Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Excel for Accounting Multi-Chapter Project Chapters 810 In this project, you will use skills and procedures presented in Chapters 8-10 together as you analyze financial

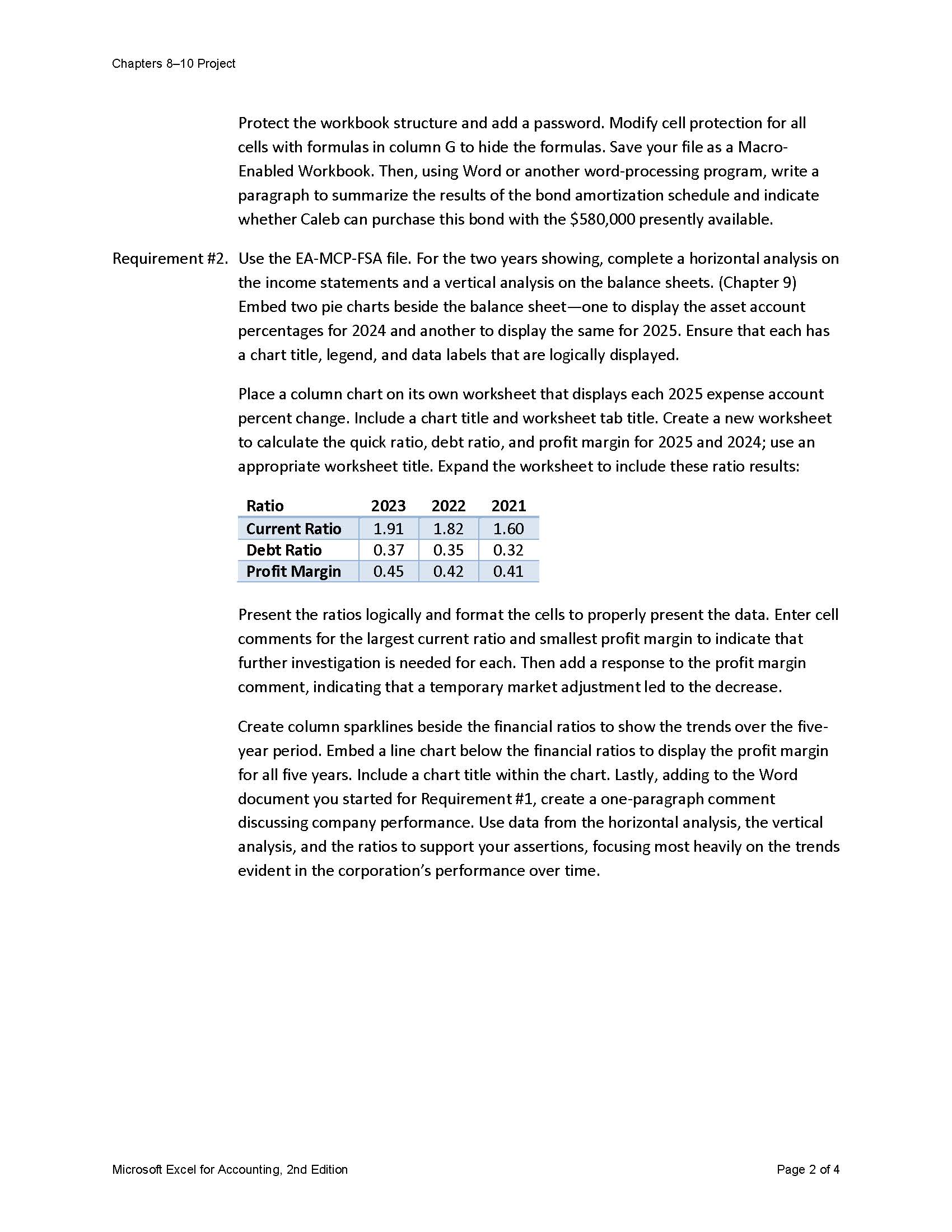

Excel for Accounting Multi-Chapter Project Chapters 810 In this project, you will use skills and procedures presented in Chapters 8-10 together as you analyze financial results for Offsides Corporation. Follow all instructions and use the approaches presented in the chapters to present the analysis in good form. Submit your work per your instructor's directions. Offsides Corporation manufactures hockey equipment and installs ice rinks in Boston, MA, and surrounding areas. The owner, Caleb Nelson, has built the business substantially since its inception five years ago. To maintain this growth, Caleb hires you as an outside consultant to help him make a few decisions. To begin, the business has accumulated significant cash reserves over its first three years, and Caleb is considering investing in a particular bond. He would like you to advise him as to whether the $580,000 of currently available cash is sufficient to purchase this bond. Next, Caleb would like to better understand whether operations have improved over the past few years. He wants you to perform a financial statement analysis, including an examination of key ratios, so you can advise him on the performance of the corporation. Finally, Caleb needs assistance in forecasting the company's performance over the next year by establishing both a cash budget and a purchases budget for 2026 . He would also like to understand the unit sales necessary to break even and to earn profit at various levels over the next year. Project Requirements Requirement \#1. Start a new file. Reduce the width of column A to 0.75 and the height of row 1 to 7.20. Enter the bond details in the range B2:C8. Include a centered header and appropriate titles. Enter the details for a bond with a $580,000 face value, a four-year life, semiannual interest payments, a contract interest rate of 9%, and an effective interest rate of 12%. The bond is issued on 1/1/26. (Hint: Values must be entered here so they can be used in subsequent formulas.) Enter bond calculations for the present value, future value, and payments in the range B10:C13. The future value will generate a result that matches the above figure; you complete this calculation to check your work. Create a bond amortization schedule beginning in cell B15 with the proper headers in row 15. (Chapter 8 ) Calculate totals for the appropriate columns. Assign an appropriate name to the worksheet tab. Record a macro that generates every formula in the worksheet after the bond details (in the range B2:C8 ) and dates have been entered. Run the macro to ensure it operates properly. Insert a text box in an appropriate location, add an appropriate name in it, and assign the macro to it. Protect the workbook structure and add a password. Modify cell protection for all cells with formulas in column G to hide the formulas. Save your file as a MacroEnabled Workbook. Then, using Word or another word-processing program, write a paragraph to summarize the results of the bond amortization schedule and indicate whether Caleb can purchase this bond with the $580,000 presently available. Requirement \#2. Use the EA-MCP-FSA file. For the two years showing, complete a horizontal analysis on the income statements and a vertical analysis on the balance sheets. (Chapter 9) Embed two pie charts beside the balance sheet-one to display the asset account percentages for 2024 and another to display the same for 2025. Ensure that each has a chart title, legend, and data labels that are logically displayed. Place a column chart on its own worksheet that displays each 2025 expense account percent change. Include a chart title and worksheet tab title. Create a new worksheet to calculate the quick ratio, debt ratio, and profit margin for 2025 and 2024; use an appropriate worksheet title. Expand the worksheet to include these ratio results: Present the ratios logically and format the cells to properly present the data. Enter cell comments for the largest current ratio and smallest profit margin to indicate that further investigation is needed for each. Then add a response to the profit margin comment, indicating that a temporary market adjustment led to the decrease. Create column sparklines beside the financial ratios to show the trends over the fiveyear period. Embed a line chart below the financial ratios to display the profit margin for all five years. Include a chart title within the chart. Lastly, adding to the Word document you started for Requirement \#1, create a one-paragraph comment discussing company performance. Use data from the horizontal analysis, the vertical analysis, and the ratios to support your assertions, focusing most heavily on the trends evident in the corporation's performance over time. Microsoft Excel for Accounting, 2nd Edition Page 2 of 4

