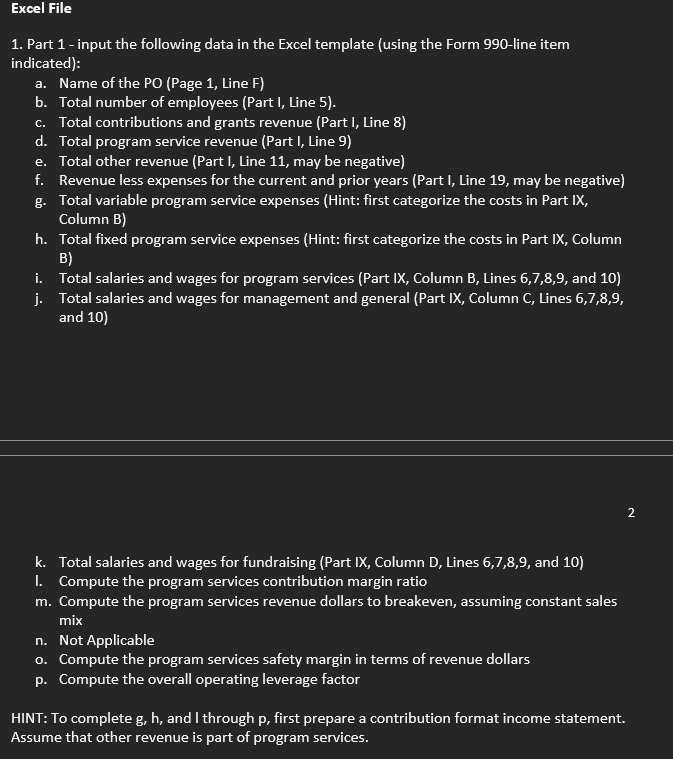

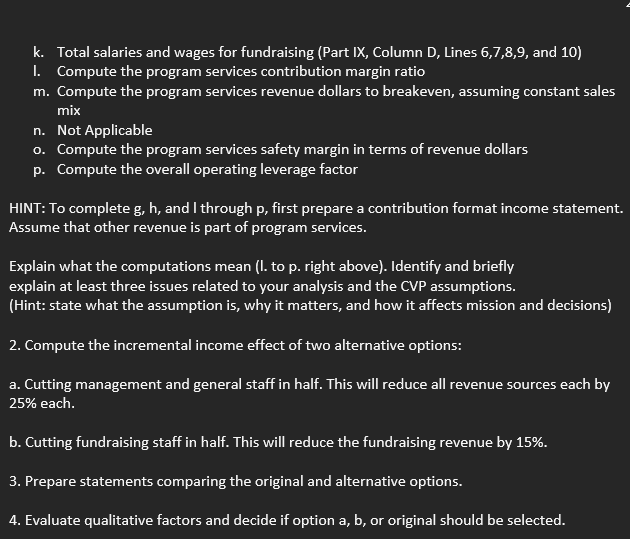

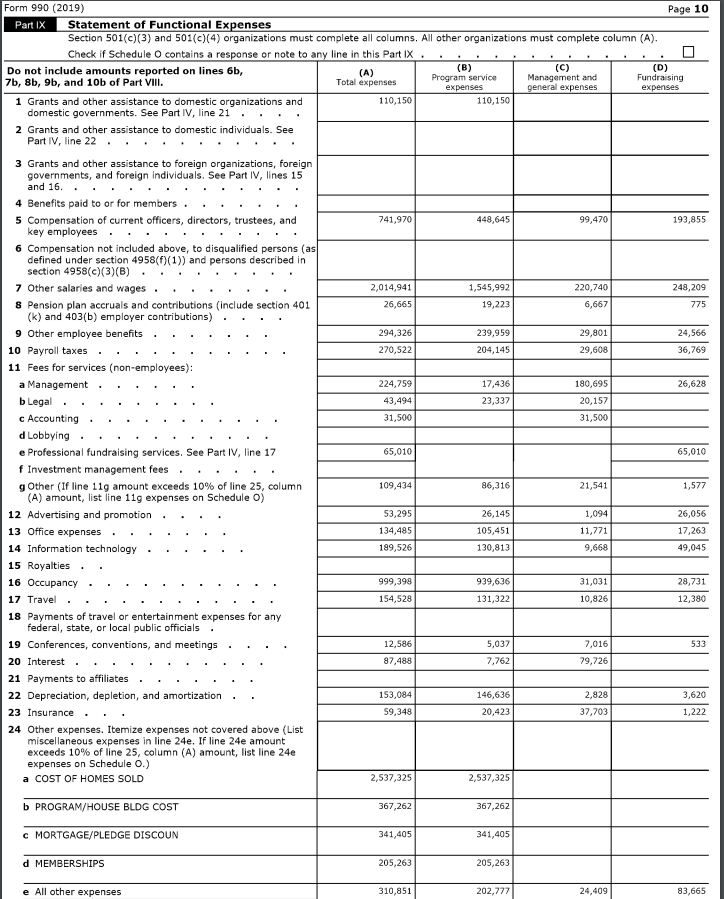

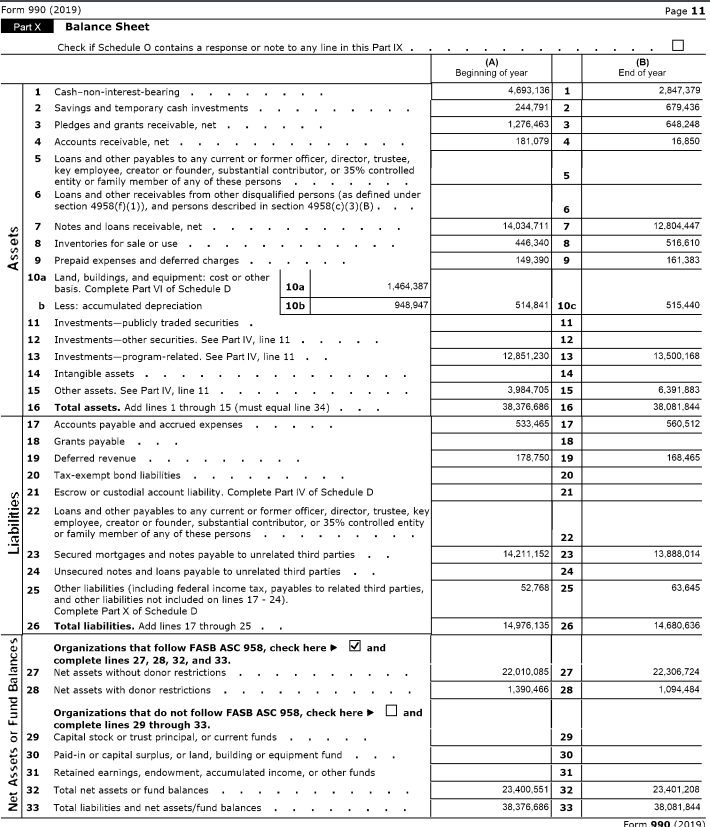

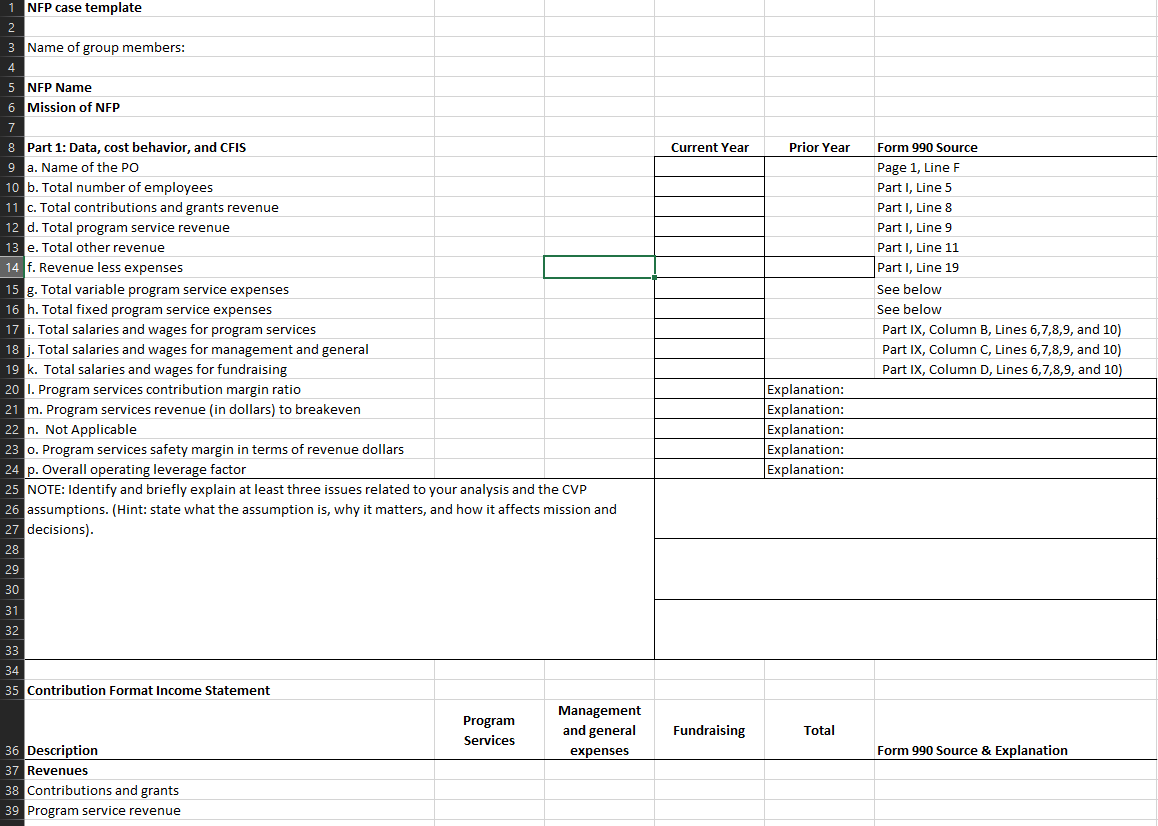

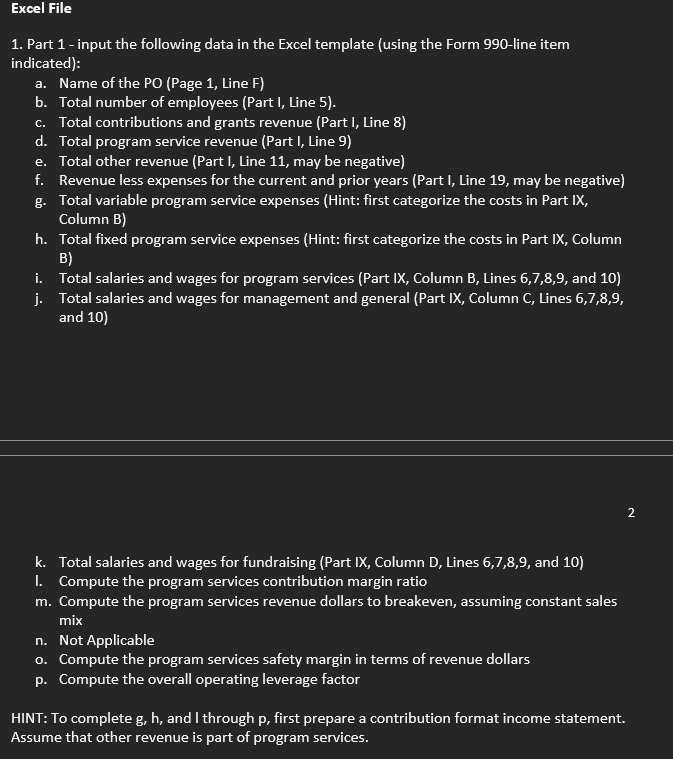

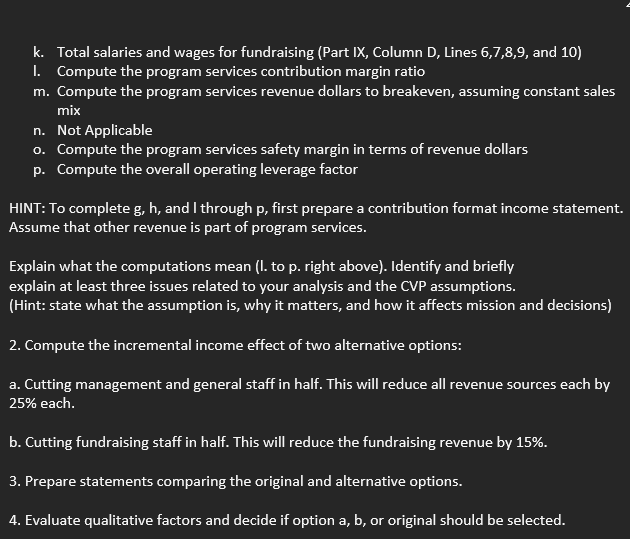

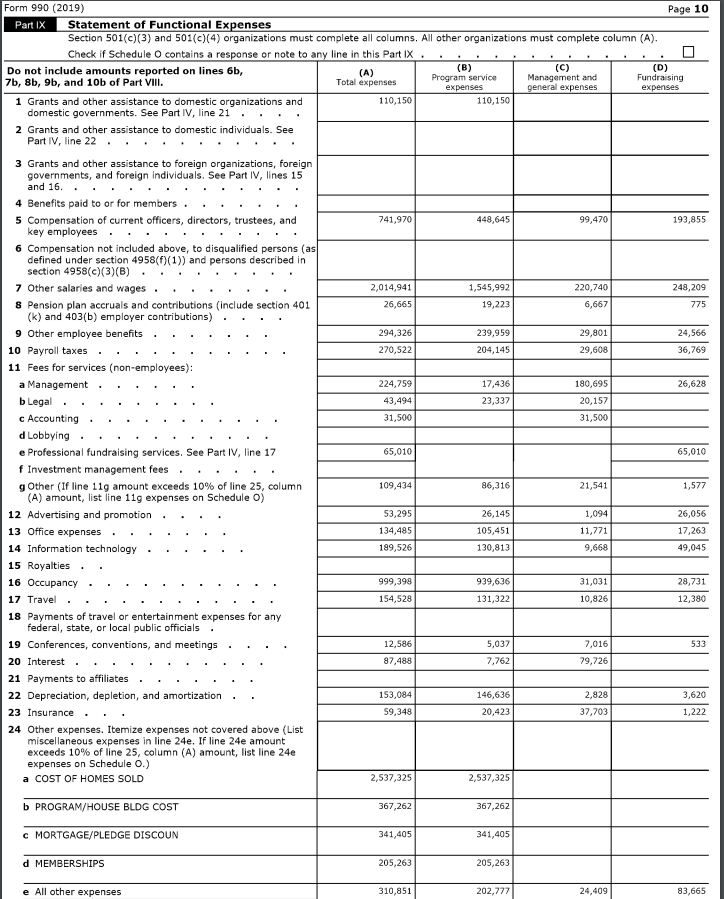

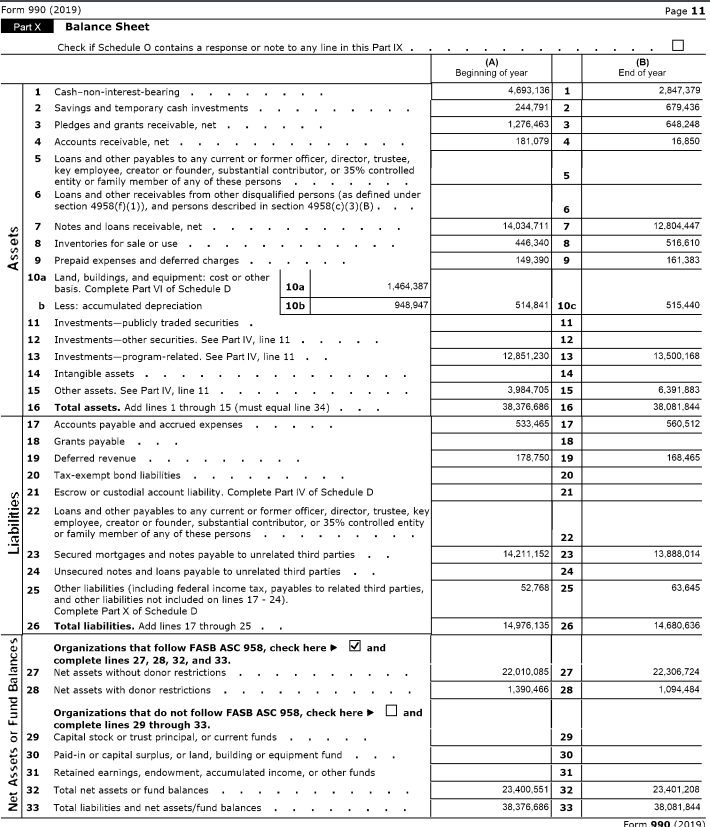

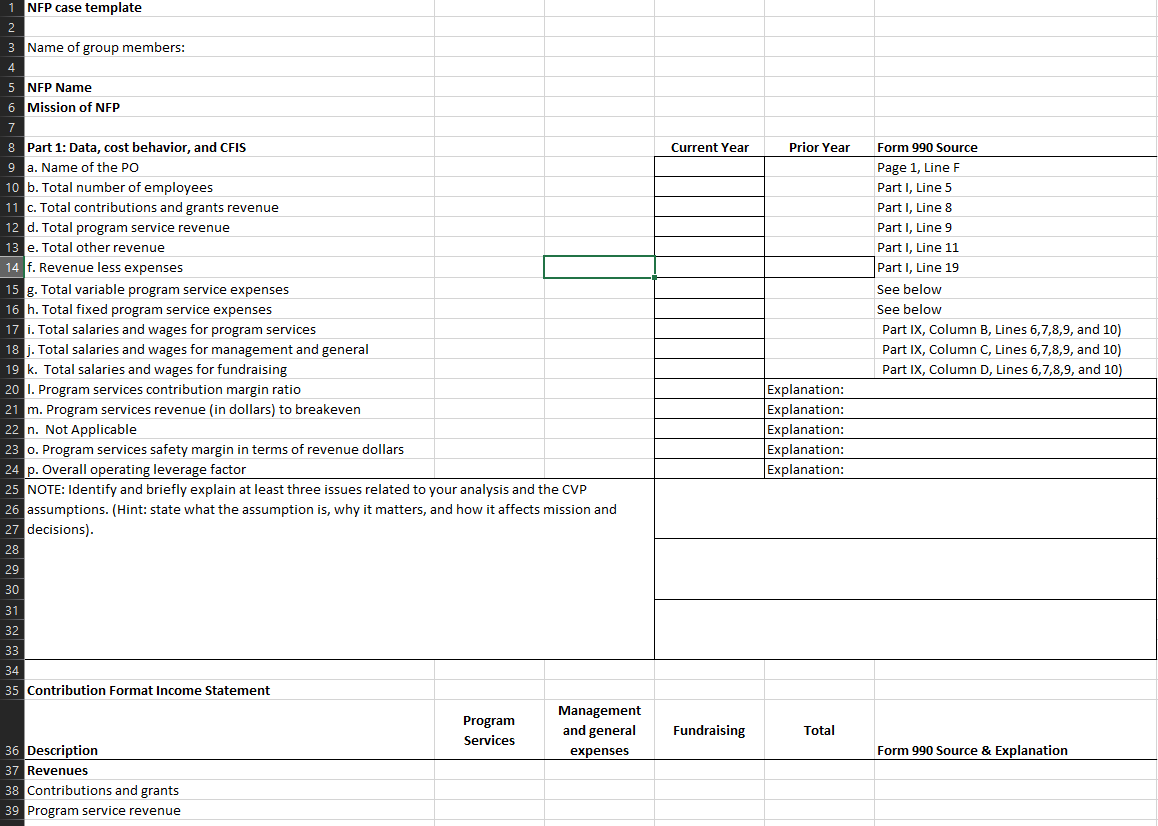

Excel File 1. Part 1 - input the following data in the Excel template (using the Form 990-line item indicated): a. Name of the PO (Page 1, Line F) b. Total number of employees (Part I, Line 5). c. Total contributions and grants revenue (Part I, Line 8) d. Total program service revenue (Part I, Line 9) e. Total other revenue (Part I, Line 11, may be negative) f. Revenue less expenses for the current and prior years (Part I, Line 19, may be negative) g. Total variable program service expenses (Hint: first categorize the costs in Part IX, Column B) h. Total fixed program service expenses (Hint: first categorize the costs in Part IX, Column B) i. Total salaries and wages for program services (Part IX, Column B, Lines 6,7,8,9, and 10) j. Total salaries and wages for management and general (Part IX, Column C, Lines 6,7,8,9, and 10) 2 k. Total salaries and wages for fundraising (Part IX, Column D, Lines 6,7,8,9, and 10) I. Compute the program services contribution margin ratio m. Compute the program services revenue dollars to breakeven, assuming constant sales mix n. Not Applicable o. Compute the program services safety margin in terms of revenue dollars p. Compute the overall operating leverage factor HINT: To complete g, h, and I through p, first prepare a contribution format income statement. Assume that other revenue is part of program services. k. Total salaries and wages for fundraising (Part IX, Column D, Lines 6,7,8,9, and 10) I. Compute the program services contribution margin ratio m. Compute the program services revenue dollars to breakeven, assuming constant sales mix n. Not Applicable o. Compute the program services safety margin in terms of revenue dollars p. Compute the overall operating leverage factor HINT: To complete g, h, and I through p, first prepare a contribution format income statement. Assume that other revenue is part of program services. Explain what the computations mean (I. to p. right above). Identify and briefly explain at least three issues related to your analysis and the CVP assumptions. (Hint: state what the assumption is, why it matters, and how it affects mission and decisions) 2. Compute the incremental income effect of two alternative options: a. Cutting management and general staff in half. This will reduce all revenue sources each by 25% each. b. Cutting fundraising staff in half. This will reduce the fundraising revenue by 15%. 