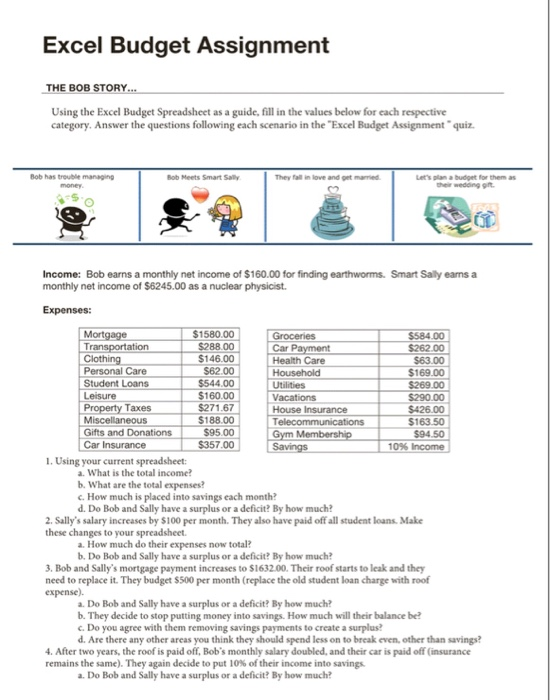

Excel Budget Assignment THE BOB STORY.. Using the Excel Budget Spreadsheet as a guide, fill in the values below for each respective category. Answer the questions following each scenario in the "Excel Budget Assignment quiz. Bob has trouble managing Bob Meets Smart Sally They fall in love and get mad budget for them as the wedding gift Income: Bob earns a monthly net income of $160.00 for finding earthworms. Smart Sally earns a monthly net income of $6245.00 as a nuclear physicist. Expenses: Mortgage $1580.00 Groceries $584.00 Transportation $288.00 Car Payment $262.00 Clothing $146.00 Health Care $63.00 Personal Care $62.00 Household $169.00 Student Loans $544.00 Utilities $269.00 Leisure $160.00 Vacations $290.00 Property Taxes $271.67 House Insurance $426.00 Miscellaneous S188.00 Telecommunications $163.50 Gifts and Donations $95.00 Gym Membership $94.50 Car Insurance $357.00 Savings 10% Income 1. Using your current spreadsheet: a. What is the total income? b. What are the total expenses? c. How much is placed into savings each month? d. Do Bob and Sally have a surplus or a deficit? By how much? 2. Sally's salary increases by $100 per month. They also have paid off all student loans. Make these changes to your spreadsheet. a. How much do their expenses now total? b. Do Bob and Sally have a surplus or a deficit? By how much? 3. Bob and Sally's mortgage payment increases to $1632.00. Their roof starts to leak and they need to replace it. They budget $500 per month (replace the old student loan charge with roof expense) a. Do Bob and Sally have a surplus or a deficit? By how much? b. They decide to stop putting money into savings. How much will their balance be? c. Do you agree with them removing savings payments to create a surplus? d. Are there any other areas you think they should spend less on to break even, other than savings? 4. After two years, the roof is paid off, Bob's monthly salary doubled, and their car is paid off insurance remains the same). They again decide to put 10% of their income into savings a. Do Bob and Sally have a surplus or a deficit? By how much? Excel Budget Assignment THE BOB STORY.. Using the Excel Budget Spreadsheet as a guide, fill in the values below for each respective category. Answer the questions following each scenario in the "Excel Budget Assignment quiz. Bob has trouble managing Bob Meets Smart Sally They fall in love and get mad budget for them as the wedding gift Income: Bob earns a monthly net income of $160.00 for finding earthworms. Smart Sally earns a monthly net income of $6245.00 as a nuclear physicist. Expenses: Mortgage $1580.00 Groceries $584.00 Transportation $288.00 Car Payment $262.00 Clothing $146.00 Health Care $63.00 Personal Care $62.00 Household $169.00 Student Loans $544.00 Utilities $269.00 Leisure $160.00 Vacations $290.00 Property Taxes $271.67 House Insurance $426.00 Miscellaneous S188.00 Telecommunications $163.50 Gifts and Donations $95.00 Gym Membership $94.50 Car Insurance $357.00 Savings 10% Income 1. Using your current spreadsheet: a. What is the total income? b. What are the total expenses? c. How much is placed into savings each month? d. Do Bob and Sally have a surplus or a deficit? By how much? 2. Sally's salary increases by $100 per month. They also have paid off all student loans. Make these changes to your spreadsheet. a. How much do their expenses now total? b. Do Bob and Sally have a surplus or a deficit? By how much? 3. Bob and Sally's mortgage payment increases to $1632.00. Their roof starts to leak and they need to replace it. They budget $500 per month (replace the old student loan charge with roof expense) a. Do Bob and Sally have a surplus or a deficit? By how much? b. They decide to stop putting money into savings. How much will their balance be? c. Do you agree with them removing savings payments to create a surplus? d. Are there any other areas you think they should spend less on to break even, other than savings? 4. After two years, the roof is paid off, Bob's monthly salary doubled, and their car is paid off insurance remains the same). They again decide to put 10% of their income into savings a. Do Bob and Sally have a surplus or a deficit? By how much