Answered step by step

Verified Expert Solution

Question

1 Approved Answer

excel calculations and word file explanations. 2 page maximum If you will live for X years after retirement and the estimated return for your investment

excel calculations and word file explanations. 2 page maximum

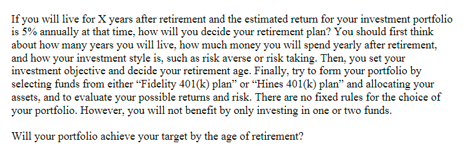

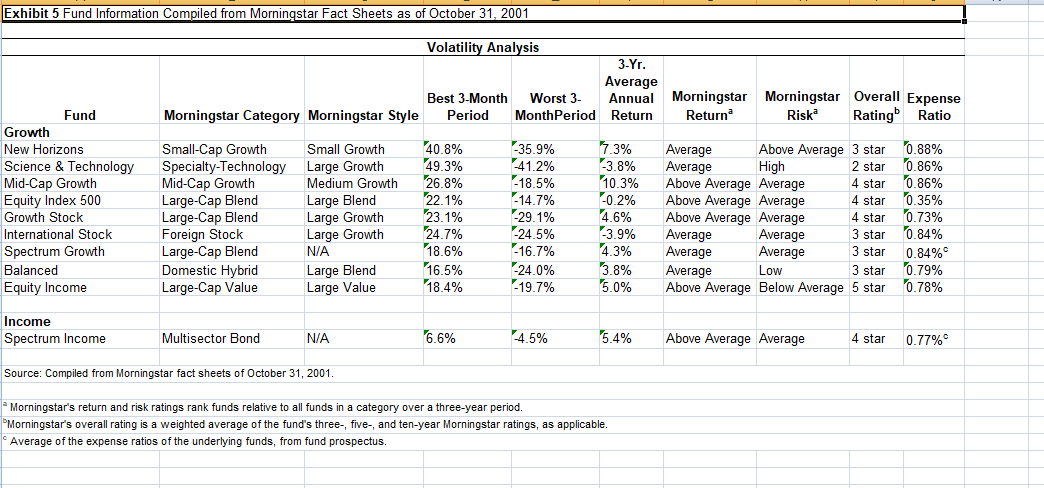

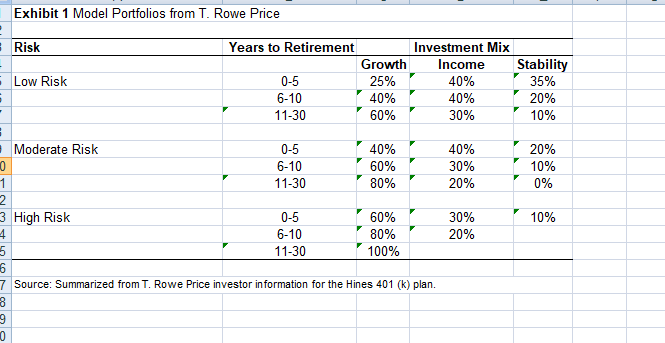

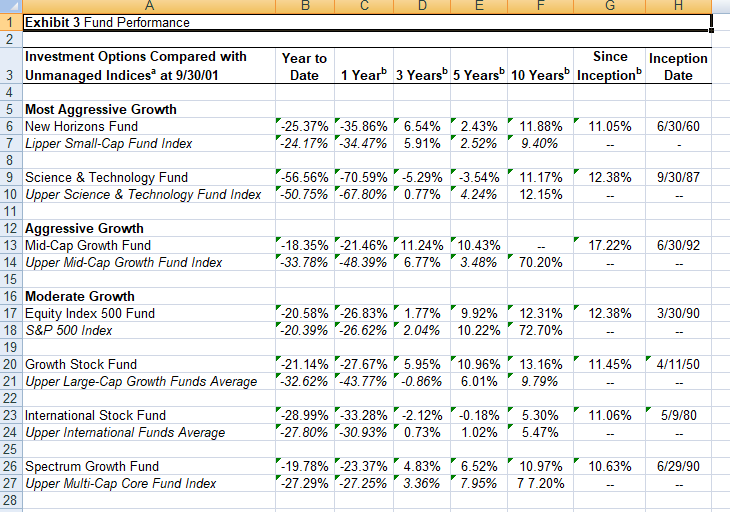

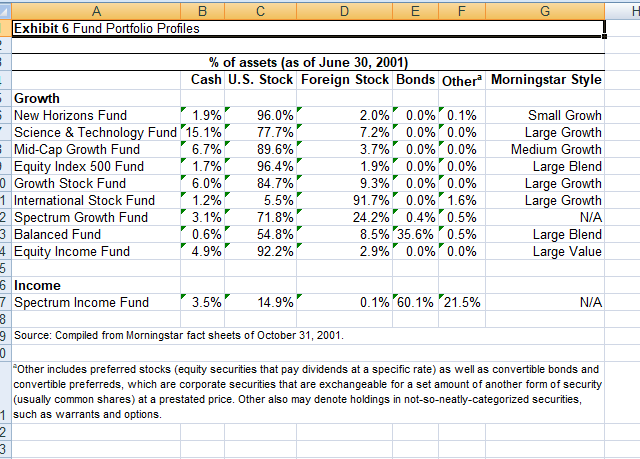

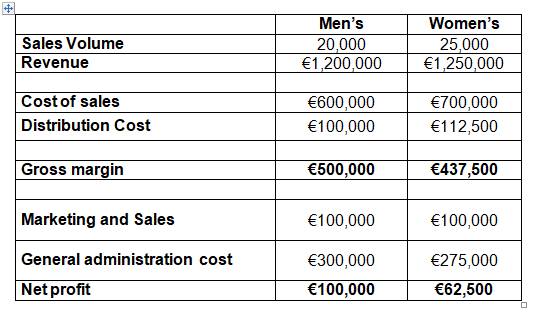

If you will live for X years after retirement and the estimated return for your investment portfolio is 5% annually at that time, how will you decide your retirement plan? You should first think about how many years you will live, how much money you will spend yearly after retirement, and how your investment style is, such as risk averse or risk taking. Then, you set your investment objective and decide your retirement age. Finally, try to form your portfolio by selecting funds from either "Fidelity 401(k) plan" or "Hines 401(k) plan" and allocating your assets, and to evaluate your possible returns and risk. There are no fixed rules for the choice your portfolio. However, you will not benefit by only investing in one or two funds. Will your portfolio achieve your target by the age of retirement? Exhibit 5 Fund Information Compiled from Morningstar Fact Sheets as of October 31, 2001 Volatility Analysis Fund Growth New Horizons Science & Technology Mid-Cap Growth Equity Index 500 Growth Stock International Stock Spectrum Growth Balanced Equity Income Income Spectrum Income Morningstar Category Morningstar Style Small-Cap Growth Specialty-Technology Mid-Cap Growth Large-Cap Blend Large-Cap Blend Foreign Stock Large-Cap Blend Domestic Hybrid Large-Cap Value Multisector Bond Small Growth Large Growth Medium Growth Large Blend Large Growth Large Growth N/A Large Blend Large Value N/A Source: Compiled from Morningstar fact sheets of October 31, 2001. Best 3-Month Period 40.8% 49.3% 26.8% 22.1% 23.1% 24.7% 18.6% 16.5% 18.4% 6.6% Worst 3 MonthPeriod -35.9% -41.2% -18.5% -14.7% -29.1% -24.5% -16.7% -24.0% -19.7% -4.5% 3-Yr. Average Annual Morningstar Return Return 7.3% -3.8% 10.3% -0.2% 4.6% -3.9% 4.3% 3.8% 5.0% 5.4% * Morningstar's return and risk ratings rank funds relative to all