Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Examples of industries that would use process costing include the pharmaceutical and semiconductor industry. 2) The principal difference between process costing and job costing is

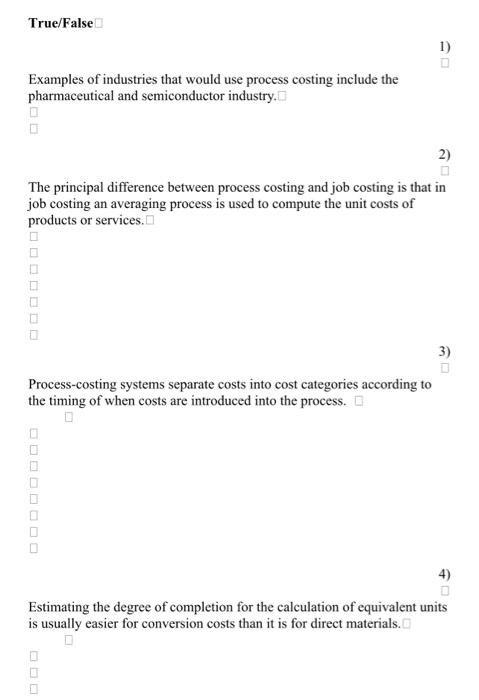

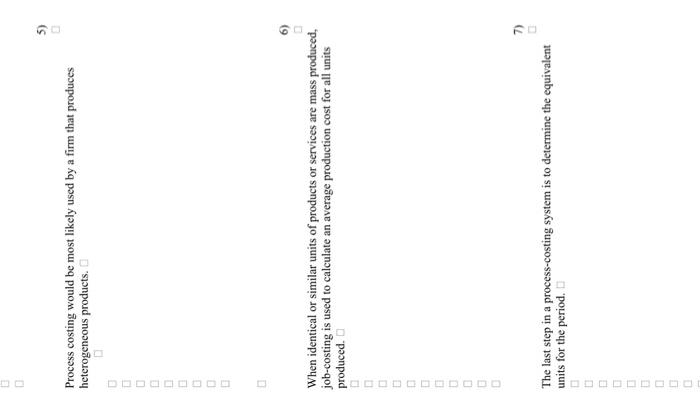

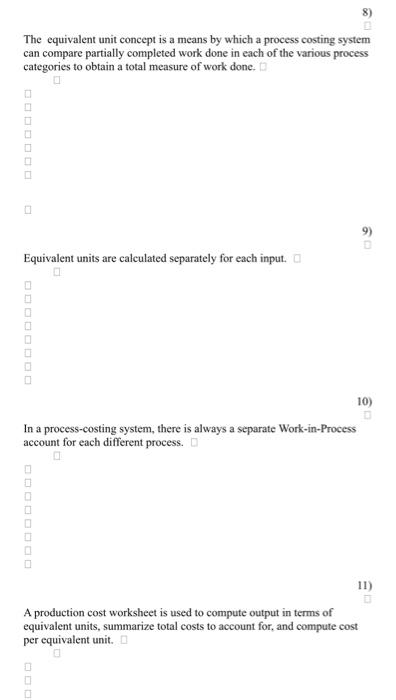

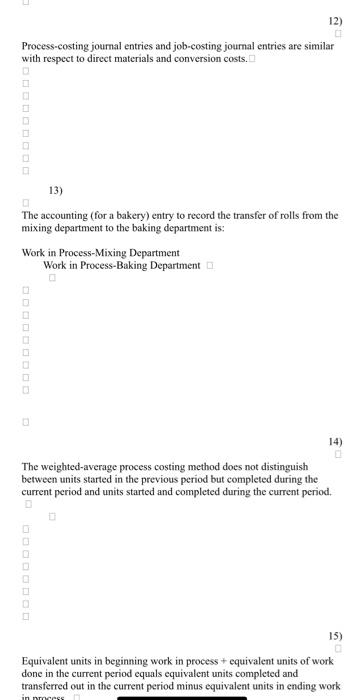

Examples of industries that would use process costing include the pharmaceutical and semiconductor industry. 2) The principal difference between process costing and job costing is that in job costing an averaging process is used to compute the unit costs of products or services. 3) Process-costing systems separate costs into cost categories according to the timing of when costs are introduced into the process. 4) Estimating the degree of completion for the calculation of equivalent units is usually easier for conversion costs than it is for direct materials. Process costing would be most likely used by a firm that produces heterogeneous products. 6) When identical or similar units of products or services are mass produced, job-costing is used to calculate an average production cost for all units produced. The equivalent unit concept is a means by which a process costing system can compare partially completed work done in each of the various process categories to obtain a total measure of work done. 9) Equivalent units are calculated separately for each input. 10) In a process-costing system, there is always a separate Work-in-Process account for each different process. 11) A production cost worksheet is used to compute output in terms of equivalent units, summarize total costs to account for, and compute cost per equivalent unit. Process-costing jourmal entries and job-costing journal entries are similar with respect to direct materials and conversion costs. 13) The accounting (for a bakery) entry to record the transfer of rolls from the mixing department to the baking department is: Work in Process-Mixing Department Work in Process-Baking Department 14) The weighted-average process costing method does not distinguish between units started in the previous period but completed during the current period and units started and completed during the current period. 15) Equivalent units in beginning work in process + equivalent units of work done in the current period equals equivalent units completed and transferred out in the current period minus equivalent units in ending work In the weighted-average costing method, the costs of direct materials in beginning inventory are not included in the cost per unit calculation since direct materials are almost always added at the start of the production process. 17) To calculate weighted-average conversion cost per equivalent unit, you divide total conversion costs to date by total equivalent units of work done to date. 18) The weighted-average cost is the total of all costs entering the Work-inProcess account (whether they are from beginning work-in-process or from work started during the current period) divided by total equivalent units of work done to date. 19) The equivalent units are not needed in a weighted-average system, because all costs are just averaged. The cost of units completed can differ materially between the weighted average and the FIFO methods of process costing

