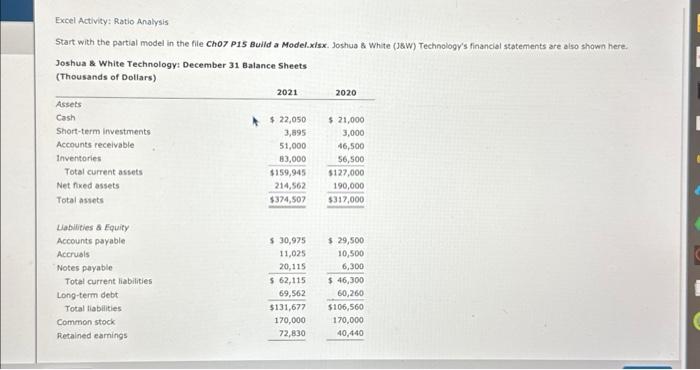

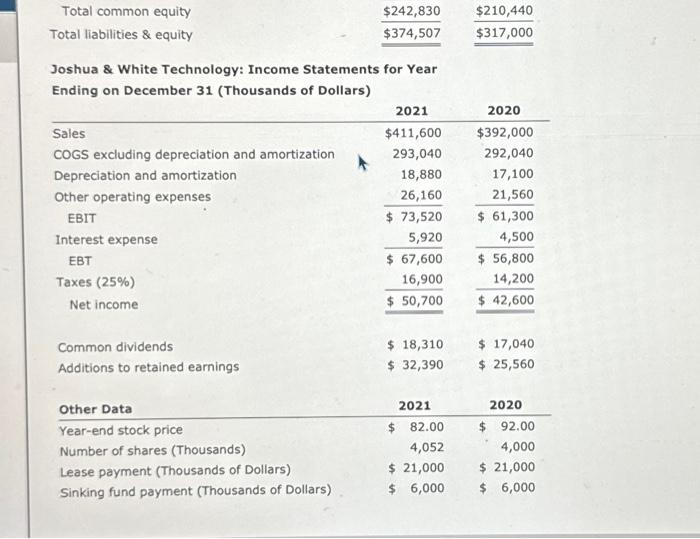

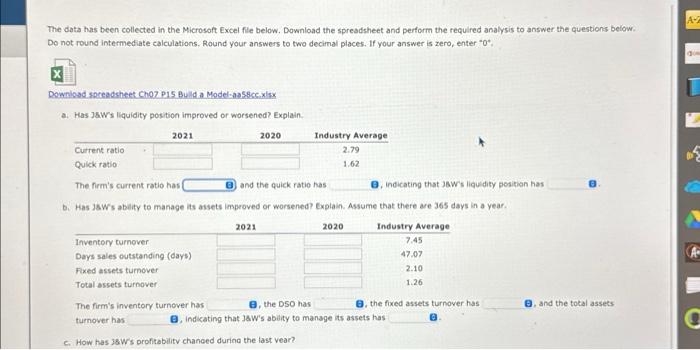

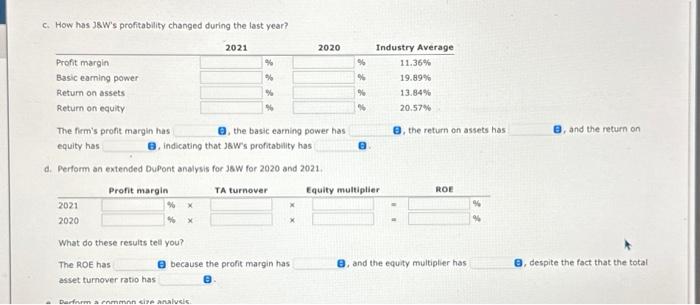

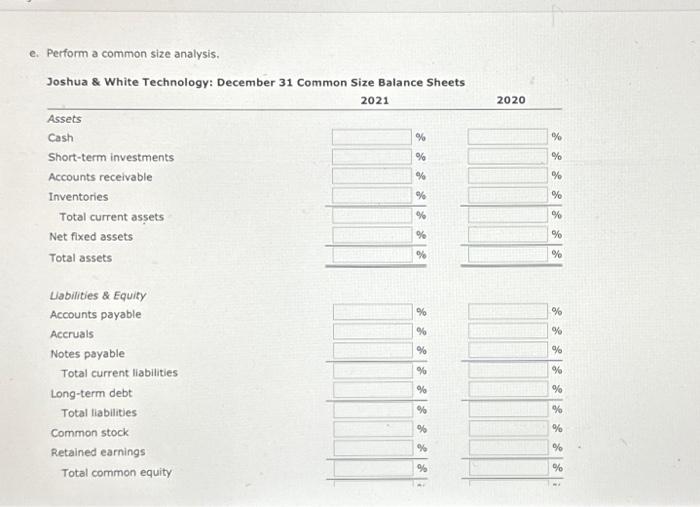

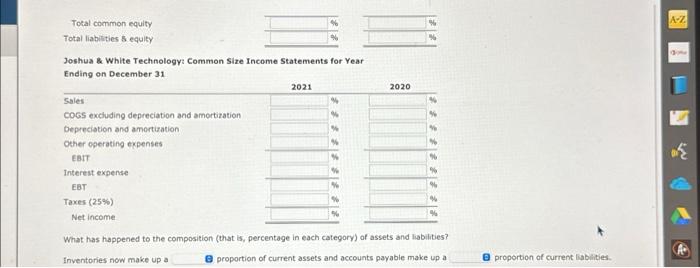

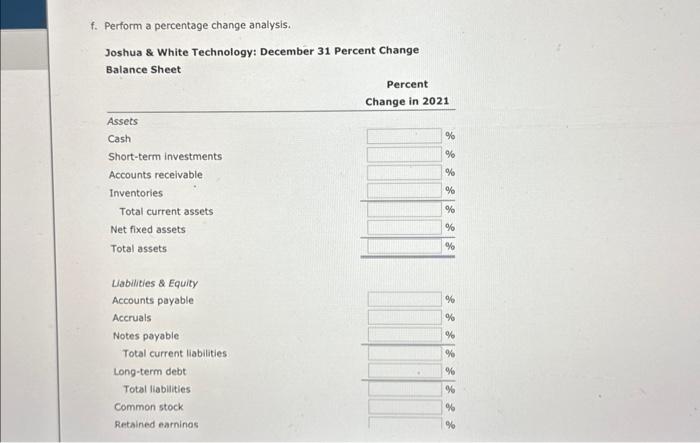

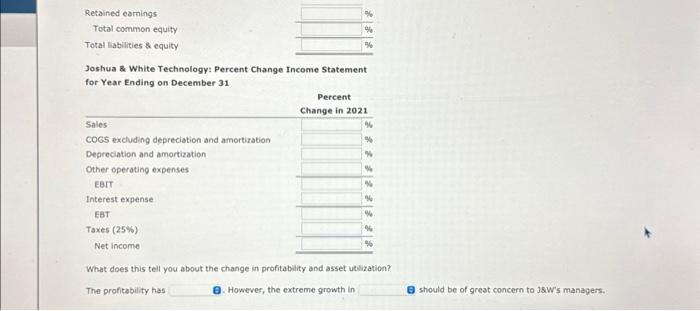

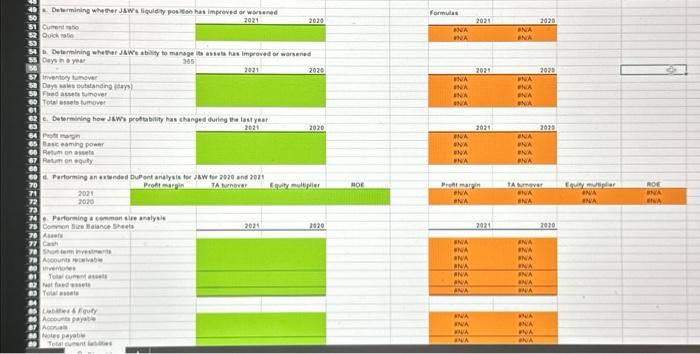

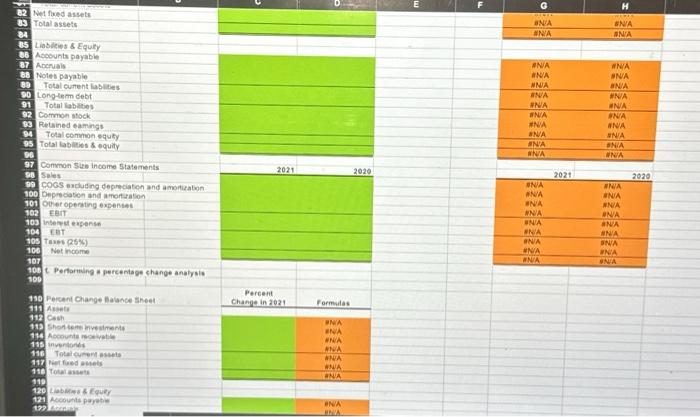

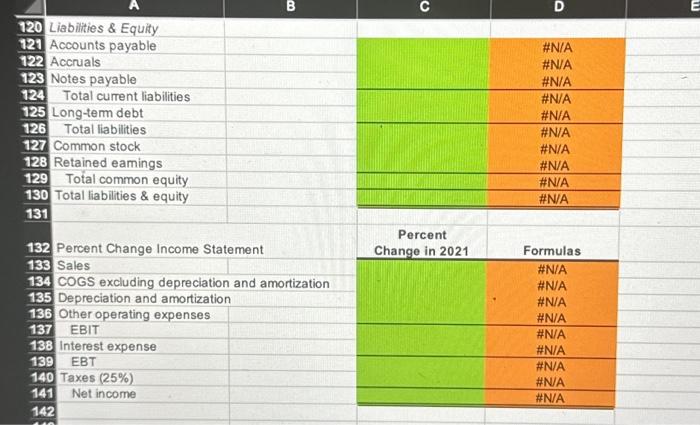

Excel Activity: Ratio Analysis Start with the partial model in the file choz P15 Build a Model.xisx. Joshua s White (1sw) Technology's financial statements are also shown here. Joshua \& White Technology: December 31 Balance Sheets Joshua \& White Technology: Income Statements for Year Ending on December 31 (Thousands of Dollars) The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations, Round your answers to two decimal places. If your answer is zero, enter " 0 ", Download soceadsheet Cho7 P15 Bulld a Modelaassicc.xisx a. Has Jswrs liquidity position improved or worsened? Explain. The firm's current ratio has and the quick ratio has , indicating that Jawrs liguidity position has b. Has JsW's abilty to manage is assets improved or worsened? Explain. Assume that there are 365 days in a year. The firm's inventory turnover has , the DSO has , the fixed assets turnover has and the total assets turnover has , indikating that JaW's abity to manage its assets has c. How has 38 w's orofitabilitv chanced durina the last vear? c. How has J8W's profitability changed during the last year? The firm's profit margin has , the basic earning power has , the return on assets has and the return on equity has , indicating that Jew's profitability has d. Perform an extended DuPont analysis for 38W for 2020 and 2021. What do these results tell you? The ROE has because the profit margin has , and the equity multiplier has , despite the fact that the total asset turnover ratio has e. Perform a common size analysis. Joshua \& White Technology: Common Size Income Statements for Year Ending on December 31 What has happened to the composition (that is, percentage in each category) of assets and