funds in a category over a three-year period. Morningstar's overall rating is a weighted average of the fund's three-, five-, and ten-year Morningstar ratings, as applicable. Average of the expense ratios of the underlying funds, from fund prospectus. Average Average Morningstar Overall Expense Riska Ratingb Ratio Above Average High Above Average Average Above Average Average Above Average Average Average Average Low 3 star 2 star 4 star 4 star 4 star 3 star 3 star Average Average Average 3 star Above Average Below Average 5 star Above Average Average 4 star 0.88% 0.86% 0.86% 0.35% 0.73% 0.84% 0.84% 0.79% 0.78% 0.77% - 8 0 Exhibit 1 Model Portfolios from T. Rowe Price Risk 9 0 Low Risk Moderate Risk 1 2 3 High Risk 4 Years to Retirement 0-5 6-10 11-30 0-5 6-10 11-30 0-5 6-10 11-30 Growth 25% 40% 60% 40% 60% 80% 60% 80% 100% Investment Mix Income 40% 40% 30% 5 6 7 Source: Summarized from T. Rowe Price investor information for the Hines 401 (k) plan. 8 40% 30% 20% 30% 20% Stability 35% 20% 10% 20% 10% 0% 10% 12 Exhibit 3 Fund Performance Investment Options Compared with 3 Unmanaged Indices at 9/30/01 4 5 Most Aggressive Growth 6 New Horizons Fund 7 Lipper Small-Cap Fund Index 8 12 Aggressive Growth 13 Mid-Cap Growth Fund 14 Upper Mid-Cap Growth Fund Index 15 16 Moderate Growth 17 Equity Index 500 Fund 18 S&P 500 Index 19 20 Growth Stock Fund 21 Upper Large-Cap Growth Funds Average 22 23 International Stock Fund 24 Upper International Funds Average 25 B 26 Spectrum Growth Fund 27 Upper Multi-Cap Core Fund Index 28 Year to Date 9 Science & Technology Fund -56.56% -70.59% -5.29% -3.54% 11.17% 10 Upper Science & Technology Fund Index -50.75% -67.80% 0.77% 4.24% 12.15% 11 Since Inception 1 Year 3 Years 5 Years 10 Years Inception Date -25.37% -35.86% 6.54% 2.43% -24.17% -34.47% 5.91% 2.52% 9.40% 11.88% 11.05% 6/30/60 -18.35% -21.46% 11.24% 10.43% -33.78% -48.39% 6.77% 3.48% 70.20% -28.99% -33.28% -2.12% -0.18% -27.80% -30.93% 0.73% 1.02% 12.38% 9/30/87 -20.58% -26.83% 1.77% 9.92% 12.31% 12.38% 3/30/90 -20.39% -26.62% 2.04% 10.22% 72.70% 17.22% 6/30/92 -21.14% -27.67% 5.95% 10.96% 13.16% 11.45% 4/11/50 -32.62% -43.77% -0.86% 6.01% 9.79% -19.78% -23.37% 4.83% 6.52% 10.97% -27.29% -27.25% 3.36% 7.95% 7 7.20% 5.30% 11.06% 5/9/80 5.47% 10.63% 6/29/90 3 A B Exhibit 6 Fund Portfolio Profiles Growth 6 New Horizons Fund 