Excel for Accounting Multi-Chapter Project Chapters 810 In this project, you will use skills and procedures presented in Chapters 8-10 together as you analyze financial results for Offsides Corporation. Follow all instructions and use the approaches presented in the chapters to present the analysis in good form. Submit your work per your instructor's directions. Offsides Corporation manufactures hockey equipment and installs ice rinks in Boston, MA, and surrounding areas. The owner, Caleb Nelson, has built the business substantially since its inception five years ago. To maintain this growth, Caleb hires you as an outside consultant to help him make a few decisions. To begin, the business has accumulated significant cash reserves over its first three years, and Caleb is considering investing in a particular bond. He would like you to advise him as to whether the $580,000 of currently available cash is sufficient to purchase this bond. Next, Caleb would like to better understand whether operations have improved over the past few years. He wants you to perform a financial statement analysis, including an examination of key ratios, so you can advise him on the performance of the corporation. Finally, Caleb needs assistance in forecasting the company's performance over the next year by establishing both a cash budget and a purchases budget for 2026 . He would also like to understand the unit sales necessary to break even and to earn profit at various levels over the next year. Project Requirements Requirement \#1. Start a new file. Reduce the width of column A to 0.75 and the height of row 1 to 7.20. Enter the bond details in the range B2:C8. Include a centered header and appropriate titles. Enter the details for a bond with a $580,000 face value, a four-year life, semiannual interest payments, a contract interest rate of 9%, and an effective interest rate of 12%. The bond is issued on 1/1/26. (Hint: Values must be entered here so they can be used in subsequent formulas.) Enter bond calculations for the present value, future value, and payments in the range B10:C13. The future value will generate a result that matches the above figure; you complete this calculation to check your work. Create a bond amortization schedule beginning in cell B15 with the proper headers in row 15. (Chapter 8 ) Calculate totals for the appropriate columns. Assign an appropriate name to the worksheet tab. Record a macro that generates every formula in the worksheet after the bond details (in the range B2:C8 ) and dates have been entered. Run the macro to ensure it operates properly. Insert a text box in an appropriate location, add an appropriate name in it, and assign the macro to it. Protect the workbook structure and add a password. Modify cell protection for all cells with formulas in column G to hide the formulas. Save your file as a MacroEnabled Workbook. Then, using Word or another word-processing program, write a paragraph to summarize the results of the bond amortization schedule and indicate whether Caleb can purchase this bond with the $580,000 presently available. Requirement \#2. Use the EA-MCP-FSA file. For the two years showing, complete a horizontal analysis on the income statements and a vertical analysis on the balance sheets. (Chapter 9) Embed two pie charts beside the balance sheet-one to display the asset account percentages for 2024 and another to display the same for 2025. Ensure that each has a chart title, legend, and data labels that are logically displayed. Place a column chart on its own worksheet that displays each 2025 expense account percent change. Include a chart title and worksheet tab title. Create a new worksheet to calculate the quick ratio, debt ratio, and profit margin for 2025 and 2024; use an appropriate worksheet title. Expand the worksheet to include these ratio results: Present the ratios logically and format the cells to properly present the data. Enter cell comments for the largest current ratio and smallest profit margin to indicate that further investigation is needed for each. Then add a response to the profit margin comment, indicating that a temporary market adjustment led to the decrease. Create column sparklines beside the financial ratios to show the trends over the fiveyear period. Embed a line chart below the financial ratios to display the profit margin for all five years. Include a chart title within the chart. Lastly, adding to the Word document you started for Requirement \#1, create a one-paragraph comment discussing company performance. Use data from the horizontal analysis, the vertical analysis, and the ratios to support your assertions, focusing most heavily on the trends evident in the corporation's performance over time. Microsoft Excel for Accounting, 2nd Edition Page 2 of 4 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started