Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Excel Hydro took a loan contract which requires a payment of $40 million plus interest two years after the contract's date of issue. The interest

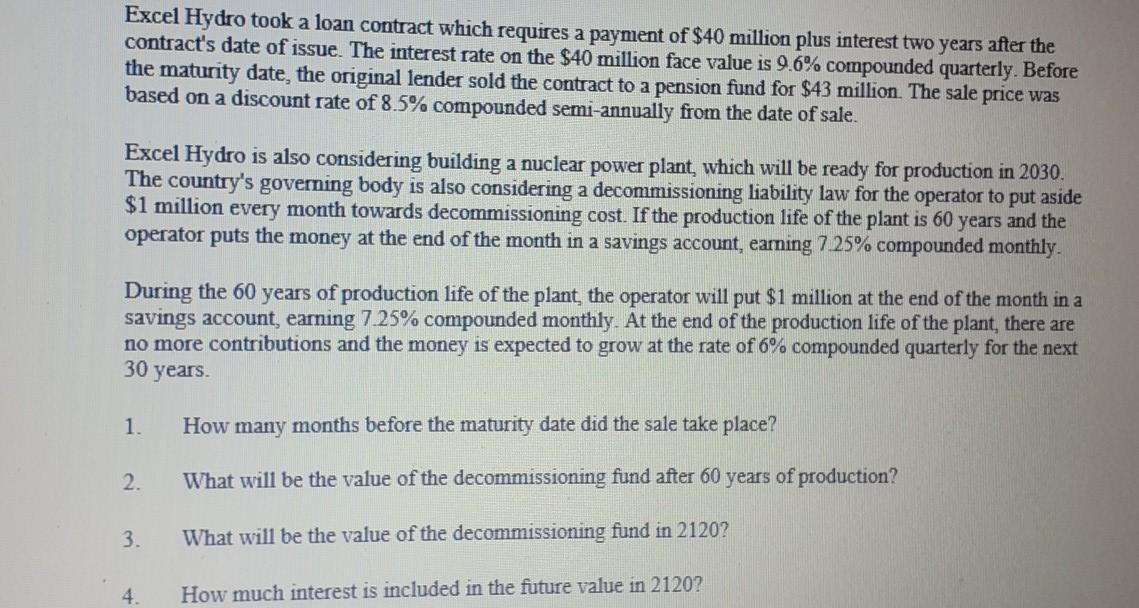

Excel Hydro took a loan contract which requires a payment of $40 million plus interest two years after the contract's date of issue. The interest rate on the $40 million face value is 9.6% compounded quarterly. Before the maturity date, the original lender sold the contract to a pension fund for $43 million. The sale price was based on a discount rate of 8.5% compounded semi-annually from the date of sale. Excel Hydro is also considering building a nuclear power plant, which will be ready for production in 2030. The country's governing Body is also considering a decommissioning liability law for the operator to put aside $1 million every month towards decommissioning cost. If the production life of the plant is 60 years and the operator puts the money at the end of the month in a savings account, earning 7 25% compounded monthly. During the 60 years of production life of the plant, the operator will put $1 million at the end of the month in a savings account, earning 7.25% compounded monthly. At the end of the production life of the plant, there are no more contributions and the money is expected to grow at the rate of 6% compounded quarterly for the next 30 years. 1. How many months before the maturity date did the sale take place? 2. What will be the value of the decommissioning fund after 60 years of production? 3. What will be the value of the decommissioning fund in 2120? 4. How much interest is included in the future value in 2120

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started