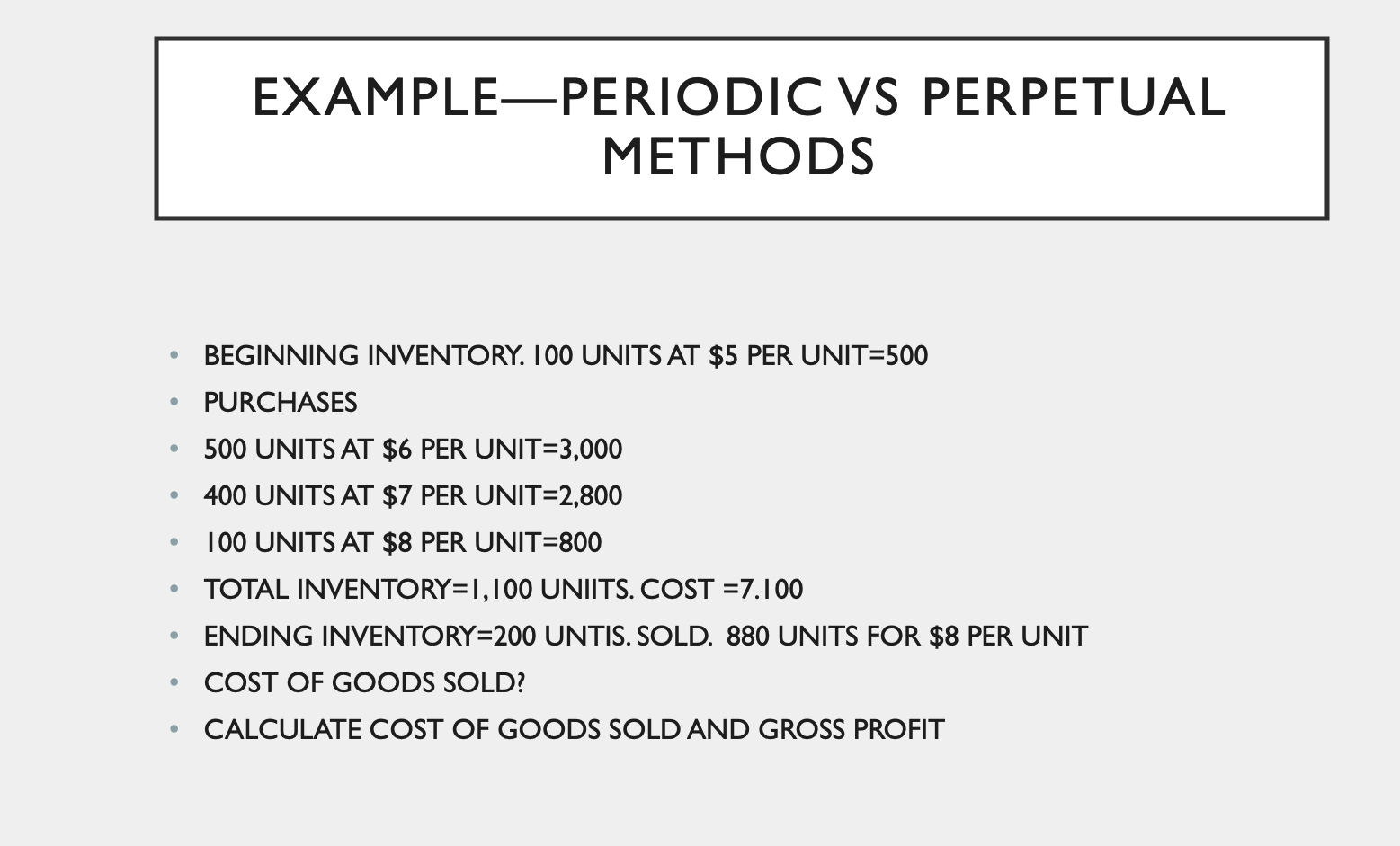

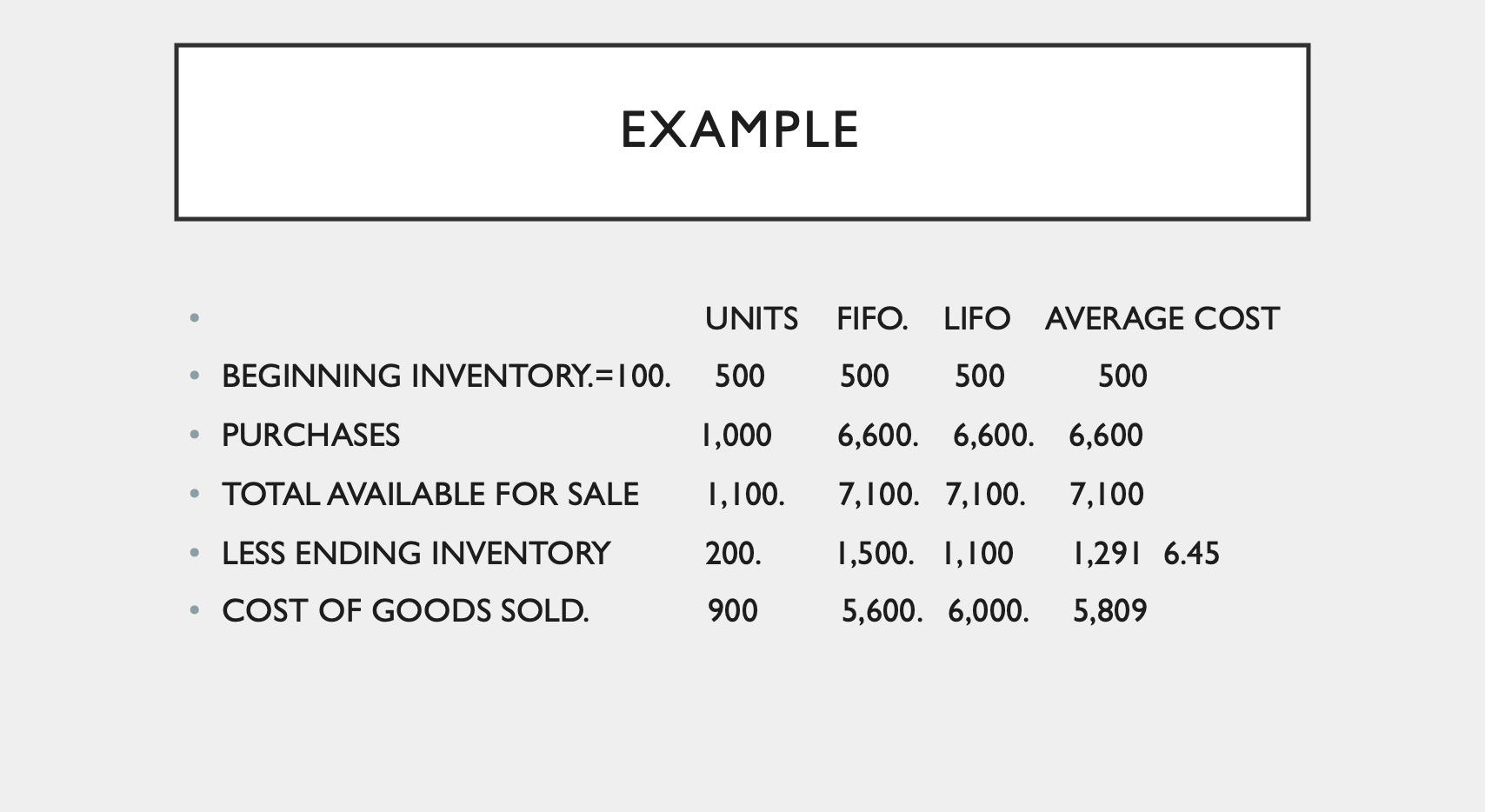

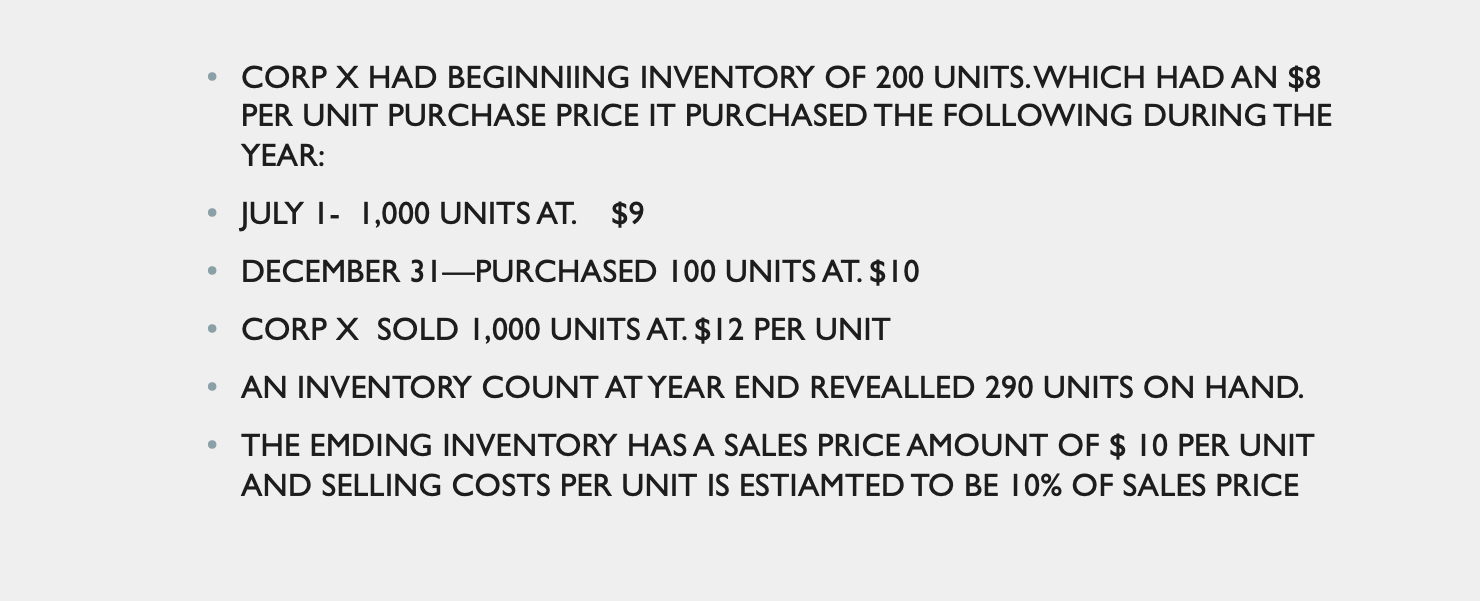

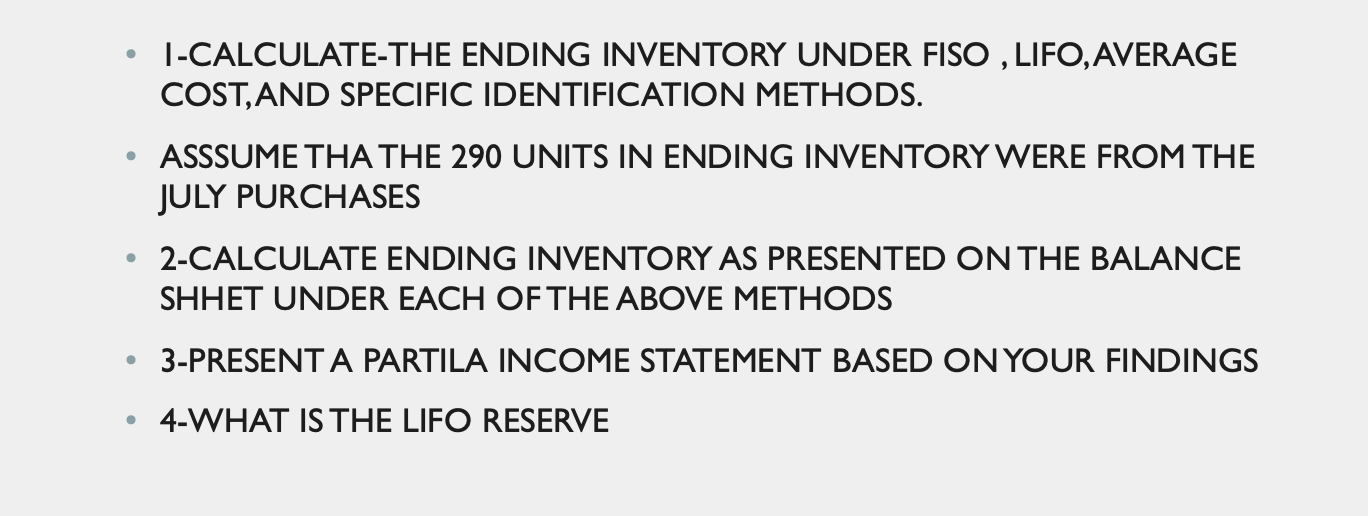

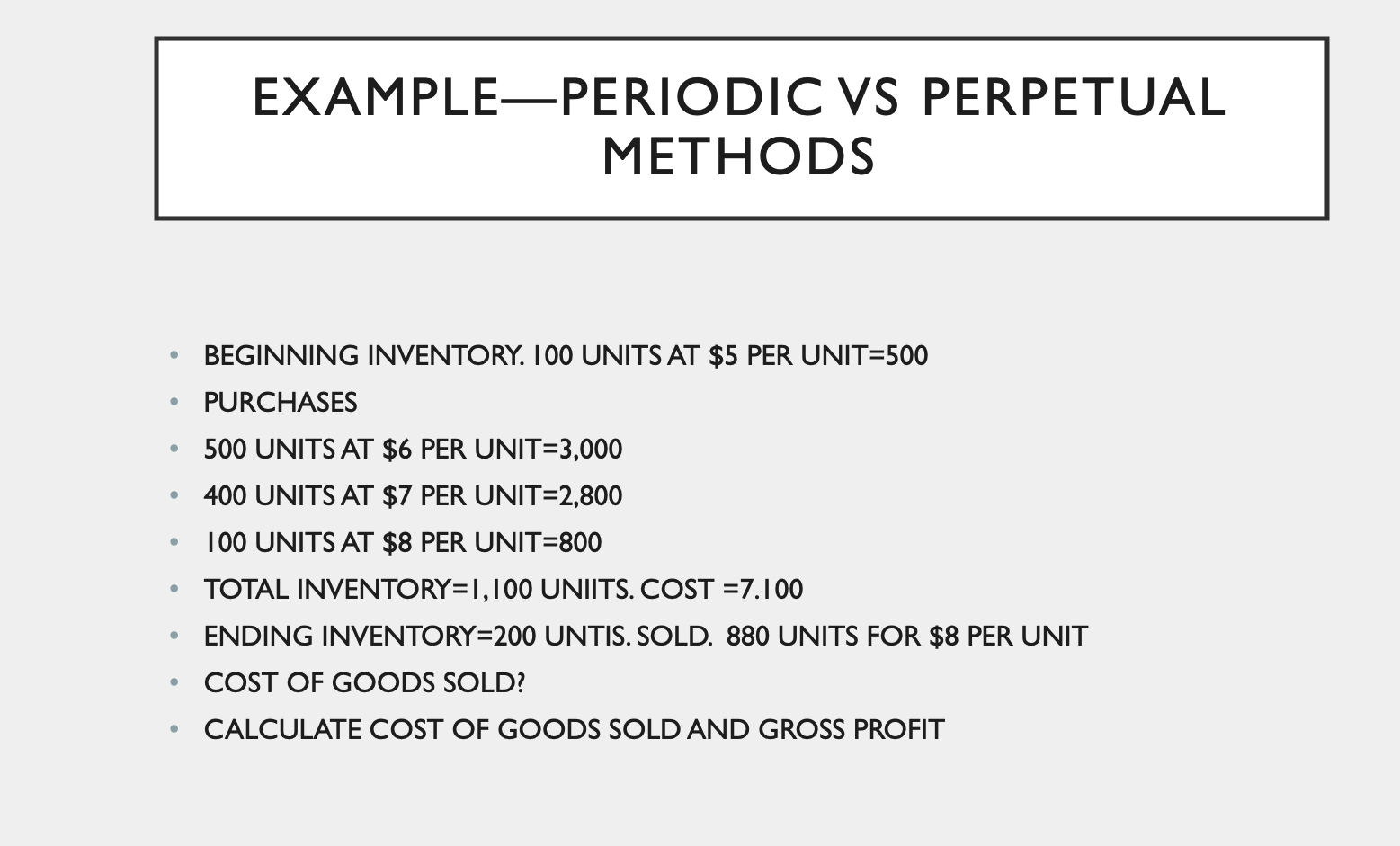

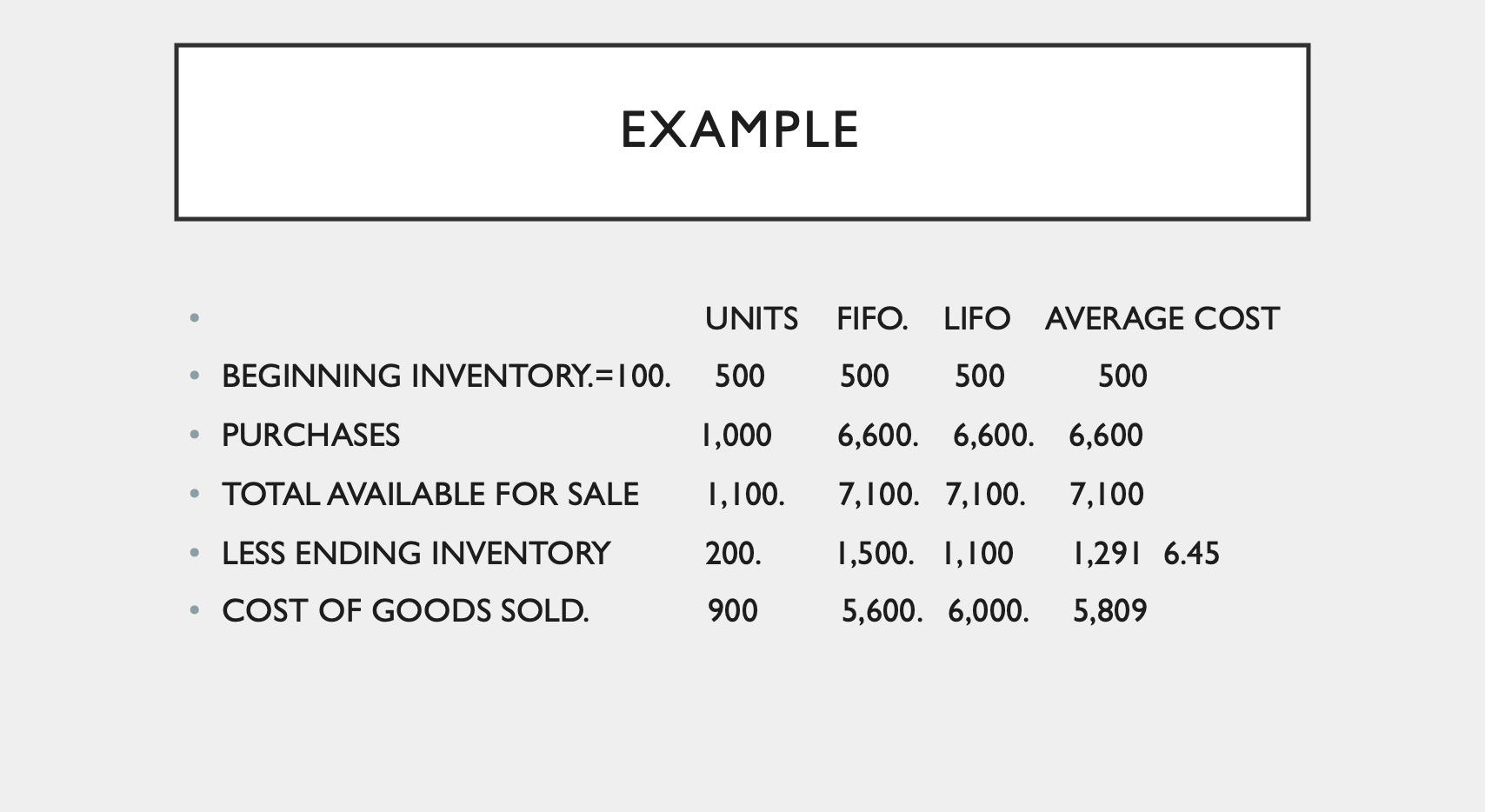

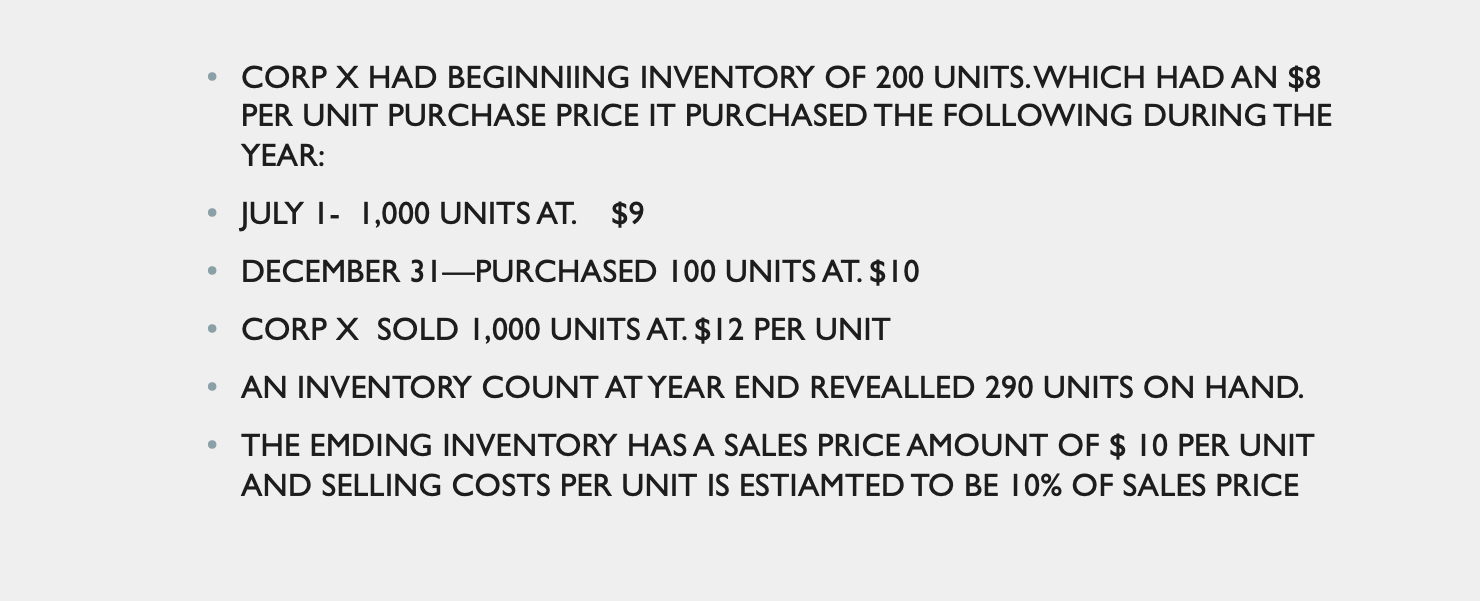

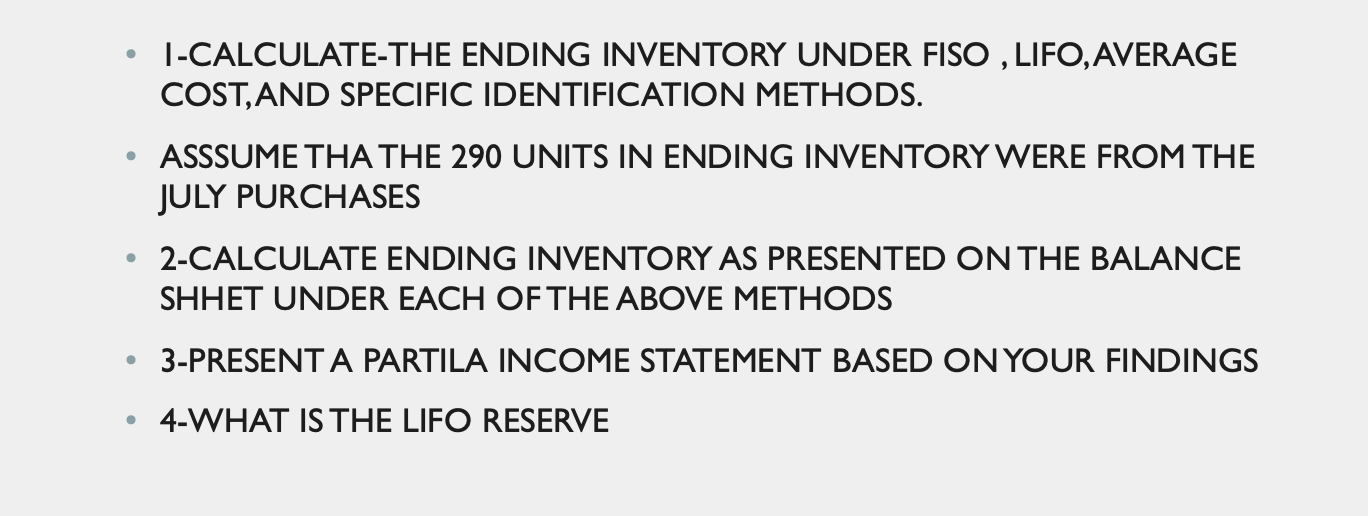

EXAMPLE-PERIODIC VS PERPETUAL METHODS . . . . BEGINNING INVENTORY. 