liabilities? fiventories now make up a proportion of current assets and accounts payable make up a proportion of current liabilities. f. Perform a percentage change analysis. Joshua \& White Technology: December 31 Percent Change Joshua \& White Technology: Percent Change Income Statement for Year Ending on December 31 What does this tell you about the change in profitability and asset utilization? The profitability has However, the extreme growth in should be of great concern to JsWr's managers. Cument aso 2921 2020 Oolch rotin Farmula: 2021 2028 Deys in o yee? 305 20212020 inventiog turcover Daye arist Butatanding farn? Find astes symever Tote esseto tumure! Protir maron Banc eaming power Retum an asieto Retim on toulty 2021 Preht -argin TA turnerer. 2020 2020 \begin{tabular}{|c|c|} \hline 2021 & 202 \\ \hline H.A & \\ \hline WNa & min \\ \hline mon & min \\ \hline Wra & WVA \\ \hline PreAt murgin & takmerst \\ \hline tha & sinx \\ \hline the & WNA \\ \hline \end{tabular} Comen Dire Balance Bhets 2021 1920 Ausis Cant Shos iem noteteris Mcourto nockinge invemotes Totwi exmen atiets net fond vasels Tour essels Lanated is forty. Recource popate heonis hoies parebe Total elesent iatiotes \begin{tabular}{|c|c|c|c|c|} \hline 120 & Liabilities \& Equity & & & \\ \hline 121 & Accounts payable & & & \#N/A \\ \hline 122 & Accruals & & & #N/A \\ \hline 123 & Notes payable & & & #N/A \\ \hline 124 & Total current liabilities & & & # N/A \\ \hline 125 & Long-term debt & & & #N/A \\ \hline 126 & Total liabilities & & & #N/A \\ \hline 127 & Common stock & & & #N/A \\ \hline 128 & Retained eamings & & & \#N/A \\ \hline 129 & Total common equity & & & \#N/A \\ \hline 130 & Total liabilities \& equity & & & \#N/A \\ \hline \multicolumn{5}{|l|}{131} \\ \hline 132 & \multicolumn{2}{|c|}{\begin{tabular}{l} Percent Change Income Statement \\ Sales \end{tabular}} & \begin{tabular}{c} Percent \\ Change in 2021 \\ \end{tabular} & Formulas \\ \hline 133 & Sales & & & # N/A \\ \hline 134 & \multicolumn{2}{|c|}{ COGS excluding depreciation and amortization } & & #N/A \\ \hline 135 & 5 Depreciation and amortization & & & #N/A \\ \hline 136 & Other operating