Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Excel format for answer, please Exercise 3-22 Presented below are the assumptions and principles. 1. Full disclosure principle. 2. Going concern assumption. 3. Monetary unit

Excel format for answer, please

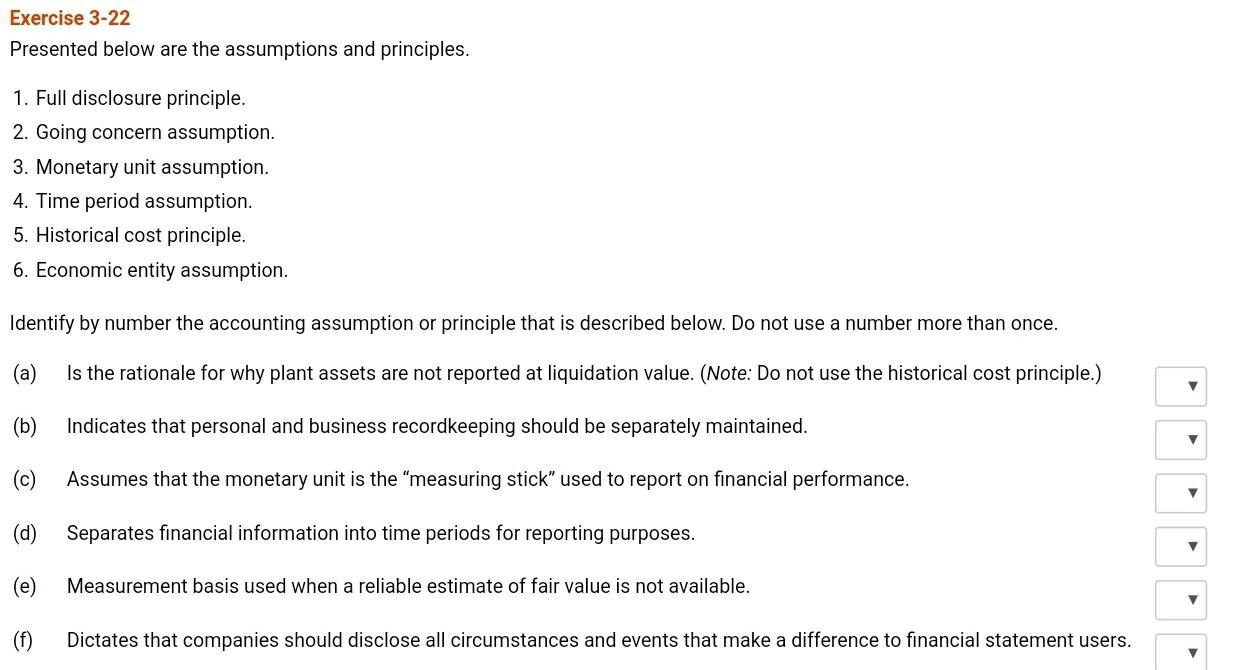

Exercise 3-22 Presented below are the assumptions and principles. 1. Full disclosure principle. 2. Going concern assumption. 3. Monetary unit assumption. 4. Time period assumption. 5. Historical cost principle. 6. Economic entity assumption. Identify by number the accounting assumption or principle that is described below. Do not use a number more than once. (a) Is the rationale for why plant assets are not reported at liquidation value. (Note: Do not use the historical cost principle.) (b) Indicates that personal and business recordkeeping should be separately maintained. (c) Assumes that the monetary unit is the "measuring stick" used to report on financial performance. (d) Separates financial information into time periods for reporting purposes. (e) Measurement basis used when a reliable estimate of fair value is not available. (f) Dictates that companies should disclose all circumstances and events that make a difference to financial statement usersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started