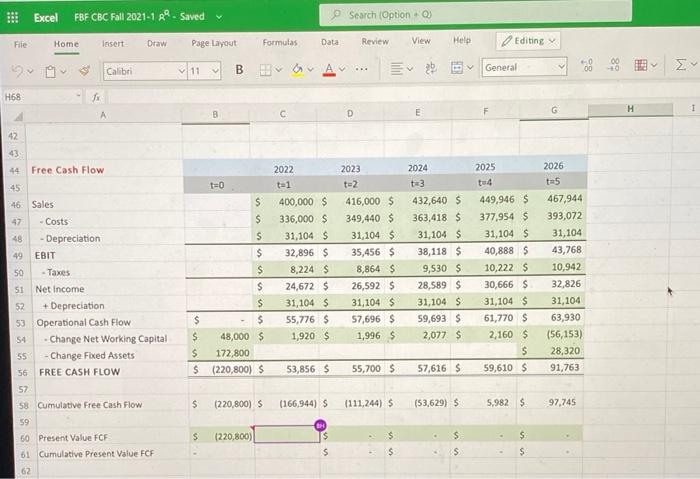

Excel FBF CBC Fall 2021-1 - Saved Search (Option File Home Insert Draw Page Layout Formulas Data Review View Help Editing Calibri V 18 General w BEA H68 G H C D 42 43 44 Free Cash Flow 2022 te1 2023 t=2 2025 t4 2026 ta5 45 t=0 46 Sales 47 - Costs 48 - Depreciation 49 EBIT 400,000 $ 336,000 S 31,104 $ 32,896 $ 8,224 $ 24,672 $ 31,104 $ 55,776 S 1,920 $ $ $ $ $ S $ $ $ $ $ 48,000 $ $ 172,800 $(220,800) $ 416,000 $ 349,440 $ 31,104 $ 35,456 $ 8,864 $ 26,592 $ 31,104 $ 57,696 $ 1,996 $ 2024 3 432,640 $ 363,418 $ 31,104 $ 38,118 $ 9,530 $ 28,589 $ 31,104 S 59,693 $ 2,077 $ 50 Taxes 51 Net Income 52 + Depreciation 53 Operational Cash Flow 54 - Change Net Working Capital 55 - Change Fixed Assets 56 FREE CASH FLOW 57 58 Cumulative Free Cash Flow 59 60 Present Value FCF 61 Cumulative Present Value FCF 449,946 $ 377,954 $ 31,104 $ 40,888 $ 10,222 $ 30,666 S 31,104 $ 61,770 $ 2,160 $ $ 59,610 $ 467,944 393,072 31,104 43,768 10,942 32,826 31,104 63,930 (56,153) 28,320 91.763 53,8565 55,700$ 57,616 $ $ (220,800) S (166,944) S (111,244) 5 (53,629) 5,982 $ 97,745 $ (220,800) $ $ $ $ $ $ 62 Excel FBF CBC Fall 2021-1 - Saved Search (Option File Home Insert Draw Page Layout Formulas Data Review View Help Editing Calibri V 18 General w BEA H68 G H C D 42 43 44 Free Cash Flow 2022 te1 2023 t=2 2025 t4 2026 ta5 45 t=0 46 Sales 47 - Costs 48 - Depreciation 49 EBIT 400,000 $ 336,000 S 31,104 $ 32,896 $ 8,224 $ 24,672 $ 31,104 $ 55,776 S 1,920 $ $ $ $ $ S $ $ $ $ $ 48,000 $ $ 172,800 $(220,800) $ 416,000 $ 349,440 $ 31,104 $ 35,456 $ 8,864 $ 26,592 $ 31,104 $ 57,696 $ 1,996 $ 2024 3 432,640 $ 363,418 $ 31,104 $ 38,118 $ 9,530 $ 28,589 $ 31,104 S 59,693 $ 2,077 $ 50 Taxes 51 Net Income 52 + Depreciation 53 Operational Cash Flow 54 - Change Net Working Capital 55 - Change Fixed Assets 56 FREE CASH FLOW 57 58 Cumulative Free Cash Flow 59 60 Present Value FCF 61 Cumulative Present Value FCF 449,946 $ 377,954 $ 31,104 $ 40,888 $ 10,222 $ 30,666 S 31,104 $ 61,770 $ 2,160 $ $ 59,610 $ 467,944 393,072 31,104 43,768 10,942 32,826 31,104 63,930 (56,153) 28,320 91.763 53,8565 55,700$ 57,616 $ $ (220,800) S (166,944) S (111,244) 5 (53,629) 5,982 $ 97,745 $ (220,800) $ $ $ $ $ $ 62