3. Prepare statements comparing the original and alternative options. 4. Evaluate qualitative factors and decide if option a, b, or original should be selected. Form 990 (2019) Part IX Page 10 Statement of Functional Expenses Section 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A). Check if Schedule O contains a response or note to any line in this Part IX (B) (C) (D) Do not include amounts reported on lines 6b, (A) Total expenses 7b, 8b, 9b, and 10b of Part VIII. Program service expenses Management and general expenses Fundraising expenses 1 Grants and other assistance to domestic organizations and domestic governments. See Part IV, line 21. 2 Grants and other assistance to domestic individuals. See Part IV, line 22. 3 Grants and other assistance to foreign organizations, foreign governments, and foreign individuals. See Part IV, lines 15 and 16. 4 Benefits paid to or for members. 5 Compensation of current officers, directors, trustees, and key employees. 6 Compensation not included above, to disqualified persons (as defined under section 4958(f)(1)) and persons described in section 4958(c)(3)(B) 7 Other salaries and wages. 8 Pension plan accruals and contributions (include section 401 (k) and 403(b) employer contributions) . 9 Other employee benefits 10 Payroll taxes... 11 Fees for services (non-employees): a Management b Legal c Accounting d Lobbying e Professional fundraising services. See Part IV, line 17 f Investment management fees.... g Other (If line 11g amount exceeds 10% of line 25, column (A) amount, list line 11g expenses on Schedule O) 12 Advertising and promotion 13 Office expenses 14 Information technology 15 Royalties 16 Occupancy 17 Travel 18 Payments of travel or entertainment expenses for any federal, state, or local public officials 19 Conferences, conventions, and meetings 20 Interest 21 Payments to affiliates 22 Depreciation, depletion, and amortization 23 Insurance. 