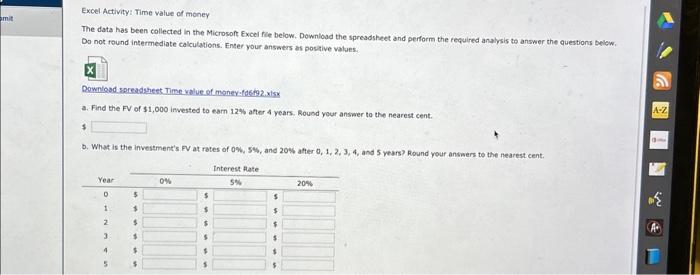

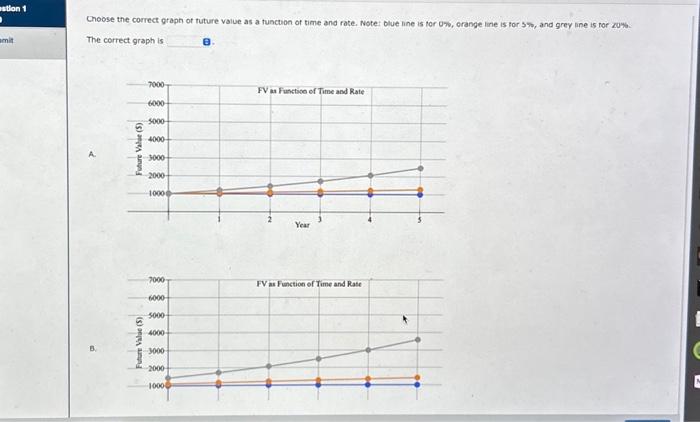

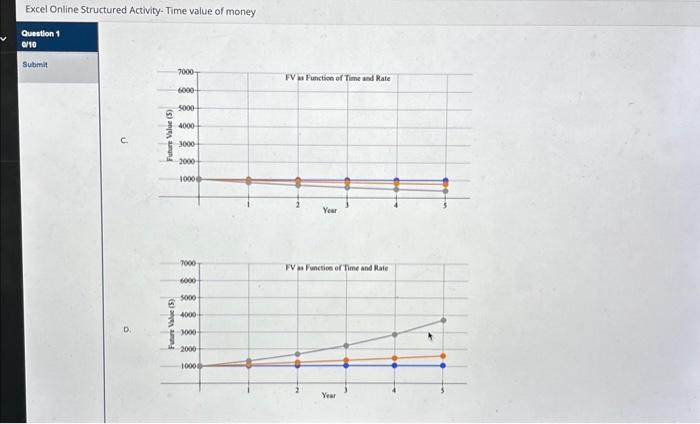

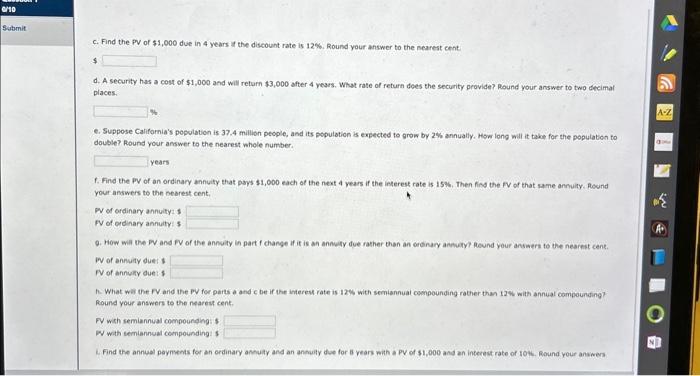

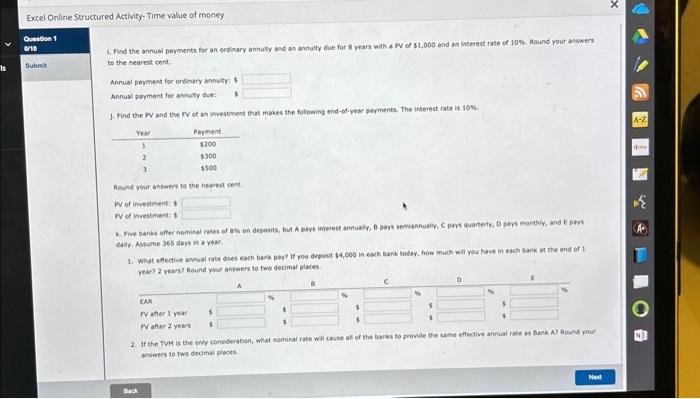

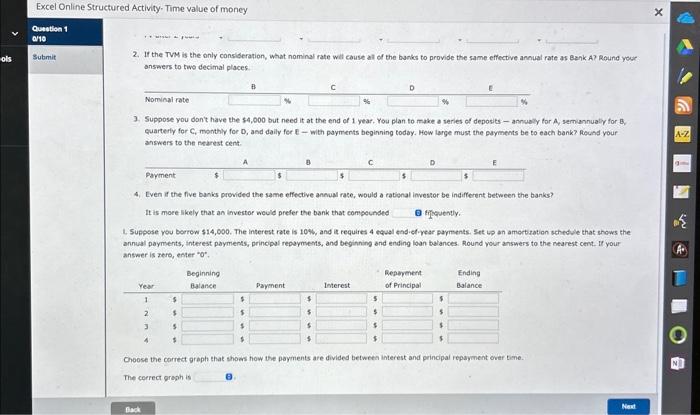

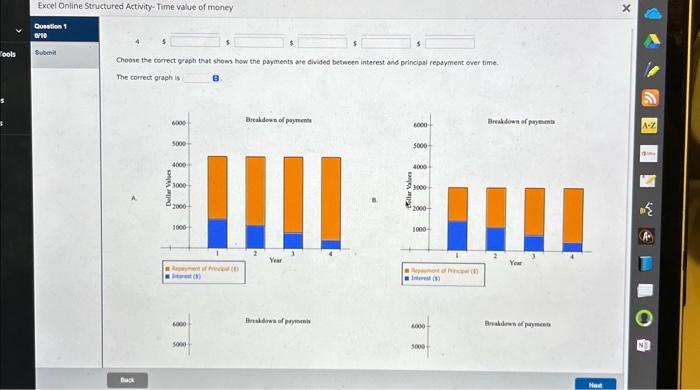

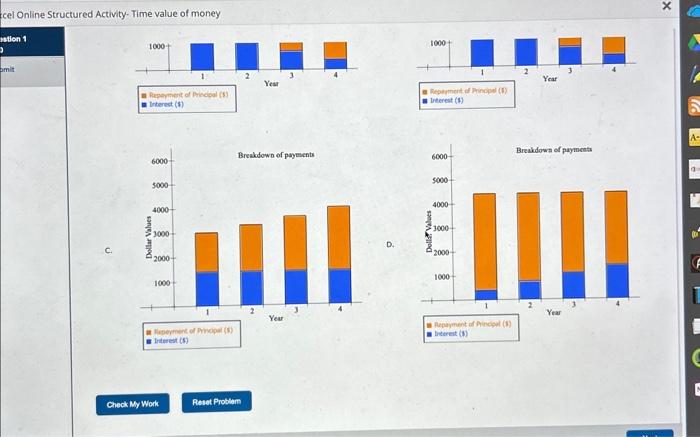

Excel Activity: Time value of money The data has been collected in the Microsoft Excel rie below, Downlosd the spreadsheet and perform the fequired analysis to answer the auestions belew. Do not round intermediate calculations: Enger your answers an positive valaes: Download spreadghest Time value of moneysufded9 2 xisk a. Find the FV of $1,000 invested to eam 12% after 4 years. Round your answer to the nearest cent. 3 b. What is the investment's EV at rates of 0%,5%, and 20% after 0,1,2,3,4, and 5 years? Roond your anwers to the nearest cent. Choose the correct grapt of tuture value as a function of time and fate. Note: olue line is tor 0%, orange line is tor 3%, and grey line is tor a0\%s. The correct graph is Excel Online Structured Activity- Time value of money c. Find the PV of $1,000 due in 4 years if the discount rate is 12%. Round your answer to the pearest cent 4 d. A security has a cost of $1;000 and will retarn $3,000 after 4 years. What rate of return does the security provide? Round your answer to two deimal places. e. Suppose Cahifornia's popolation is 37.4 million people, and its population is expected to grow by 2% annualiy. How long will it take for the population to double? Round your answer to the nearest whole number. years f. Find the PY of an ordinary annuity that pays $1,000 each of the next 4 years if the interest rate is isw, Then find the FV of that same annuity. Aleand your andwers to the nesrest cent. PV of ardinary annuity1 3 FV of ordinary annuityi 5 9. How will the PV and fV of the annuity in part f change if it is ah annily due rather than an ordnary arswaty? Round your answerk to the nearest cene. it of annsity duet 1 FV of innuity due 15 h. What wat the FV and the pV foe parts a and c be if the interest rate is 12% with semiannual compounding rather than t2w with annual campounding? Round your answers to the nearest cent, P wish semiannual compoundingis W with lemiannual coenpounding is Wind the annual peyments for an ordinary anhuty and an ankuity doe for a vears with a py of 51,000 and an interest rate of 1046 . Bound your anamens 1. Find the annual payments for an oroinary annu ty and an annuly due for B years with a the of $1,000 and an interest rate of 10 an. Aound your answers to the nearest cent. Mrnual pevenent for ordnacy bhenutyi s Annual parment for anhuty dut: 1. Find the fy and the FV of an investment that makes the folowing end-of-yebr payments. The interest rate is Iow: Fennd your onswers te the neareit teat Fo of inveitmenti 1 fr of iwestment: 1 daily. Aswome 