Examples of industries that would use process costing include the pharmaceutical and semiconductor industry. 2) The principal difference between process costing and job costing is that in job costing an averaging process is used to compute the unit costs of products or services. 3) Process-costing systems separate costs into cost categories according to the timing of when costs are introduced into the process. 4) Estimating the degree of completion for the calculation of equivalent units is usually easier for conversion costs than it is for direct materials. Process costing would be most likely used by a firm that produces heterogeneous products. 6) When identical or similar units of products or services are mass produced, job-costing is used to calculate an average production cost for all units produced. The equivalent unit concept is a means by which a process costing system can compare partially completed work done in each of the various process categories to obtain a total measure of work done. 9) Equivalent units are calculated separately for each input. 10) In a process-costing system, there is always a separate Work-in-Process account for each different process. 11) A production cost worksheet is used to compute output in terms of equivalent units, summarize total costs to account for, and compute cost per equivalent unit. Process-costing jourmal entries and job-costing journal entries are similar with respect to direct materials and conversion costs. 13) The accounting (for a bakery) entry to record the transfer of rolls from the mixing department to the baking department is: Work in Process-Mixing Department Work in Process-Baking Department 14) The weighted-average process costing method does not distinguish between units started in the previous period but completed during the current period and units started and completed during the current period. 15) Equivalent units in beginning work in process + equivalent units of work done in the current period equals equivalent units completed and transferred out in the current period minus equivalent units in ending work In the weighted-average costing method, the costs of direct materials in beginning inventory are not included in the cost per unit calculation since direct materials are almost always added at the start of the production process. 17) To calculate weighted-average conversion cost per equivalent unit, you divide total conversion costs to date by total equivalent units of work done to date. 18) The weighted-average cost is the total of all costs entering the Work-inProcess account (whether they are from beginning work-in-process or from work started during the current period) divided by total equivalent units of work done to date. 19) The equivalent units are not needed in a weighted-average system, because all costs are just averaged. The cost of units completed can differ materially between the weighted average and the FIFO methods of process costing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started