24 Other expenses. Itemize expenses not covered above (List miscellaneous expenses in line 24e. If line 24e amount exceeds 10% of line 25, column (A) amount, list line 24e expenses on Schedule O.) a COST OF HOMES SOLD b PROGRAM/HOUSE BLDG COST c MORTGAGE/PLEDGE DISCOUN d MEMBERSHIPS e All other expenses 110,150 741,970 2,014,941 26,665 294,326 270,522 224,759 43,494 31,500 65,010 109,434 53,295 134,485 189,526 999,398 154,528 12,586 87,488 153,084 59,348 2,537,325 367,262 341,405 205,263 310,851 110,150 448,645 1,545,992 19,223 239,959 204,145 17,436 23,337 86,316 26,145 105,451 130,813 939,636 131,322 5,037 7,762 146,636 20,423 2,537,325 367,262 341,405 205,263 202,777 99,470 220,740 6,667 29,801 29,608 180,695 20,157 31,500 21,541 1,094 11,771 9,668 31,031 10,826 7,016 79,726 2,828 37,703 24,409 193,855 248,209 775 24,566 36,769 26,628 65,010 1,577 26,056 17,263 49,045 28,731 12,380 533 3,620 1,222 83,665 Form 990 (2019) Part X Assets Liabilities Net Assets or Fund Balances Balance Sheet Check if Schedule O contains a response or note to any line in this Part IX 1 Cash-non-interest-bearing 2 Savings and temporary cash investments 3 Pledges and grants receivable, net 4 Accounts receivable, net ... 5 Loans and other payables to any current or former officer, director, trustee, key employee, creator or founder, substantial contributor, or 35% controlled entity or family member of any of these persons 6 Loans and other receivables from other disqualified persons (as defined under section 4958(f)(1)), and persons described in section 4958(c)(3)(B). 7 Notes and loans receivable, net 8 Inventories for sale or use 9 Prepaid expenses and deferred charges 10a Land, buildings, and equipment: cost or other basis. Complete Part VI of Schedule D 10a 1,464,387 b Less: accumulated depreciation 10b 948,947 11 Investments-publicly traded securities 12 Investments-other securities. See Part IV, line 11 13 Investments-program-related. See Part IV, line 11 14 Intangible assets 15 Other assets. See Part IV, line 11 16 Total assets. Add lines 1 through 15 (must equal line 34) 17 Accounts payable and accrued expenses 18 Grants payable. 19 Deferred revenue 20 Tax-exempt bond liabilities 21 Escrow or custodial account liability. Complete Part IV of Schedule D 22 Loans and other payables to any current or former officer, director, trustee, key employee, creator or founder, substantial contributor, or 35% controlled entity or family member of any of these persons. 23 Secured mortgages and notes payable to unrelated third parties. 24 Unsecured notes and loans payable to unrelated third parties. 