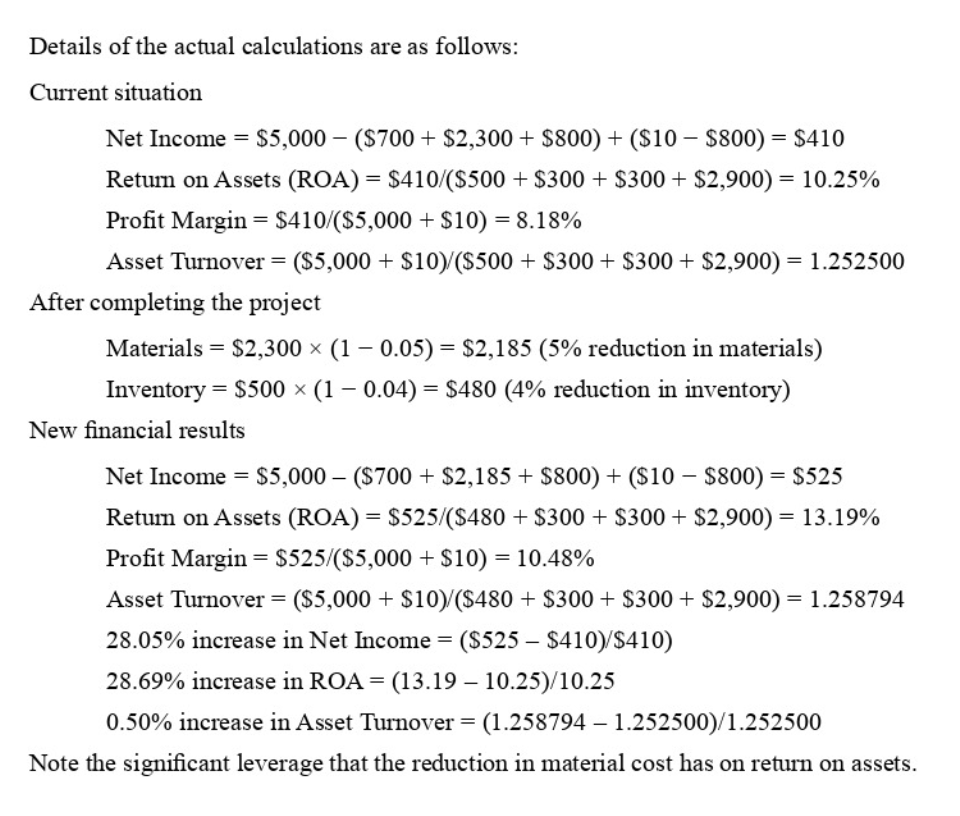

EXAMPLE: The Supply Chain Improvement Model A firm currently has the following assets, revenue and expenses obtained from the past year financial statements (note all $ are in millions): Labor = $700, Materials = $2,300, Overhead = $800, Other Expenses = $800 Inventory = $500, Receivables = $300, Cash = $300, Fixed Assets = $2,900 Sales Revenue = $5,000, Other Revenue = $10 The firm is considering a project that would reduce materials cost by 5% and lower inventory assets by 4%. What would be the impact on the firm's ROA, profit margin and asset turnover? Solution Figure 2-3 illustrates a format for a spreadsheet. The spreadsheet has the current assets, and income and expense data on the left. The project changes are entered as shown with the impact of the change on the right. This format allows what-if analysis to be easily performed relative to the impact of the proposed project changes. Project changes Assets Cash After completing the project $300 $2,900 $480 $300 $3,980 Current data $300 $2,900 $500 $300 $4,000 Fixed Assets Inventory Receivables -4.00% Total -5.00% Income and Expenses Sales Revenue Labor Materials Overhead Gross Margin Other Revenue Other Expenses Net Income $5,000 $700 $2,300 $800 $1,200 $10 $800 $410 $5,000 $700 $2,185 $800 $1,315 $10 $800 $525 ROA Profit Margin Asset Turnover 10.25% 8.18% 1.2525 13.19% 10.48% 1.2588 Change 28.69% 28.05% 0.50% FIGURE 2-3 Supply Chain Improvement Model Details of the actual calculations are as follows: Current situation Net Income = $5,000 - ($700 + $2,300 + $800) + ($10 $800) = $410 Return on Assets (ROA) = $410/($500 + $300 + $300 + $2,900) = 10.25% Profit Margin = $410/($5,000 + $ 10) = 8.18% Asset Turnover = ($5,000 + $10)/($500 + $300 + $300 + $2,900) = 1.252500 After completing the project Materials = $2,300 x (1 0.05) = $2,185 (5% reduction in materials) Inventory = $500 x (1 0.04) = $480 (4% reduction in inventory) New financial results Net Income = $5,000 ($700 + $2,185 + $800) + ($10 $800) = $525 Return on Assets (ROA) = $525/($480 + $300 + $300 + $2,900) = 13.19% Profit Margin = $525/($5,000 + $ 10) = 10.48% Asset Turnover = ($5,000 + $10)/($480 + $300 + $300 + $2,900) = 1.258794 28.05% increase in Net Income = ($525 $410)/$410) 28.69% increase in ROA = (13.19 - 10.25)/10.25 0.50% increase in Asset Turnover = (1.258794 1.252500)/1.252500 Note the significant leverage that the reduction in material cost has on return on assets. FINANCIAL IMPACT PROBLEMS 1) Your firm is reporting the financial information shown in Figure 2.3 to its shareholders. To better understand the expected financial impact of potential projects, the firm has asked you to set up a spreadsheet that has the data shown in Figure 2-3. Use this spreadsheet to answer the following questions: a) Replicate the calculations shown in Figure 2-3. Make sure that a reduction of materials by 5% and inventory by 4% results in a 28.89% change in return on assets, a 28.05% change in profit margin, and a 0.50% change in asset tumover. Does your spreadsheet show the same results ? b) Your firm is considering a project where a major assembly would be out- sourced. You estimate that this project would reduce labor cost by 4% but increase material cost by 1%. Further, you expect that you could reduce your fixed assets by about 10%. Starting from the "original financial data, what would be the impact of this project on your firm's performance measures? (Copy the calculations done in Part a to a new Part b tab and do these calculations there.) c) Management has challenged you to develop a project that will increase ROA by 2%. You can only focus on a single Operating Expense. What would you focus on and how much would you target reducing the account to get exactly the 2% improvement in ROA? (Show your