365 dars in a year. 1. What effective arryai rate doel each bank por? if you deposit s4, hoo in each bank today, how mioh wil yeo Naye in each bank at the end of 1 waar? 2 vears? lound your answers to twe decimal placet anceers to two decimal places 2. If the TVM is the bnly consideration, what nominal rate will couse all of the burks to provide the same effectove annual rate as Bank A? Round your answers to hwo decimal places 3. Suppose you don't have the s4,000 but need it at the end of 1 year. You plan fo make a series of deposits - annuely for A, serniannualy for B, euarterly for C, monthly for D, and daily fer E - with payments beginning today. How large must the gayments be to each bank? focund your answers to the nearest cent. 4. Eyen if the five banis provided the same effective annual race, would a rabional investor be indifferent between the barks? It is more likely that an lenvertor weuld prefer the bank that compeunded mifesectly. 1. Supgose you borrow 514,000 . The interest rate is 10%, and is requires 4 equal end.cf-year payments. set bp an amortiation schedule that shows the annual payments, interest payments, principal repaymests, and beginning and ending loan balances. Round your answers to the enearest cent. If your answer is zero, enter "o". Ohoose the correct graph that thoes how the payments are divided between interest and principal repayment over time. The corect praph is Choose the correct graph that shows how the parments are divided beteeen interest and princlpal repayment ever time. The correct graph is . reel Online Structured Activity- Time value of money Excel Activity: Time value of money The data has been collected in the Microsoft Excel rie below, Downlosd the spreadsheet and perform the fequired analysis to answer the auestions belew. Do not round intermediate calculations: Enger your answers an positive valaes: Download spreadghest Time value of moneysufded9 2 xisk a. Find the FV of $1,000 invested to eam 12% after 4 years. Round your answer to the nearest cent. 3 b. What is the investment's EV at rates of 0%,5%, and 20% after 0,1,2,3,4, and 5 years? Roond your anwers to the nearest cent. Choose the correct grapt of tuture value as a function of time and fate. Note: olue line is tor 0%, orange line is tor 3%, and grey line is tor a0\%s. The correct graph is Excel Online Structured Activity- Time value of money c. Find the PV of $1,000 due in 4 years if the discount rate is 12%. Round your answer to the pearest cent 4 d. A security has a cost of $1;000 and will retarn $3,000 after 4 years. What rate of return does the security provide? Round your answer to two deimal places. e. Suppose Cahifornia's popolation is 37.4 million people, and its population is expected to grow by 2% annualiy. How long will it take for the population to double? Round your answer to the nearest whole number. years f. Find the