1.9% Science & Technology Fund 15.1% Mid-Cap Growth Fund 6.7% Equity Index 500 Fund 1.7% 6.0% 0 Growth Stock Fund 1 International Stock Fund 2 Spectrum Growth Fund 3 Balanced Fund 4 Equity Income Fund 5 % of assets (as of June 30, 2001) Cash U.S. Stock Foreign Stock Bonds Other Morningstar Style 1.2% 3.1% 0.6% 4.9% 96.0% 77.7% 89.6% 96.4% 84.7% 5.5% 71.8% 54.8% 92.2% 6 Income 7 Spectrum Income Fund 8 9 Source: Compiled from Morningstar fact sheets of October 31, 2001. 0 3.5% E 14.9% F 2.0% 0.0% 0.1% 7.2% 0.0% 0.0% 3.7% 0.0% 0.0% 1.9% 0.0% 0.0% 9.3% 0.0% 0.0% 91.7% 0.0% 1.6% 24.2% 0.4% 0.5% 8.5% 35.6% 0.5% 2.9% 0.0% 0.0% 0.1% 60.1% 21.5% Small Growh Large Growth Medium Growth Large Blend Large Growth Large Growth N/A Large Blend Large Value N/A *Other includes preferred stocks (equity securities that pay dividends at a specific rate) as well as convertible bonds and convertible preferreds, which are corporate securities that are exchangeable for a set amount of another form of security (usually common shares) at a prestated price. Other also may denote holdings in not-so-neatly-categorized securities, 1 such as warrants and options. 2 3 Sales Volume Revenue Cost of sales Distribution Cost Gross margin Marketing and Sales General administration cost Net profit Men's 20,000 1,200,000 600,000 100,000 500,000 100,000 300,000 100,000 Women's 25,000 1,250,000 700,000 112,500 437,500 100,000 275,000 62,500 D If you will live for X years after retirement and the estimated return for your investment portfolio is 5% annually at that time, how will you decide your retirement plan? You should first think about how many years you will live, how much money you will spend yearly after retirement, and how your investment style is, such as risk averse or risk taking. Then, you set your investment objective and decide your retirement age. Finally, try to form your portfolio by selecting funds from either "Fidelity 401(k) plan" or "Hines 401(k) plan" and allocating your assets, and to evaluate your possible returns and risk. There are no fixed rules for the choice your portfolio. However, you will not benefit by only investing in one or two funds. Will your portfolio achieve your target by the age of retirement? Exhibit 5 Fund Information Compiled from Morningstar Fact Sheets as of October 31, 2001 Volatility Analysis Fund Growth New