25 Other liabilities (including federal income tax, payables to related third parties, and other liabilities not included on lines 17 - 24). Complete Part X of Schedule D 26 Total liabilities. Add lines 17 through 25. Organizations that follow FASB ASC 958, check here and complete lines 27, 28, 32, and 33. Net assets without donor restrictions Net assets with donor restrictions. Organizations that do not follow FASB ASC 958, check here and complete lines 29 through 33. 29 Capital stock or trust principal, or current funds 30 Paid-in or capital surplus, or land, building or equipment fund 31 Retained earnings, endowment, accumulated income, or other funds Total net assets or fund balances Total liabilities and net assets/fund balances 27 28 283338 (A) Beginning of year 4,693,136 1 244,791 2 1,276,463 3 181,079 4 5 6 14,034,711 446,340 149,390 7 8 9 60 00 514,841 10c 11 12 12,851,230 13 14 3,984,705 15 38,376,686 16 533,465 17 18 178,750 19 20 21 22 14,211,152 23 24 52,768 25 14,976,135 26 22,010,085 27 1,390,466 28 29 30 31 23,400,551 32 38,376,686 33 Page 11 (B) End of year 2,847,379 679,436 648,248 16,850 12,804,447 516,610 161,383 515,440 13,500,168 6,391,883 38,081,844 560,512 168,465 13,888,014 63,645 14,680,636 22,306,724 1,094,484 23,401,208 38,081,844 Form 990 (2019) 1 NFP case template 2 Name of group members: 4 5 NFP Name 6 Mission of NFP 7 8 Part 1: Data, cost behavior, and CFIS 9 a. Name of the PO 10 b. Total number of employees 11 c. Total contributions and grants revenue 12 d. Total program service revenue 13 e. Total other revenue 14 f. Revenue less expenses 15 g. Total variable program service expenses 16 h. Total fixed program service expenses 17 i. Total salaries and wages for program services 18 j. Total salaries and wages for management and general 19 k. Total salaries and wages for fundraising 20 1. Program services contribution margin ratio 21 m. Program services revenue (in dollars) to breakeven 22 n. Not Applicable 23 o. Program services safety margin in terms of revenue dollars 24 p. Overall operating leverage factor 25 NOTE: Identify and briefly explain at least three issues related to your analysis and the CVP 26 assumptions. (Hint: state what the assumption is, why it matters, and how it affects mission and 27 decisions). 