Question

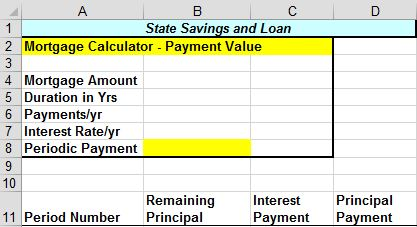

Excel Help: Assignment 20 (Chapter 6, Level 2 Case)Mortgage Calculator Instructions: Show all formula work for each Fill in the mortgage calculator using the followinginformation:

Excel Help: Assignment 20 (Chapter 6, Level 2 Case)Mortgage Calculator

Instructions:

Show all formula work for each

Fill in the mortgage calculator using the followinginformation:

Mortgage Amount: $270,000

Duration in Years: 30 years

Interest Rate: 5.75%

Payments per year: 12

Calculate the periodic payment using the PMT function. Round tothe nearest cent.

Complete the amortization table as follows:

Fill in the periods (12 payments per year for 30 years)

In cell B12, enter the beginning principal by capturing theamount in cell B4.

In cell C12, use the IPMT function to calculate the InterestPayment.

In cell D12, use the PPMT function to calculate the PrincipalPayment.

In cell B13, enter a formula to calculate the remainingprincipal for period 2.

Copy cell B13 down the column. Copy cells C12 and D12 down thecolumn.

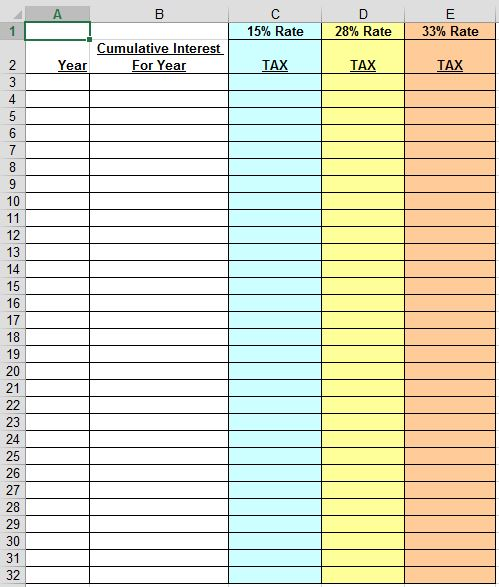

Click on the Tax worksheet.

Complete the table as follows:

Column A: Enter periods 1-30

Column B: Use the CUMIPMT function to calculate the cumulativeinterest for each year

Cell C3: Enter a formula that will calculate the tax deductionfor period 1. Your formula should copy both down the column andacross the row.

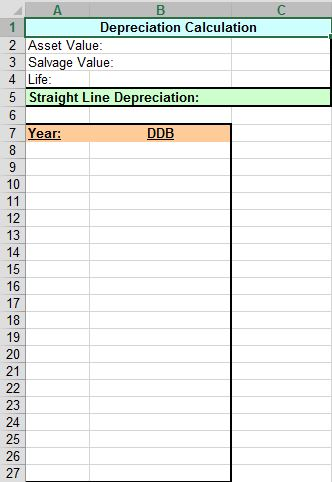

Click on the Depreciation worksheetand enter the following test data:

Asset Value: $190,000

Salvage Value: $8,000

Life: 20 years

In cell C5, calculate the straight line depreciation.

Complete the 2nd table as follows:

Fill in 20 years in column A.

Calculate the depreciation in column B using the doubledeclining balance method (DDB function)

Calculator Sheet

Tax Sheet

Depreciation Sheet

| State Savings andLoan | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage Calculator - PaymentValue | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage Amount | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Duration in Yrs | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payments/yr | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Rate/yr | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Periodic Payment | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Period Number | Remaining Principal | Interest Payment | Principal Payment

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A 1 2 Mortgage Calculator - Payment Value 3 4 Mortgage Amount 5 Duration in Yrs 6 Payments/yr 7 Interest Rate/yr 8 Periodic Payment 9 10 B State Savings and Loan 11 Period Number Remaining Principal Interest Payment D Principal Payment

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started