Horizons Science & Technology Mid-Cap Growth Equity Index 500 Growth Stock International Stock Spectrum Growth Balanced Equity Income Income Spectrum Income Morningstar Category Morningstar Style Small-Cap Growth Specialty-Technology Mid-Cap Growth Large-Cap Blend Large-Cap Blend Foreign Stock Large-Cap Blend Domestic Hybrid Large-Cap Value Multisector Bond Small Growth Large Growth Medium Growth Large Blend Large Growth Large Growth N/A Large Blend Large Value N/A Source: Compiled from Morningstar fact sheets of October 31, 2001. Best 3-Month Period 40.8% 49.3% 26.8% 22.1% 23.1% 24.7% 18.6% 16.5% 18.4% 6.6% Worst 3 MonthPeriod -35.9% -41.2% -18.5% -14.7% -29.1% -24.5% -16.7% -24.0% -19.7% -4.5% 3-Yr. Average Annual Morningstar Return Return 7.3% -3.8% 10.3% -0.2% 4.6% -3.9% 4.3% 3.8% 5.0% 5.4% * Morningstar's return and risk ratings rank funds relative to all funds in a category over a three-year period. Morningstar's overall rating is a weighted average of the fund's three-, five-, and ten-year Morningstar ratings, as applicable. Average of the expense ratios of the underlying funds, from fund prospectus. Average Average Morningstar Overall Expense Riska Ratingb Ratio Above Average High Above Average Average Above Average Average Above Average Average Average Average Low 3 star 2 star 4 star 4 star 4 star 3 star 3 star Average Average Average 3 star Above Average Below Average 5 star Above Average Average 4 star 0.88% 0.86% 0.86% 0.35% 0.73% 0.84% 0.84% 0.79% 0.78% 0.77% - 8 0 Exhibit 1 Model Portfolios from T. Rowe Price Risk 9 0 Low Risk Moderate Risk 1 2 3 High Risk 4 Years to Retirement 0-5 6-10 11-30 0-5 6-10 11-30 0-5 6-10 11-30 Growth 25% 40% 60% 40% 60% 80% 60% 80% 100% Investment Mix Income 40% 40% 30% 5 6 7 Source: Summarized from T. Rowe Price investor information for the Hines 401 (k) plan. 8 40% 30% 20% 30% 20% Stability 35% 20% 10% 20% 10% 0% 10% 12 Exhibit 3 Fund Performance Investment Options Compared with 3 Unmanaged Indices at 9/30/01 4 5 Most Aggressive Growth 6 New Horizons Fund 7 Lipper Small-Cap Fund Index 8 12 Aggressive Growth 13 Mid-Cap Growth Fund 14 Upper Mid-Cap Growth Fund Index 15 16 Moderate Growth 17 Equity Index 500 Fund 18 S&P 500 Index 19 20 Growth Stock Fund 21 Upper Large-Cap Growth Funds Average 22 23 International Stock Fund 24 Upper International Funds Average 25 B 26 