100 UNITS AT $5 PER UNIT=500 PURCHASES 500 UNITS AT $6 PER UNIT=3,000 400 UNITS AT $7 PER UNIT=2,800 100 UNITS AT $8 PER UNIT=800 TOTAL INVENTORY=1,100 UNIITS. COST =7.100 ENDING INVENTORY=200 UNTIS. SOLD. 880 UNITS FOR $8 PER UNIT COST OF GOODS SOLD? CALCULATE COST OF GOODS SOLD AND GROSS PROFIT . . EXAMPLE UNITS FIFO. LIFO AVERAGE COST . BEGINNING INVENTORY.=100. 500 500 500 500 . PURCHASES 1,000 6,600. 6,600. 6,600 TOTAL AVAILABLE FOR SALE 1,100. 7,100. 7,100. 7,100 . LESS ENDING INVENTORY 200. 1,500. 1,100 1,291 6.45 COST OF GOODS SOLD. 900 5,600. 6,000. 5,809 CORP X HAD BEGINNIING INVENTORY OF 200 UNITS.WHICH HAD AN $8 PER UNIT PURCHASE PRICE IT PURCHASED THE FOLLOWING DURING THE YEAR: O JULY 1- 1,000 UNITS AT. $9 DECEMBER 31PURCHASED 100 UNITS AT. $10 CORP X SOLD 1,000 UNITS