28 29 30 31 32 33 34 35 Contribution Format Income Statement Program Services Management and general expenses 36 Description 37 Revenues 38 Contributions and grants 39 Program service revenue Current Year Fundraising Prior Year Explanation: Explanation: Explanation: Explanation: Explanation: Total Form 990 Source Page 1, Line F Part I, Line 5 Part I, Line 8 Part I, Line 9 Part I, Line 11 Part I, Line 19 See below See below Part IX, Column B, Lines 6,7,8,9, and 10) Part IX, Column C, Lines 6,7,8,9, and 10) Part IX, Column D, Lines 6,7,8,9, and 10) Form 990 Source & Explanation Excel File 1. Part 1 - input the following data in the Excel template (using the Form 990-line item indicated): a. Name of the PO (Page 1, Line F) b. Total number of employees (Part I, Line 5). c. Total contributions and grants revenue (Part I, Line 8) d. Total program service revenue (Part I, Line 9) e. Total other revenue (Part I, Line 11, may be negative) f. Revenue less expenses for the current and prior years (Part I, Line 19, may be negative) g. Total variable program service expenses (Hint: first categorize the costs in Part IX, Column B) h. Total fixed program service expenses (Hint: first categorize the costs in Part IX, Column B) i. Total salaries and wages for program services (Part IX, Column B, Lines 6,7,8,9, and 10) j. Total salaries and wages for management and general (Part IX, Column C, Lines 6,7,8,9, and 10) 2 k. Total salaries and wages for fundraising (Part IX, Column D, Lines 6,7,8,9, and 10) I. Compute the program services contribution margin ratio m. Compute the program services revenue dollars to breakeven, assuming constant sales mix n. Not Applicable o. Compute the program services safety margin in terms of revenue dollars p. Compute the overall operating leverage factor HINT: To complete g, h, and I through p, first prepare a contribution format income statement. Assume that other revenue is part of program services. k. Total salaries and wages for fundraising (Part IX, Column D, Lines 6,7,8,9, and 10) I. Compute the program services contribution margin ratio m. Compute the program services revenue dollars to breakeven, assuming constant sales mix n. Not Applicable o. Compute the program services safety margin in terms of revenue dollars p. Compute the overall operating leverage factor HINT: To complete g, h, and I through p, first prepare a contribution format income statement. Assume that other revenue is part of program services. Explain what the computations mean (I. to p. right above). Identify and briefly explain at least three issues related to your analysis and the CVP assumptions. (Hint: state what the assumption is, why it matters, and how it affects mission and decisions) 2. Compute the incremental income effect of two alternative options: a. Cutting management and general staff in half. This will reduce all revenue sources each by 25% each. b. Cutting fundraising staff in half. This will reduce the fundraising revenue by 15%. 