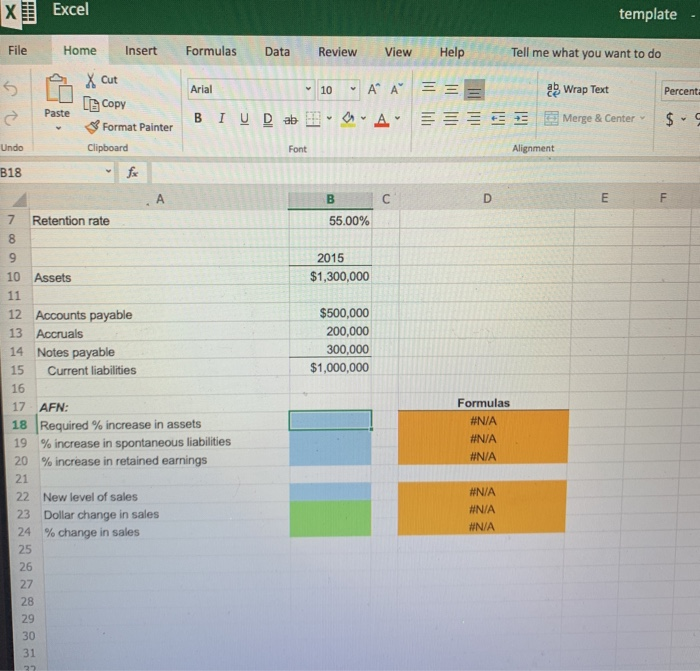

Excel Online Structured Activity: Sales Increase Maggie's Muffins, Inc., generated $2,000,000 in sales during 2015, and its yearend total assets were $1,300,000. Also, at year-end 2015, current liabilities were $1,000,000, consisting of $300,000 of notes payable, $500,000 of accounts payable, and $200,000 of accruals. Looking ahead to 2016, the company estimates that its assets must increase at the same rate as sales, its spontaneous liabilities will increase at the same rate as sales, its profit margin will be 5%, and its payout ratio will be 45%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet How large a sales increase can the company achieve without having to raise funds externally, that is, what is its self-supporting growth rate? Do not round Intermediate calculations. Round your answers to the nearest whole number Sales can increase by $ that is by Excel template - File Home Insert Formulas Data Review View Help Tell me what you want to do Arial 10 A = = = X Cut [ Copy * Format Painter Clipboard A A Wrap Text Merge & Center Paste Percent: $ - 9 BI U Dab I Alignment Undo B18 E F 7 Retention rate 55.00% 2015 $1,300,000 10 Assets 12 Accounts payable 13 Accruals 14 Notes payable 15 Current liabilities $500,000 200,000 300,000 $1,000,000 Formulas 17 AFN: Required % increase in assets 19 % increase in spontaneous liabilities 20 % increase in retained earnings #N/A #N/A #N/A 22 New level of sales 23 Dollar change in sales % change in sales #N/A #N/A #N/A Excel Online Structured Activity: Sales Increase Maggie's Muffins, Inc., generated $2,000,000 in sales during 2015, and its yearend total assets were $1,300,000. Also, at year-end 2015, current liabilities were $1,000,000, consisting of $300,000 of notes payable, $500,000 of accounts payable, and $200,000 of accruals. Looking ahead to 2016, the company estimates that its assets must increase at the same rate as sales, its spontaneous liabilities will increase at the same rate as sales, its profit margin will be 5%, and its payout ratio will be 45%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet How large a sales increase can the company achieve without having to raise funds externally, that is, what is its self-supporting growth rate? Do not round Intermediate calculations. Round your answers to the nearest whole number Sales can increase by $ that is by Excel template - File Home Insert Formulas Data Review View Help Tell me what you want to do Arial 10 A = = = X Cut [ Copy * Format Painter Clipboard A A Wrap Text Merge & Center Paste Percent: $ - 9 BI U Dab I Alignment Undo B18 E F 7 Retention rate 55.00% 2015 $1,300,000 10 Assets 12 Accounts payable 13 Accruals 14 Notes payable 15 Current liabilities $500,000 200,000 300,000 $1,000,000 Formulas 17 AFN: Required % increase in assets 19 % increase in spontaneous liabilities 20 % increase in retained earnings #N/A #N/A #N/A 22 New level of sales 23 Dollar change in sales % change in sales #N/A #N/A #N/A