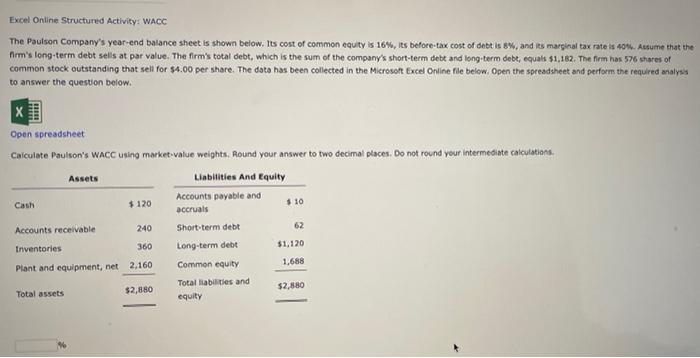

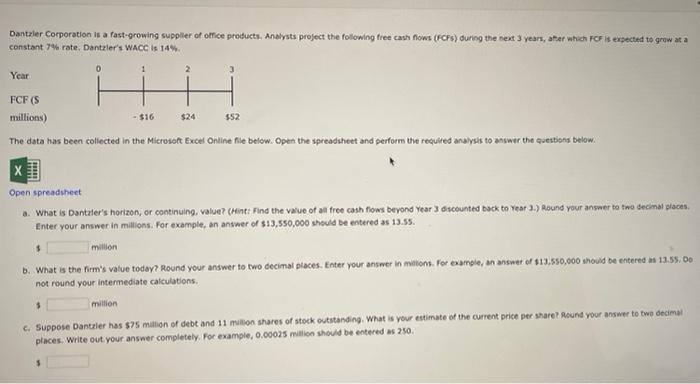

Excel Online Structured Activity: Nonconstant growth Computech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $1.00 coming 3 years from today. The dividend should grow rapidly at a rate of 36% per year-during Years 4 and 5; but after Year 5, growth should be a constant 6% per year. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet If the required return on Computech is 14%, what is the value of the stock today? Round your answer to the nearest cent. Do not round your intermediate calculations. Excel Online Structured Activity: WACC The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 16%, its before-tax cost of debt is 8%, and its marginal tax rate is 40%. firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,182. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis Assume that the to answer the question below. Xx Open spreadsheet Calculate Paulson's WACC using market-value weights, Round your answer to two decimal places. Do not round your intermediate calculations. Assets Liabilities And Equity Cash $ 120 Accounts payable and accruals $10 Accounts receivable 240 Short-term debt Inventories 360 Long-term debt Plant and equipment, net 2,160 Common equity Total liabilities and Total assets $2,880 equity 62 $1,120 1,688 $2,880 Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dantzler's WACC is 14%. 1 2 3 Year H FCF (S millions) - $16 $24 $52 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. $ million b. What is the firm's value today? Round your answer to two decimal places. Enter your answer in milions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round your intermediate calculations. $ million c. Suppose Dantzler has $75 million of debt and 11 million shares of stock outstanding. What is your estimate of the current price per share? Round your answer to two decimal places. Write out your answer completely. For example, 0.00025 million should be entered as 250. mn