3. Prepare statements comparing the original and alternative options. 4. Evaluate qualitative factors and decide if option a, b, or original should be selected. Form 990 (2019) Part IX Page 10 Statement of Functional Expenses Section 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A). Check if Schedule O contains a response or note to any line in this Part IX (B) (C) (D) Do not include amounts reported on lines 6b, (A) Total expenses 7b, 8b, 9b, and 10b of Part VIII. Program service expenses Management and general expenses Fundraising expenses 1 Grants and other assistance to domestic organizations and domestic governments. See Part IV, line 21. 2 Grants and other assistance to domestic individuals. See Part IV, line 22. 3 Grants and other assistance to foreign organizations, foreign governments, and foreign individuals. See Part IV, lines 15 and 16. 4 Benefits paid to or for members. 5 Compensation of current officers, directors, trustees, and key employees. 6 Compensation not included above, to disqualified persons (as defined under section 4958(f)(1)) and persons described in section 4958(c)(3)(B) 7 Other salaries and wages. 8 Pension plan accruals and contributions (include section 401 (k) and 403(b) employer contributions) . 9 Other employee benefits 10 Payroll taxes... 11 Fees for services (non-employees): a Management b Legal c Accounting d Lobbying e Professional fundraising services. See Part IV, line 17 f Investment management fees.... g Other (If line 11g amount exceeds 10% of line 25, column (A) amount, list line 11g expenses on Schedule O) 12 Advertising and promotion 13 Office expenses 14 Information technology 15 Royalties 16 Occupancy 17 Travel 18 Payments of travel or entertainment expenses for any federal, state, or local public officials 19 Conferences, conventions, and meetings 20 Interest 21 Payments to affiliates 22 Depreciation, depletion, and amortization 23 Insurance. 24 Other expenses. Itemize expenses not covered above (List miscellaneous expenses in line 24e. If line 24e amount exceeds 10% of line 25, column (A) amount, list line 24e expenses on Schedule O.) a COST OF HOMES SOLD b PROGRAM/HOUSE BLDG COST c MORTGAGE/PLEDGE DISCOUN d MEMBERSHIPS e All other expenses 110,150 741,970 2,014,941 26,665 294,326 270,522 224,759 43,494 31,500 65,010 109,434 53,295 134,485 189,526 999,398 154,528 12,586 87,488 153,084 59,348 2,537,325 