expenses & & & \#N/A \\ \hline 137 & 7 EBIT & & & #N/A \\ \hline 138 & 3 Interest expense & & & #N/A \\ \hline 139 & EBT & & & #N/A \\ \hline 140 & Taxes (25%) & & & #N/A \\ \hline 141 & Net income & & & #N/A \\ \hline \end{tabular} Excel Activity: Ratio Analysis Start with the partial model in the file choz P15 Build a Model.xisx. Joshua s White (1sw) Technology's financial statements are also shown here. Joshua \& White Technology: December 31 Balance Sheets Joshua \& White Technology: Income Statements for Year Ending on December 31 (Thousands of Dollars) The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations, Round your answers to two decimal places. If your answer is zero, enter " 0 ", Download soceadsheet Cho7 P15 Bulld a Modelaassicc.xisx a. Has Jswrs liquidity position improved or worsened? Explain. The firm's current ratio has and the quick ratio has , indicating that Jawrs liguidity position has b. Has JsW's abilty to manage is assets improved or worsened? Explain. Assume that there are 365 days in a year. The firm's inventory turnover has , the DSO has , the fixed assets turnover has and the total assets turnover has , indikating that JaW's abity to manage its assets has c. How has 38 w's orofitabilitv chanced durina the last vear? c. How has J8W's profitability changed during the last year? The firm's profit margin has , the basic earning power has , the return on assets has and the return on equity has , indicating that Jew's profitability has d. Perform an extended DuPont analysis for 38W for 2020 and 2021. What do these results tell you? The ROE has because the profit margin has , and the equity multiplier has , despite the fact that the total asset turnover ratio has e. Perform a common size analysis. Joshua \& White Technology: Common Size Income Statements for Year Ending on December 31 What has happened to the composition (that is, percentage in each category) of assets and liabilities? fiventories now make up a proportion of current assets and accounts payable make up a proportion of current liabilities. f. Perform a percentage change analysis. Joshua \& White Technology: December 31 Percent Change Joshua \& White Technology: Percent Change Income Statement for Year Ending on December 31 What does this tell you about the change in profitability and asset utilization? The profitability has However, the extreme growth in should be of great concern to JsWr's managers. Cument aso 2921 2020 Oolch rotin Farmula: 2021 2028 Deys in o yee? 305 20212020 inventiog turcover Daye arist Butatanding farn? Find astes symever Tote esseto tumure! Protir maron Banc eaming power Retum an asieto Retim on toulty 2021 Preht -argin TA turnerer. 2020 2020 \begin{tabular}{|c|c|} \hline 2021 & 202 \\ \hline H.A & \\ \hline WNa & min \\ \hline mon & min \\ \hline Wra & WVA \\ \hline PreAt murgin & takmerst \\ \hline tha & sinx \\ \hline the & WNA \\ \hline \end{tabular} Comen Dire Balance Bhets 2021 1920 Ausis Cant Shos iem noteteris Mcourto nockinge invemotes Totwi exmen atiets net fond vasels Tour essels Lanated is forty. Recource popate heonis hoies parebe Total elesent iatiotes \begin{tabular}{|c|c|c|c|c|} \hline 120 & Liabilities \& Equity & & & \\ \hline 121 & Accounts payable & & & \#N/A \\ \hline 122 & Accruals & & & #N/A \\ \hline 123 & Notes payable & & & #N/A \\ \hline 124 & Total current liabilities & & & # N/A \\ \hline 125 & Long-term debt & & & #N/A \\ \hline 126 & Total liabilities & & & #N/A \\ \hline 127 & Common stock & & & #N/A \\ \hline 128 & Retained eamings & & & \#N/A \\ \hline 129 & Total common equity & & & \#N/A \\ \hline 130 & Total liabilities \& equity & & & \#N/A \\ \hline \multicolumn{5}{|l|}{131} \\ \hline 132 & \multicolumn{2}{|c|}{\begin{tabular}{l} Percent Change Income Statement \\ Sales \end{tabular}} & \begin{tabular}{c} Percent \\ Change in 2021 \\ \end{tabular} & Formulas \\ \hline 133 & Sales & & & # N/A \\ \hline 134 & \multicolumn{2}{|c|}{ COGS excluding depreciation and amortization } & & #N/A \\ \hline 135 & 5 Depreciation and amortization & & & #N/A \\ \hline 136 & Other operating expenses & & & \#N/A \\ \hline 137 & 7 EBIT & & & #N/A \\ \hline 138 & 3 Interest expense & & & #N/A \\ \hline 139 & EBT & & & #N/A \\ \hline 140 & Taxes (25%) & & & #N/A \\ \hline 141 & Net income & & & #N/A \\ \hline \end{tabular}