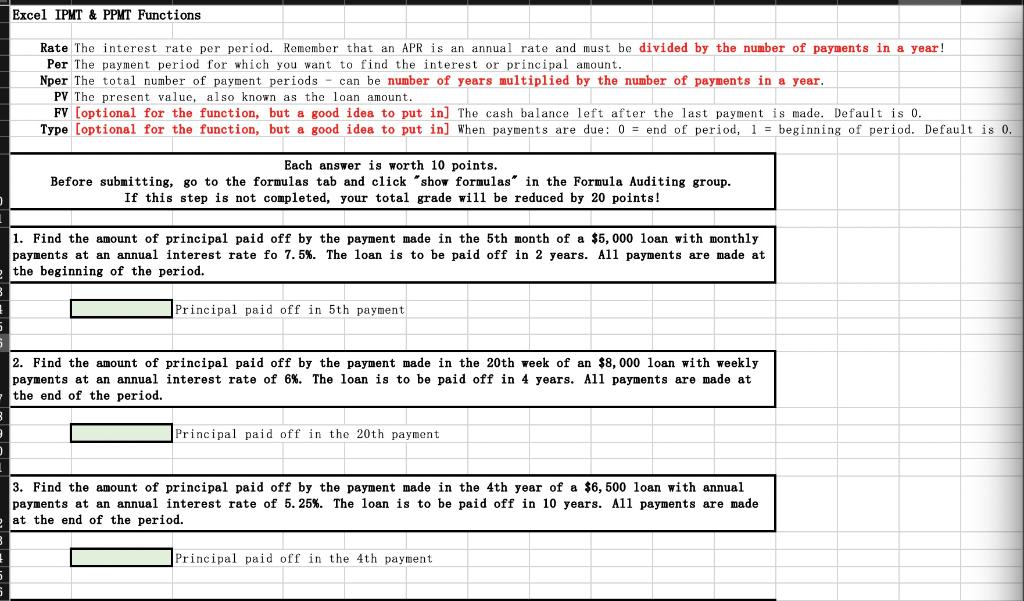

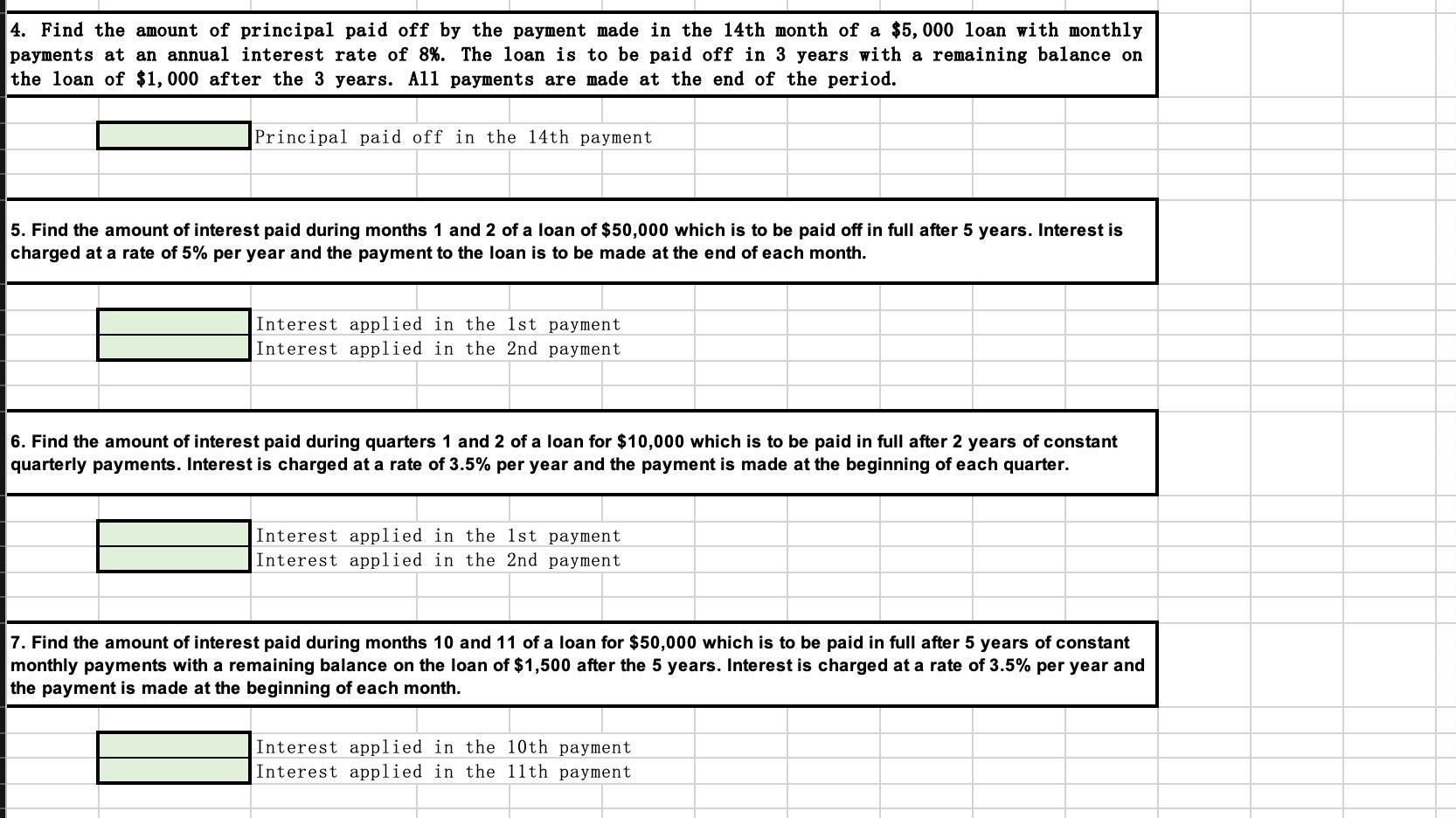

Excel IPMT & PPMT Functions Rate The interest rate per period. Remember that an APR is an annual rate and must be divided by the number of payments in a year! Per The payment period for which you want to find the interest or principal amount. Nper The total number of payment periods - can be number of years multiplied by the number of payments in a year. PV The present value, also known as the loan amount. FV (optional for the function, but a good idea to put in] The cash balance left after the last payment is made. Default is 0. Type [optional for the function, but a good idea to put in] When payments are due: 0 = end of period, 1 = beginning of period. Default is 0. Each answer is worth 10 points. Before submitting, go to the formulas tab and click "show formulas" in the Formula Auditing group. If this step is not completed, your total grade will be reduced by 20 points! 1. Find the amount of principal paid off by the payment made in the 5th month of a $5,000 loan with monthly payments at an annual interest rate fo 7.5%. The loan is to be paid off in 2 years. A11 payments are made at the beginning of the period. Principal paid off in 5th payment 2. Find the amount of principal paid off by the payment made in the 20th week of an $8,000 loan with weekly payments at an annual interest rate of 6%. The loan is to be paid off in 4 years. All payments are made at the end of the period. Principal paid off in the 20th payment 3. Find the amount of principal paid off by the payment made in the 