AT. $12 PER UNIT AN INVENTORY COUNT AT YEAR END REVEALLED 290 UNITS ON HAND. THE EMDING INVENTORY HAS A SALES PRICE AMOUNT OF $ 10 PER UNIT AND SELLING COSTS PER UNIT IS ESTIAMTED TO BE 10% OF SALES PRICE . |-CALCULATE-THE ENDING INVENTORY UNDER FISO , LIFO, AVERAGE COST, AND SPECIFIC IDENTIFICATION METHODS. ASSSUME THA THE 290 UNITS IN ENDING INVENTORY WERE FROM THE JULY PURCHASES 2-CALCULATE ENDING INVENTORY AS PRESENTED ON THE BALANCE SHHET UNDER EACH OF THE ABOVE METHODS . 3-PRESENT A PARTILA INCOME STATEMENT BASED ON YOUR FINDINGS . 4-WHAT IS THE LIFO RESERVE EXAMPLE-PERIODIC VS PERPETUAL METHODS . . . . BEGINNING INVENTORY. 100 UNITS AT $5 PER UNIT=500 PURCHASES 500 UNITS AT $6 PER UNIT=3,000 400 UNITS AT $7 PER UNIT=2,800 100 UNITS AT $8 PER UNIT=800 TOTAL INVENTORY=1,100 UNIITS. COST =7.100 ENDING INVENTORY=200 UNTIS. SOLD. 880 UNITS FOR $8 PER UNIT COST OF GOODS SOLD? CALCULATE COST OF GOODS SOLD AND GROSS PROFIT . . EXAMPLE UNITS FIFO. LIFO AVERAGE COST . BEGINNING INVENTORY.=100. 500 500 500 500 . PURCHASES 1,000 6,600. 6,600. 6,600 TOTAL AVAILABLE FOR SALE 1,100. 7,100. 7,100. 7,100 . LESS ENDING INVENTORY 200. 1,500. 1,100 1,291 6.45 COST OF GOODS SOLD. 900 5,600. 6,000. 5,809 CORP X HAD BEGINNIING INVENTORY OF 200 UNITS.WHICH HAD AN $8 PER UNIT PURCHASE PRICE IT PURCHASED THE FOLLOWING DURING THE YEAR: O JULY 1- 1,000 UNITS AT. $9 DECEMBER 31PURCHASED 100 UNITS AT. $10 CORP X SOLD 1,000 UNITS AT. $12 PER UNIT AN INVENTORY COUNT AT YEAR END REVEALLED 290 UNITS ON HAND. THE EMDING INVENTORY HAS A SALES PRICE AMOUNT OF $ 10 PER UNIT AND SELLING COSTS PER UNIT IS ESTIAMTED TO BE 10% OF SALES PRICE . |-CALCULATE-THE ENDING INVENTORY UNDER FISO , LIFO, AVERAGE COST, AND SPECIFIC IDENTIFICATION METHODS. ASSSUME THA THE 290 UNITS IN ENDING INVENTORY WERE FROM THE JULY PURCHASES 2-CALCULATE ENDING INVENTORY AS PRESENTED ON THE BALANCE SHHET UNDER EACH OF THE ABOVE METHODS . 3-PRESENT A PARTILA INCOME STATEMENT BASED ON YOUR FINDINGS . 4-WHAT IS THE LIFO RESERVE