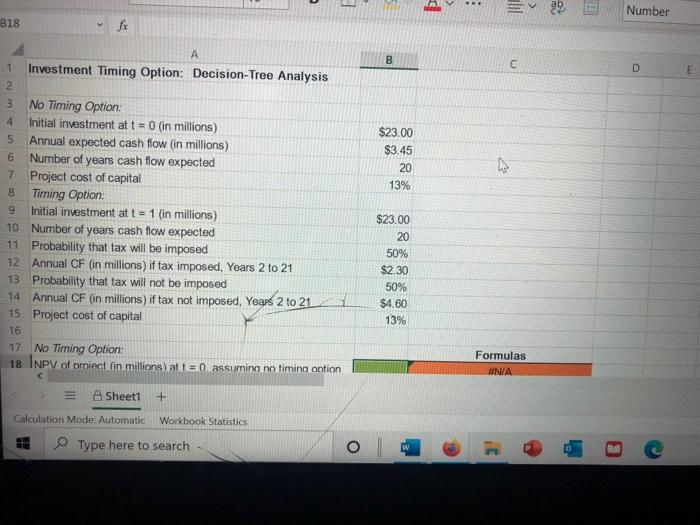

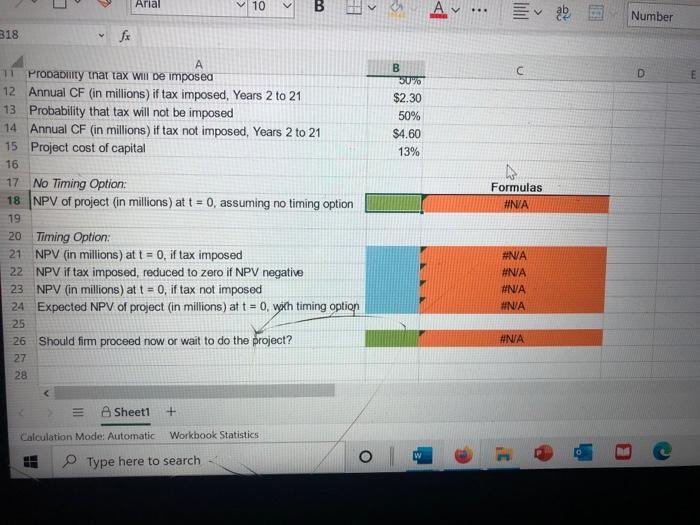

Excel Online Structured Activity: Investment Timing Option: Decision-Tree Analysis Kim Hotels is interested in developing a new hotel in Seoul. The company estimates that the hotel would require an initial investment of $23 million. Kim expects the hotel will produce positive cash flows of $3.45 million a year at the end of each of the next 20 years. The project's cost of capital is 13%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations, Open spreadsheet a. What is the project's net present value? A negative value should be entered with a negative sign. Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2. not 1,200,000. Do not round intermediate calculations. Round your answer to two decimal places. million Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answer to two decimal places. $ million b. Kim expects the cash flows to be $3.45 million a year, but it recognizes that the cash flows could actually be much higher or lower, depending on whether the Korean government imposes a large hotel tax. One year from now, Kim will know whether the tax will be imposed. There is a 50% chance that the tax will be imposed, in which case the yearly cash flows will be only $2.3 million. At the same time, there is a 50% chance that the tax will not be imposed, in which case the yearly cash flows will be $4.6 million. Kim is deciding whether to proceed with the hotel today or to wait a year to find out whether the tax will be imposed. If Kim waits a year, the initial investment will remain at $23 million. Assume that all cash flows are discounted at 13%. Use decision-tree analysis to determine whether Kim should proceed with the project today or wait a year before deciding. 3 ... ... Number B18 fx C D B 50% $2.30 50% $4.60 13% Formulas #NA 11 Probability that tax will be imposed 12 Annual CF (in millions) if tax imposed, Years 2 to 21 13 Probability that tax will not be imposed 14 Annual CF (in millions) if tax not imposed, Years 2 to 21 15 Project cost of capital 16 17 No Timing Option: 18 NPV of project (in millions) at t = 0, assuming no timing option 19 20 Timing Option: 21 NPV (in millions) at t = 0, if tax imposed 22 NPV if tax imposed, reduced to zero if NPV negative 23 NPV (in millions) at t = 0, if tax not imposed 24 Expected NPV of project (in millions) at t = 0, with timing option 25 26 Should firm proceed now or wait to do the project? 27 #NA #N/A #NA #NA #NA 28 A Sheet1 + Calculation Mode: Automatic Workbook Statistics Type here to search