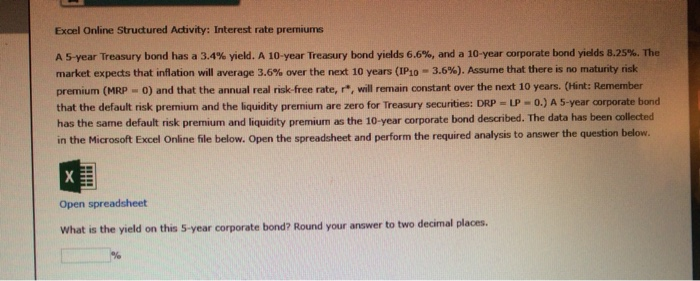

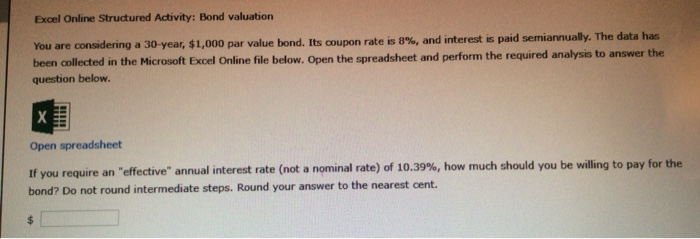

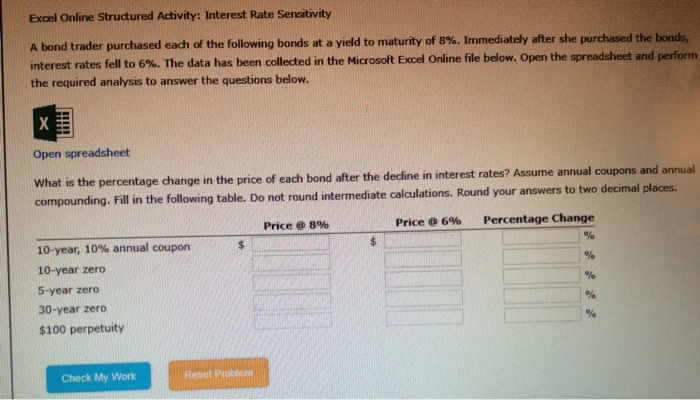

Excel Online Structured Activity: Interest rate premiums A 5-year Treasury bond has a 3.4% yield. A 10-year Treasury bond yields 6.6%, and a 10-year corporate bond yields 8.25%. The market expects that inflation will average 3.6% over the next 10 years (IP10 -3.6%). Assume that there is no matunity risk premium (MRP - 0) and that the annual real risk-free rate, will remain constant over the next 10 years. (Hint: Remember that the default nsk premium and the liquidity premium are zero for Treasury securities: DRP-UP -0.) A 5-year corporate bond has the same default risk premium and liquidity premium as the 10-year corporate bond described. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. x Open spreadsheet What is the yield on this 5-year corporate bond? Round your answer to two decimal places. Excel Online Structured Activity: Bond valuation You are considering a 30-year, $1,000 par value bond. Its coupon rate is 8%, and interest is paid semiannually. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet If you require an "effective" annual interest rate (not a nominal rate) of 10.39%, how much should you be willing to pay for the bond? Do not round intermediate steps. Round your answer to the nearest cent. Excel Online Structured Activity: Interest Rate Sensitivity A bond trader purchased each of the following bonds at a yield to maturity of 8%. Immediately after she purchased the bonds, interest rates fell to 6%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet What is the percentage change in the price of each bond after the decline in interest rates? Assume annual coupons and annual compounding, Fill in the following table. Do not round intermediate calculations. Round your answers to two decimal places Price @ 8% Price @ 6% Percentage Change 10-year, 10% annual coupon 10-year zero 5-year zero 30-year zero $100 perpetuity Check My Work