Spectrum Growth Fund 27 Upper Multi-Cap Core Fund Index 28 Year to Date 9 Science & Technology Fund -56.56% -70.59% -5.29% -3.54% 11.17% 10 Upper Science & Technology Fund Index -50.75% -67.80% 0.77% 4.24% 12.15% 11 Since Inception 1 Year 3 Years 5 Years 10 Years Inception Date -25.37% -35.86% 6.54% 2.43% -24.17% -34.47% 5.91% 2.52% 9.40% 11.88% 11.05% 6/30/60 -18.35% -21.46% 11.24% 10.43% -33.78% -48.39% 6.77% 3.48% 70.20% -28.99% -33.28% -2.12% -0.18% -27.80% -30.93% 0.73% 1.02% 12.38% 9/30/87 -20.58% -26.83% 1.77% 9.92% 12.31% 12.38% 3/30/90 -20.39% -26.62% 2.04% 10.22% 72.70% 17.22% 6/30/92 -21.14% -27.67% 5.95% 10.96% 13.16% 11.45% 4/11/50 -32.62% -43.77% -0.86% 6.01% 9.79% -19.78% -23.37% 4.83% 6.52% 10.97% -27.29% -27.25% 3.36% 7.95% 7 7.20% 5.30% 11.06% 5/9/80 5.47% 10.63% 6/29/90 3 A B Exhibit 6 Fund Portfolio Profiles Growth 6 New Horizons Fund 1.9% Science & Technology Fund 15.1% Mid-Cap Growth Fund 6.7% Equity Index 500 Fund 1.7% 6.0% 0 Growth Stock Fund 1 International Stock Fund 2 Spectrum Growth Fund 3 Balanced Fund 4 Equity Income Fund 5 % of assets (as of June 30, 2001) Cash U.S. Stock Foreign Stock Bonds Other Morningstar Style 1.2% 3.1% 0.6% 4.9% 96.0% 77.7% 89.6% 96.4% 84.7% 5.5% 71.8% 54.8% 92.2% 6 Income 7 Spectrum Income Fund 8 9 Source: Compiled from Morningstar fact sheets of October 31, 2001. 0 3.5% E 14.9% F 2.0% 0.0% 0.1% 7.2% 0.0% 0.0% 3.7% 0.0% 0.0% 1.9% 0.0% 0.0% 9.3% 0.0% 0.0% 91.7% 0.0% 1.6% 24.2% 0.4% 0.5% 8.5% 35.6% 0.5% 2.9% 0.0% 0.0% 0.1% 60.1% 21.5% Small Growh Large Growth Medium Growth Large Blend Large Growth Large Growth N/A Large Blend Large Value N/A *Other includes preferred stocks (equity securities that pay dividends at a specific rate) as well as convertible bonds and convertible preferreds, which are corporate securities that are exchangeable for a set amount of another form of security (usually common shares) at a prestated price. Other also may denote holdings in not-so-neatly-categorized securities, 1 such as warrants and options. 2 3 Sales Volume Revenue Cost of sales Distribution Cost Gross margin Marketing and Sales General administration cost Net profit Men's 20,000 1,200,000 600,000 100,000 500,000 100,000 300,000 100,000 Women's 25,000 1,250,000 700,000 112,500 437,500 100,000 275,000 62,500 D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started