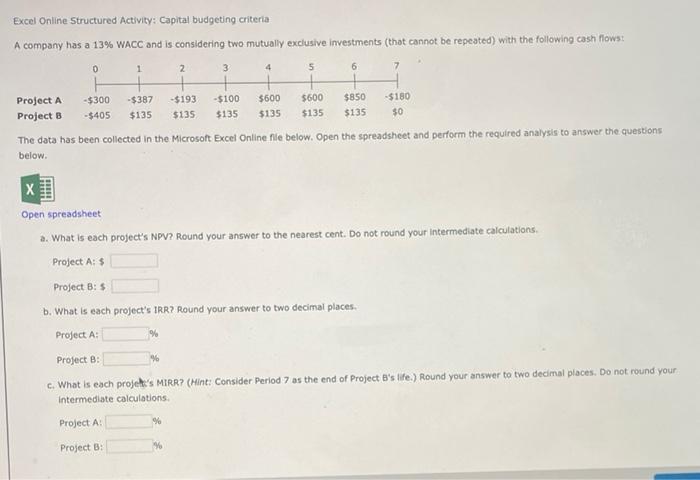

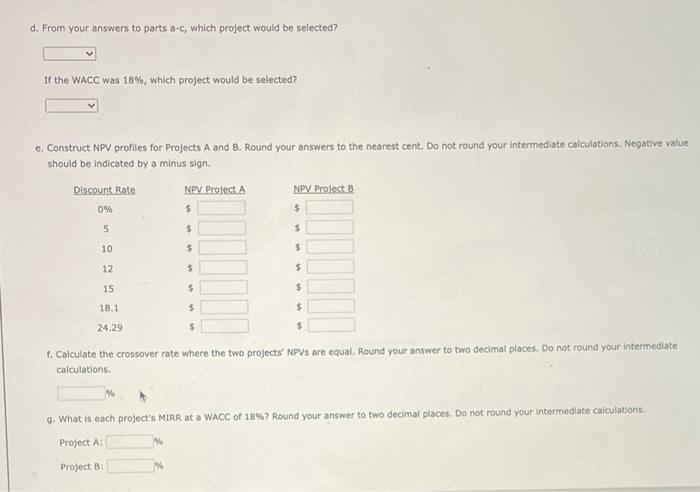

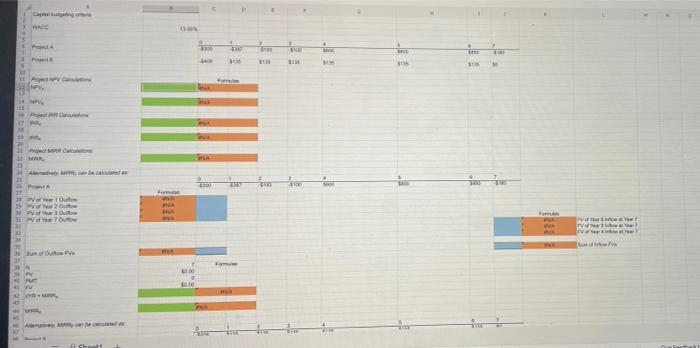

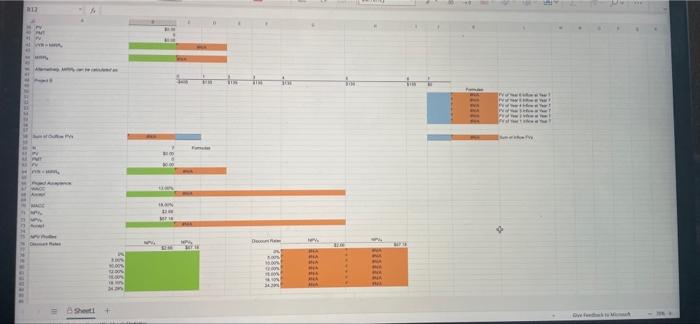

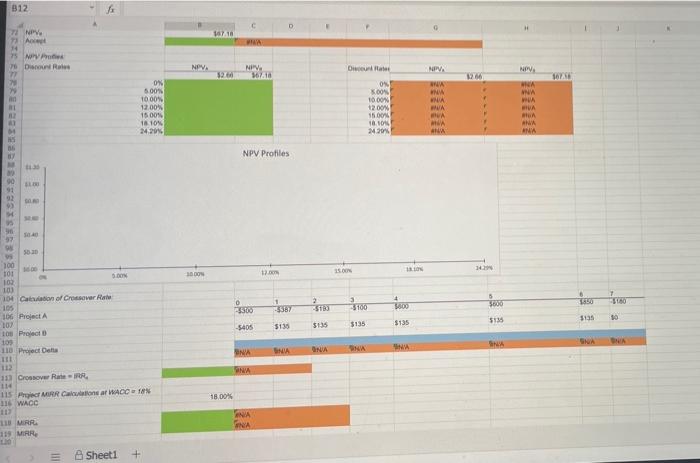

Excel Online Structured Activity: Capital budgeting criteria A company has a 13% WACC and is considering two mutually exclusive investments that cannot be repeated) with the following cash flows: 0 1 2 3 4 5 6 7 Project A -$300 - $387 -$193 - $100 $600 $600 $850 -$180 Project B -$405 $135 $135 $135 $135 $135 $135 $0 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. X Open spreadsheet a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations Project A: $ Project B: $ b. What is each project's IRR? Round your answer to two decimal places Project A: Project B: c. What is each projet's MIRR? (Mint: Consider Perlod 7 as the end of Project B's life.) Round your answer to two decimal places. Do not round your Intermediate calculations. Project A % Project : d. From your answers to parts a-c, which project would be selected? If the WACC was 18%, which project would be selected? e Construct NPV profiles for Projects A and B. Round your answers to the nearest cent. Do not round your intermediate calculations. Negative value should be indicated by a minus sign. Discount Bate NPV Project NPV Project B $ 0% $ 5 $ $ 10 $ $ 12 $ $ 15 $ $ 18.1 $ $ 24.29 $ 1. Calculate the crossover rate where the two projects NPVs are equal. Round your answer to two decimal places. Do not round your intermediate calculations 9. What is each project's MIRR at a WACC of 18%? Round your answer to two decimal places. Do not round your intermediate calculations, Project A Project B we W! NE + PPVC . NV, w SE PM 23 TO 2320 Pau of out TE tulee 31 PUT Tv m. . w She loturiu HH Shout La ACT B12 110 NPV 73 A 114 WA ANS 7 Diamo NPVA NIV 167.10 Dienas PN NOVA 327 NO V NA 500% 1000 12.00% 15009 1810 2420 ON KOON 1000 12.00 Ve V WA WA MUA MIA V MOS WW 180 21.30 W ANA NPV Profiles OF 50.30 100 101 102 MCHE WOST NOG 100 COT 5 3 6 160 0 3500 so WOO 2005 0911 3567 SCIE 5135 10 104 Cation of Crossover at 105 106 Project 102 10 Project 110 Project Delta -5405 $135 SEIS SCIS SEIS GOT SA NA SNA VINO VE SNA 11 Crossow Rate 114 115 Pro MRR Calaton a WACC 18 116 WACC 18.00% CIT NA 110 MRR 119 MRR VINE Sheet1 +