result in a Part c tab.) EXAMPLE: The Supply Chain Improvement Model A firm currently has the following assets, revenue and expenses obtained from the past year financial statements (note all $ are in millions): Labor = $700, Materials = $2,300, Overhead = $800, Other Expenses = $800 Inventory = $500, Receivables = $300, Cash = $300, Fixed Assets = $2,900 Sales Revenue = $5,000, Other Revenue = $10 The firm is considering a project that would reduce materials cost by 5% and lower inventory assets by 4%. What would be the impact on the firm's ROA, profit margin and asset turnover? Solution Figure 2-3 illustrates a format for a spreadsheet. The spreadsheet has the current assets, and income and expense data on the left. The project changes are entered as shown with the impact of the change on the right. This format allows what-if analysis to be easily performed relative to the impact of the proposed project changes. Project changes Assets Cash After completing the project $300 $2,900 $480 $300 $3,980 Current data $300 $2,900 $500 $300 $4,000 Fixed Assets Inventory Receivables -4.00% Total -5.00% Income and Expenses Sales Revenue Labor Materials Overhead Gross Margin Other Revenue Other Expenses Net Income $5,000 $700 $2,300 $800 $1,200 $10 $800 $410 $5,000 $700 $2,185 $800 $1,315 $10 $800 $525 ROA Profit Margin Asset Turnover 10.25% 8.18% 1.2525 13.19% 10.48% 1.2588 Change 28.69% 28.05% 0.50% FIGURE 2-3 Supply Chain Improvement Model Details of the actual calculations are as follows: Current situation Net Income = $5,000 - ($700 + $2,300 + $800) + ($10 $800) = $410 Return on Assets (ROA) = $410/($500 + $300 + $300 + $2,900) = 10.25% Profit Margin = $410/($5,000 + $ 10) = 8.18% Asset Turnover = ($5,000 + $10)/($500 + $300 + $300 + $2,900) = 1.252500 After completing the project Materials = $2,300 x (1 0.05) = $2,185 (5% reduction in materials) Inventory = $500 x (1 0.04) = $480 (4% reduction in inventory) New financial results Net Income = $5,000 ($700 + $2,185 + $800) + ($10 $800) = $525 Return on Assets (ROA) = $525/($480 + $300 + $300 + $2,900) = 13.19% Profit Margin = $525/($5,000 + $ 10) = 10.48% Asset Turnover = ($5,000 + $10)/($480 + $300 + $300 + $2,900) = 1.258794 28.05% increase in Net Income = ($525 $410)/$410) 28.69% increase in ROA = (13.19 - 10.25)/10.25 0.50% increase in Asset Turnover = (1.258794 1.252500)/1.252500 Note the significant leverage that the reduction in material cost has on return on assets. FINANCIAL IMPACT PROBLEMS 1) Your firm is reporting the financial information shown in Figure 2.3 to its shareholders. To better understand the expected financial impact of potential projects, the firm has asked you to set up a spreadsheet that has the data shown in Figure 2-3. Use this spreadsheet to answer the following questions: a) Replicate the calculations shown in Figure 2-3. Make sure that a reduction of materials by 5% and inventory by 4% results in a 28.89% change in return on assets, a 28.05% change in profit margin, and a 0.50% change in asset tumover. Does your spreadsheet show the same results ? b) Your firm is considering a project where a major assembly would be out- sourced. You estimate that this project would reduce labor cost by 4% but increase material cost by 1%. Further, you expect that you could reduce your fixed assets by about 10%. Starting from the "original financial data, what would be the impact of this project on your firm's performance measures? (Copy the calculations done in Part a to a new Part b tab and do these calculations there.) c) Management has challenged you to develop a project that will increase ROA by 2%. You can only focus on a single Operating Expense. What would you focus on and how much would you target reducing the account to get exactly the 2% improvement in ROA? (Show your result in a Part c tab.)