PY of an ordinary annuity that pays $1,000 each of the next 4 years if the interest rate is isw, Then find the FV of that same annuity. Aleand your andwers to the nesrest cent. PV of ardinary annuity1 3 FV of ordinary annuityi 5 9. How will the PV and fV of the annuity in part f change if it is ah annily due rather than an ordnary arswaty? Round your answerk to the nearest cene. it of annsity duet 1 FV of innuity due 15 h. What wat the FV and the pV foe parts a and c be if the interest rate is 12% with semiannual compounding rather than t2w with annual campounding? Round your answers to the nearest cent, P wish semiannual compoundingis W with lemiannual coenpounding is Wind the annual peyments for an ordinary anhuty and an ankuity doe for a vears with a py of 51,000 and an interest rate of 1046 . Bound your anamens 1. Find the annual payments for an oroinary annu ty and an annuly due for B years with a the of $1,000 and an interest rate of 10 an. Aound your answers to the nearest cent. Mrnual pevenent for ordnacy bhenutyi s Annual parment for anhuty dut: 1. Find the fy and the FV of an investment that makes the folowing end-of-yebr payments. The interest rate is Iow: Fennd your onswers te the neareit teat Fo of inveitmenti 1 fr of iwestment: 1 daily. Aswome 365 dars in a year. 1. What effective arryai rate doel each bank por? if you deposit s4, hoo in each bank today, how mioh wil yeo Naye in each bank at the end of 1 waar? 2 vears? lound your answers to twe decimal placet anceers to two decimal places 2. If the TVM is the bnly consideration, what nominal rate will couse all of the burks to provide the same effectove annual rate as Bank A? Round your answers to hwo decimal places 3. Suppose you don't have the s4,000 but need it at the end of 1 year. You plan fo make a series of deposits - annuely for A, serniannualy for B, euarterly for C, monthly for D, and daily fer E - with payments beginning today. How large must the gayments be to each bank? focund your answers to the nearest cent. 4. Eyen if the five banis provided the same effective annual race, would a rabional investor be indifferent between the barks? It is more likely that an lenvertor weuld prefer the bank that compeunded mifesectly. 1. Supgose you borrow 514,000 . The interest rate is 10%, and is requires 4 equal end.cf-year payments. set bp an amortiation schedule that shows the annual payments, interest payments, principal repaymests, and beginning and ending loan balances. Round your answers to the enearest cent. If your answer is zero, enter "o". Ohoose the correct graph that thoes how the payments are divided between interest and principal repayment over time. The corect praph is Choose the correct graph that shows how the parments are divided beteeen interest and princlpal repayment ever time. The correct graph is . reel Online Structured Activity- Time value of money