Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Excel File Edit View Insert Format Tools Data Window Help AutoSave OFF v Midterm+Exam+BUSI+1004+W22+Workbook-3 Home Insert Draw Page Layout Formulas Data Review View Tell

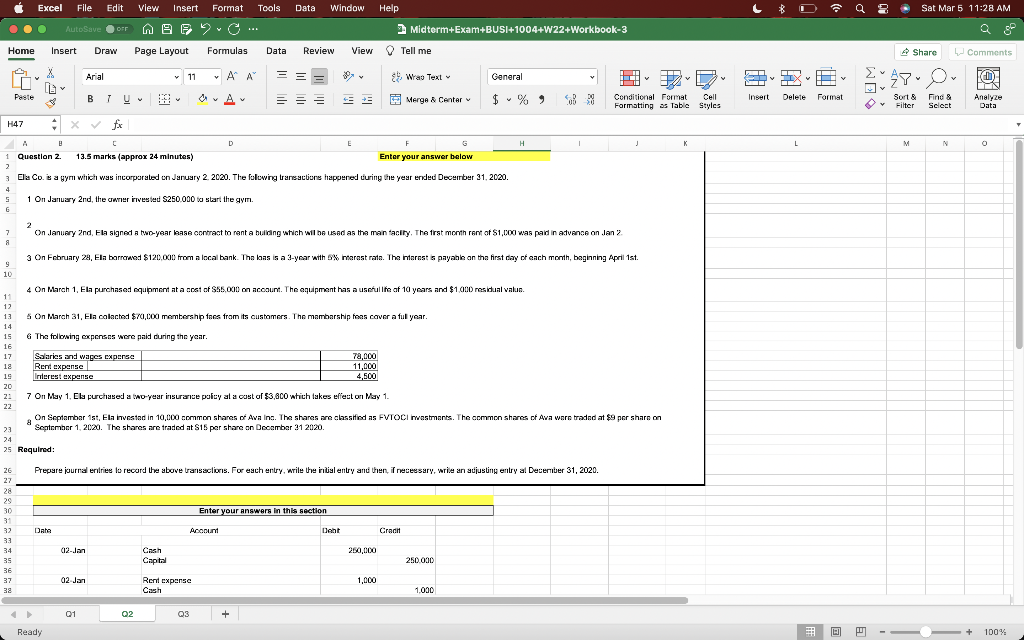

Excel File Edit View Insert Format Tools Data Window Help AutoSave OFF v Midterm+Exam+BUSI+1004+W22+Workbook-3 Home Insert Draw Page Layout Formulas Data Review View Tell me X v Arial 11 A A = Wrap Text General Paste B 7 U & A x == Merge & Center %" Cell Conditional Format Formatting as Table Styles Insert Delete Format H47 x fx A B D Question 2. 13.5 marks (approx 24 minutes) 2 E F Enter your answer below 3 Ela Co. is a gym which was incorporated on January 2.2020. The following transactions happened during the year ended December 31, 2020. 4 5 1 On January 2nd, the owner invested $250,000 to start the gym. 2 7 9 10 J On January 2nd, Ela signed a two-year lease contract to rent a building which will be used as the main facility. The first month rent of $1,000 was paid in advance on Jan 2. 3 On February 28, Ella borrowed $120,000 from a local bank. The loas is a 3-year with 5% interest rate. The interest is payable on the first day of each month, beginning April 1st. 4 On March 1, Ela purchased equipment at a cost of $55,000 on account. The equipment has a useful life of 10 years and $1,000 residual value. 11 12 13 5 On March 31, Ela colected $70,000 membership fees from its customers. The membership fees cover a full year. 14 15 6 The following expenses were paid during the year. 16 17 Salaries and wages expense 18 Rent expense 19 Interest expense 78,000 11,000 4,500 20 21 22 8 23 24 7 On May 1. Ela purchased a two-year insurance policy at a cost of $3,800 which takes effect on May 1. On September 1st, Ella invested in 10,000 common shares of Ava Inc. The shares are classified as FVTOCI investments. The common shares of Ava were traded at $9 per share on September 1, 2020. The shares are traded at $15 per share on December 31 2020. 25 Required: 26 Prepare journal entries to record the above transactions. For each entry, write the initial entry and then, if necessary, write an adjusting entry al December 31, 2020. 27 28 29 30 Enter your answers in this section 31 32 Date Account Debt Cradit 33 34 012-Jan Cash 250,000 35 Capital 36 37 02-Jan 38 Rent expense Cash 250.000 1,000 1,000 Ready Q1 02 Q3 + L WA Sat Mar 5 11:28 AM Share Comments v Sort & Filter Find & Select Analyze Data M N 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started