Question

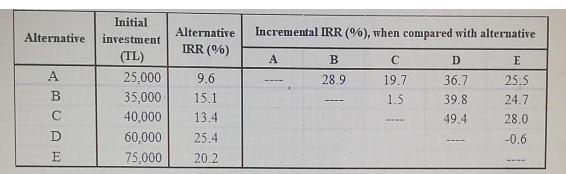

Examples of how to read this table: the IRR of project A is 9.6%, and the IRR of the incremental investment project when project A

Examples of how to read this table: the IRR of project A is 9.6%, and the IRR of the incremental investment project when project A is compared to project B is 28.9%.

1) If the alternatives are independent and the MARR is 18%, which alternative(s)should be selected? Explain your answer.

2) If the alternatives are mutually exclusive and the MARR is 15% per year, which alternative should be selected? Explain your answer. For each comparison, also show the corresponding figure where you can compare the alternatives (.e., a figure with both alteratives at the same time).

Initial Alternative Incremental IRR (%), when compared with alternative Alternative investment IRR (%) (TL) A D E A 25,000 9.6 28.9 19.7 36.7 25.5 35,000 15.1 1.5 39.8 24.7 40,000 13.4 49 4 28.0 60,000 25.4 -0.6 E 75,000 20.2

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 MARR18 The Alternative IRR should be more than 18 to be selected Alternative ANOT SELECTED ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started