367,262 341,405 205,263 310,851 110,150 448,645 1,545,992 19,223 239,959 204,145 17,436 23,337 86,316 26,145 105,451 130,813 939,636 131,322 5,037 7,762 146,636 20,423 2,537,325 367,262 341,405 205,263 202,777 99,470 220,740 6,667 29,801 29,608 180,695 20,157 31,500 21,541 1,094 11,771 9,668 31,031 10,826 7,016 79,726 2,828 37,703 24,409 193,855 248,209 775 24,566 36,769 26,628 65,010 1,577 26,056 17,263 49,045 28,731 12,380 533 3,620 1,222 83,665 Form 990 (2019) Part X Assets Liabilities Net Assets or Fund Balances Balance Sheet Check if Schedule O contains a response or note to any line in this Part IX 1 Cash-non-interest-bearing 2 Savings and temporary cash investments 3 Pledges and grants receivable, net 4 Accounts receivable, net ... 5 Loans and other payables to any current or former officer, director, trustee, key employee, creator or founder, substantial contributor, or 35% controlled entity or family member of any of these persons 6 Loans and other receivables from other disqualified persons (as defined under section 4958(f)(1)), and persons described in section 4958(c)(3)(B). 7 Notes and loans receivable, net 8 Inventories for sale or use 9 Prepaid expenses and deferred charges 10a Land, buildings, and equipment: cost or other basis. Complete Part VI of Schedule D 10a 1,464,387 b Less: accumulated depreciation 10b 948,947 11 Investments-publicly traded securities 12 Investments-other securities. See Part IV, line 11 13 Investments-program-related. See Part IV, line 11 14 Intangible assets 15 Other assets. See Part IV, line 11 16 Total assets. Add lines 1 through 15 (must equal line 34) 17 Accounts payable and accrued expenses 18 Grants payable. 19 Deferred revenue 20 Tax-exempt bond liabilities 21 Escrow or custodial account liability. Complete Part IV of Schedule D 22 Loans and other payables to any current or former officer, director, trustee, key employee, creator or founder, substantial contributor, or 35% controlled entity or family member of any of these persons. 23 Secured mortgages and notes payable to unrelated third parties. 24 Unsecured notes and loans payable to unrelated third parties. 25 Other liabilities (including federal income tax, payables to related third parties, and other liabilities not included on lines 17 - 24). Complete Part X of Schedule D 26 Total liabilities. Add lines 17 through 25. Organizations that follow FASB ASC 958, check here and complete lines 27, 28, 32, and 33. Net assets without donor restrictions Net assets with donor restrictions. Organizations that do not follow FASB ASC 958, check here and complete lines 29 through 33. 