4th year of a $6,500 loan with annual payments at an annual interest rate of 5.25%. The loan is to be paid off in 10 years. All payments are made at the end of the period. Principal paid off in the 4th payment 4. Find the amount of principal paid off by the payment made in the 14th month of a $5,000 loan with monthly payments at an annual interest rate of 8%. The loan is to be paid off in 3 years with a remaining balance on the loan of $1,000 after the 3 years. All payments are made at the end of the period. Principal paid off in the 14th payment 5. Find the amount of interest paid during months 1 and 2 of a loan of $50,000 which is to be paid off in full after 5 years. Interest is charged at a rate of 5% per year and the payment to the loan is to be made at the end of each month. Interest applied in the 1st payment Interest applied in the 2nd payment 6. Find the amount of interest paid during quarters 1 and 2 of a loan for $10,000 which is to be paid in full after 2 years of constant quarterly payments. Interest is charged at a rate of 3.5% per year and the payment is made at the beginning of each quarter. Interest applied in the 1st payment Interest applied in the 2nd payment 7. Find the amount of interest paid during months 10 and 11 of a loan for $50,000 which is to be paid in full after 5 years of constant monthly payments with a remaining balance on the loan of $1,500 after the 5 years. Interest is charged at a rate of 3.5% per year and the payment is made at the beginning of each month. Interest applied in the 10th payment Interest applied in the 11th payment