examples of transactions-processing systems

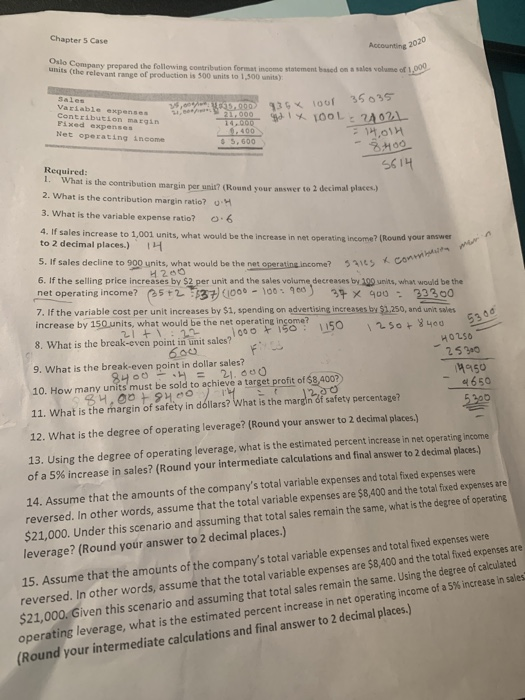

Accounting 2020 Oslo Company prepared the following contribution format income statement based on a les volume of 1,00 Chapter 5 Case units the relevant range of production is 500 units to 1,300 units) 3,000 Variable expenses Contribution margin Fixed expenses Net operating income x contribuita 5300 35035 935 tour gd 1 x 100L : 2402L $ 5,600 = 14,014 8100 Required: 1. What is the contribution margin per unit? (Round your answer to 2 decimal places) 5614 2. What is the contribution margin ratio? OH 3. What is the variable expense ratio? 4. If sales increase to 1,001 units, what would be the increase in net operating income? (Round your answer to 2 decimal places.) 5. If sales decline to 900 units, what would be the net operating income? H 200 6. If the selling price increases by $2 per unit and the sales volume decreases by 199 units, what would be the net operating income? 5+2 537) (1000 - 100 900 37 x 400 33300 7. If the variable cost per unit increases by $1, spending on advertising increases by $1,250, and unit ses increase by 150 units, what would be the net operating income? ziti 2.2- 1000 F 150 1150 1250 +8400 8. What is the break-even point in unit sales? 600 9. What is the break-even point in dollar sales? 2530 8400 = 21000 19950 10. How many units must be sold to achieve a target profit of $8,400? 4659 84,00 94.00 14. 11. What is the margin of safety in dollars? What is the margin of safety percentage? 5300 12. What is the degree of operating leverage? (Round your answer to 2 decimal places.) 13. Using the degree of operating leverage, what is the estimated percent increase in net operating income of a 5% increase in sales? (Round your intermediate calculations and final answer to 2 decimal places.) 14. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $8,400 and the total fixed expenses are $21,000. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? (Round your answer to 2 decimal places.) H0250 12.00 15. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $8,400 and the total fixed expenses are $21,000. Given this scenario and assuming that total sales remain the same. Using the degree of calculated operating leverage, what is the estimated percent increase in net operating income of a 5% increase in sales (Round your intermediate calculations and final answer to 2 decimal places.)