29 Capital stock or trust principal, or current funds 30 Paid-in or capital surplus, or land, building or equipment fund 31 Retained earnings, endowment, accumulated income, or other funds Total net assets or fund balances Total liabilities and net assets/fund balances 27 28 283338 (A) Beginning of year 4,693,136 1 244,791 2 1,276,463 3 181,079 4 5 6 14,034,711 446,340 149,390 7 8 9 60 00 514,841 10c 11 12 12,851,230 13 14 3,984,705 15 38,376,686 16 533,465 17 18 178,750 19 20 21 22 14,211,152 23 24 52,768 25 14,976,135 26 22,010,085 27 1,390,466 28 29 30 31 23,400,551 32 38,376,686 33 Page 11 (B) End of year 2,847,379 679,436 648,248 16,850 12,804,447 516,610 161,383 515,440 13,500,168 6,391,883 38,081,844 560,512 168,465 13,888,014 63,645 14,680,636 22,306,724 1,094,484 23,401,208 38,081,844 Form 990 (2019) 1 NFP case template 2 Name of group members: 4 5 NFP Name 6 Mission of NFP 7 8 Part 1: Data, cost behavior, and CFIS 9 a. Name of the PO 10 b. Total number of employees 11 c. Total contributions and grants revenue 12 d. Total program service revenue 13 e. Total other revenue 14 f. Revenue less expenses 15 g. Total variable program service expenses 16 h. Total fixed program service expenses 17 i. Total salaries and wages for program services 18 j. Total salaries and wages for management and general 19 k. Total salaries and wages for fundraising 20 1. Program services contribution margin ratio 21 m. Program services revenue (in dollars) to breakeven 22 n. Not Applicable 23 o. Program services safety margin in terms of revenue dollars 24 p. Overall operating leverage factor 25 NOTE: Identify and briefly explain at least three issues related to your analysis and the CVP 26 assumptions. (Hint: state what the assumption is, why it matters, and how it affects mission and 27 decisions). 28 29 30 31 32 33 34 35 Contribution Format Income Statement Program Services Management and general expenses 36 Description 37 Revenues 38 Contributions and grants 39 Program service revenue Current Year Fundraising Prior Year Explanation: Explanation: Explanation: Explanation: Explanation: Total Form 990 Source Page 1, Line F Part I, Line 5 Part I, Line 8 Part I, Line 9 Part I, Line 11 Part I, Line 19 See below See below Part IX, Column B, Lines 6,7,8,9, and 10) Part IX, Column C, Lines 6,7,8,9, and 10) Part IX, Column D, Lines 6,7,8,9, and 10) Form 990 Source & Explanation