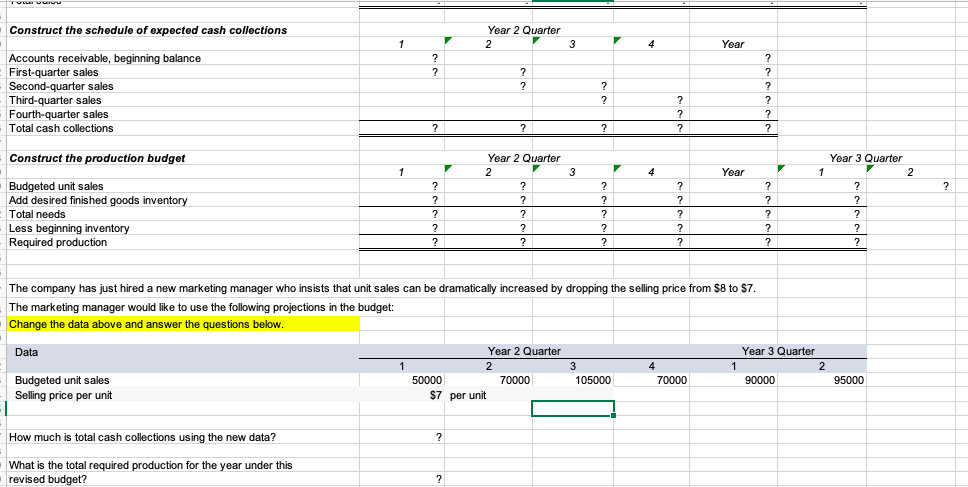

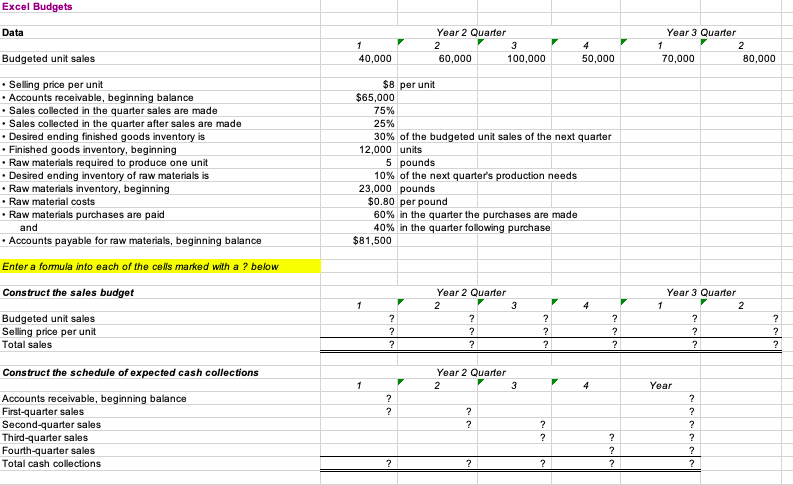

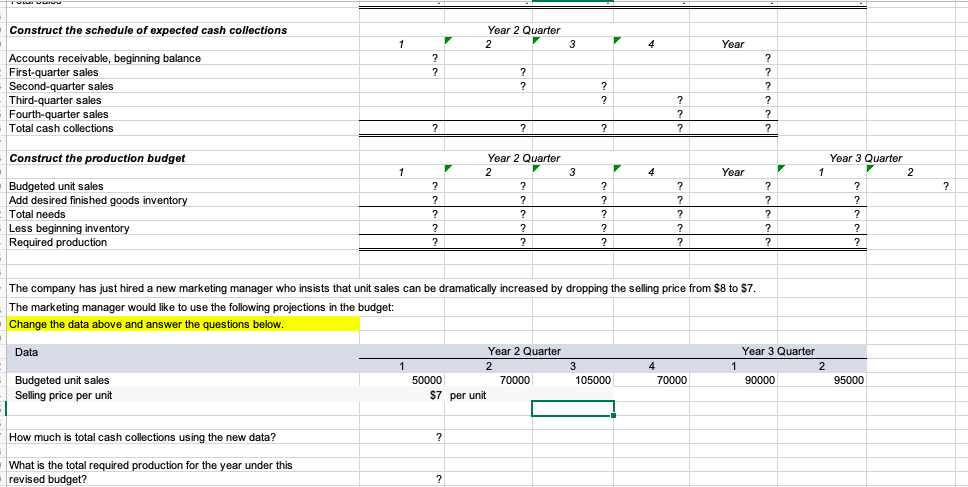

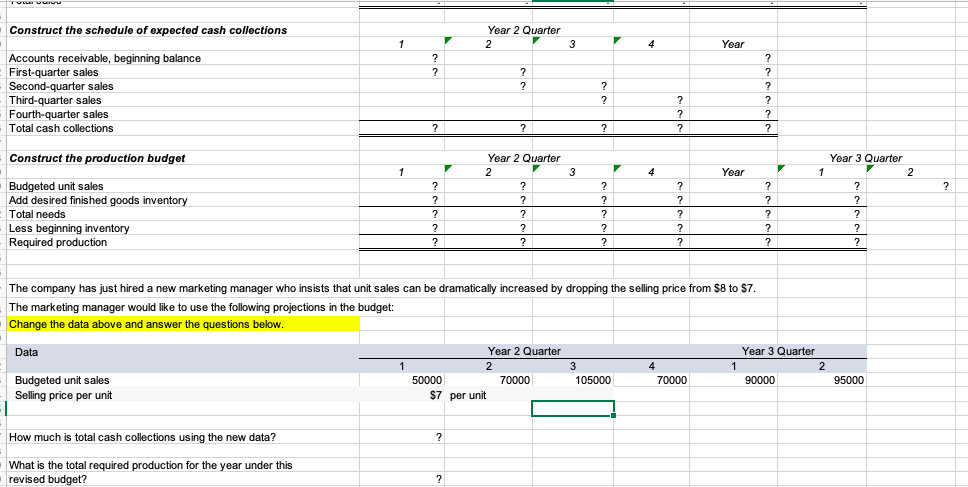

Excel Budgets Data Year 2 Quarter Year 3 Quarter 2 3 4 2 Budgeted unit sales 40,000 60,000 100,000 50,000 70,000 80,000 . Selling price per unit $8 per unit . Accounts receivable, beginning balance $65,000 . Sales collected in the quarter sales are made 75% . Sales collected in the quarter after sales are made 25% . Desired ending finished goods inventory is 30% of the budgeted unit sales of the next quarter Finished goods inventory, beginning 12,000 units Raw materials required to produce one unit 5 pounds . Desired ending inventory of raw materials is 10% of the next quarter's production needs Raw materials inventory, beginning 23,000 pounds Raw material costs $0.80 per pound . Raw materials purchases are paid 60% in the quarter the purchases are made and 40% in the quarter following purchase * Accounts payable for raw materials, beginning balance $81,500 Enter a formula into each of the cells marked with a ? below Construct the sales budget Year 2 Quarter Year 3 Quarter F 2 3 4 1 2 Budgeted unit sales Selling price per unit Total sales "JJ Construct the schedule of expected cash collections Year 2 Quarter F 2 3 F 4 Year Accounts receivable, beginning balance First-quarter sales Second-quarter sales Third-quarter sales Fourth-quarter sales Total cash collections ?Construct the schedule of expected cash collections Year 2 Quarter 2 4 Year Accounts receivable, beginning balance First-quarter sales Second-quarter sales Third-quarter sales Fourth-quarter sales Total cash collections ? ? 2 Construct the production budget Year 2 Quarter Year 3 Quarter 2 3 4 Year 1 2 Budgeted unit sales ? 7 Add desired finished goods inventory Total needs ? ? Less beginning inventory ? Required production 7 ? The company has just hired a new marketing manager who insists that unit sales can be dramatically increased by dropping the selling price from $8 to $7. The marketing manager would like to use the following projections in the budget: Change the data above and answer the questions below. Data Year 2 Quarter Year 3 Quarter 1 2 3 4 1 2 Budgeted unit sales 50000 70000 105000 70000 90000 95000 Selling price per unit $7 per unit How much is total cash collections using the new data? What is the total required production for the year under this revised budget? 2